'Tis Only My Opinion!™December 2016 - Volume 36, Number 12Outlook 2017"The Crystal Ball is Cloudy"

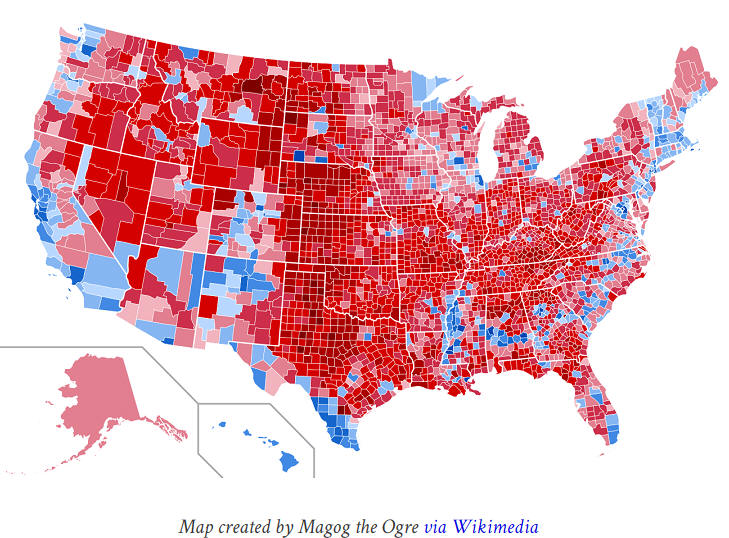

The United States of America is a constitutional republicThe election of Donald J. Trump as President of the U.S. will not be official until the meeting of the Electoral College at which the official vote will take place on December 19, 2016. At the moment, Mr. Trump holds a commanding lead of 306 electoral votes. In our constitutional republic, the position of President and Vice-President is determined in the electoral college. A candidate can win the popular vote and not be elected to the Presidency. The 2016 election was a shock for liberal elites and many in the media. They could not fathom how America could possibly vote for Donald J. Trump and shun the presumptive next President of the United States, Hillary Rodham Clinton. Given the polling, predicting a Clinton victory was not ridiculous. If one trusting nothing but the polling data, a Clinton electoral college win seemed like a pretty safe bet. But Americans defied expectations at the polls, and Trump won several “blue” states like Pennsylvania, Michigan, and Wisconsin. Overall, Trump carried 3084 counties and Clinton won just 57.

However, both Jill Stein of the Green Party and Hillary Clinton of the Democratic party and their respective campaigns are trying to utilize recounts and intimidation to change votes or deny certification of electors in states like Wisconsin, Michigan and Delaware from meeting the December 13th date. If the efforts fails to change the current voting totals, Mr. Trump will become the 45th President of the United States of America on January 20, 2017. To many voters, the election of Donald Trump places many of programs initiated by the Clinton and Obama administrations of the past two decades in jeopardy. The Six "D's"As we stated in the May 2016 'Opinion newsletter, politicians cannot defeat the long-term effects of the six "D's", which are Demographics, Defense, Dollar, Debt, Derivatives and Default. The incoming Trump administration will be hard-pressed to fund any of its programs through increasing deficit spending. In FY 2016 the Obama administration acknowledged a deficit of $587 billion yet the increase in federal debt was $1.422 trillion. Just another example of how the Ministry of Truth works to obfuscate the real state of affairs.

Moreover, the stated deficit and the stated federal debt numbers fail to take into account the off-balance sheet obligations for which the taxpayers are on the hook for. The report of the U.S. Government according to GAAP principles for FY 2015 acknowledged that those liabilities were multiples of the federal debt shown in the above table. In the latest CFR GAAP report ending as of September 30, 2015, Treasury Secretary Lew reported that the discounted value of the federal government's unfunded liabilities stood in excess of $45 trillion. Of course, the discount rate used was not disclosed in the report. Some analysts believe that the non-discounted amount of unfunded liabilities now stands in excess of $200 trillion. CBO GAAP FY 2015 stated Unfunded Liabilities of $45 Trillion but no discount rate given. At the current time, the Social Security Disability program is expected to be insolvent in 2022, Medicare in 2030 and Social Security in 2035 according to the House Budget Committee. Trumps' Campaign PromisesDuring the 2016 Presidential campaign, President-Elect Trump made many promises including:

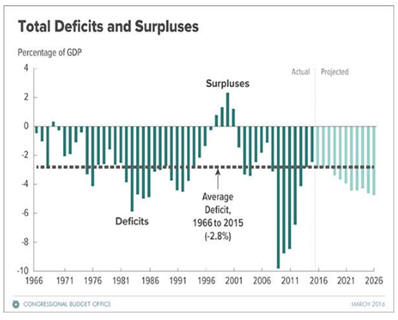

While these campaign promises resonated with the voters, there are many obstacles that will have to be overcome to implement any of them as well as finding the funds to implement the programs. The Challenge AheadThe House of Representatives according to the Constitution holds the purse strings. Will the Republican leadership strive to exert its own vision of change on Trump's programs? We have already seen an attempt to reinstitute pork-barrel additions to bills and an effort to balance any new spending with tax cuts. Will Congress give the President the Line-Item Veto power? Current Federal Spending & DebtThe FY 2017 budget submitted by the Obama Administration projected a stated deficit of $503 billion. Of course, the federal debt as of the end of FY 2016 as shown above already exceeded the estimate of $19.3 trillion shown in the budget documents for end of FY 2017. The following graph shows that the Obama Administration is projecting continued accelerating deficits going forward from FY 2016.

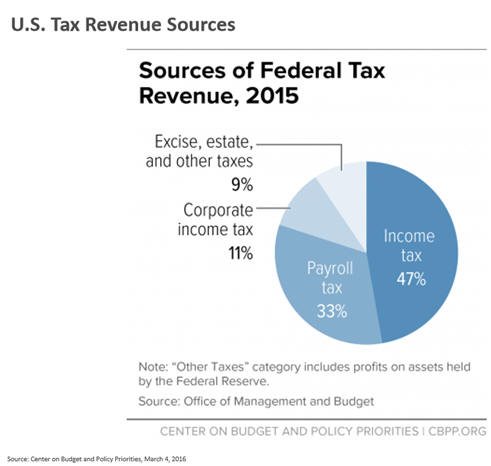

It will be up to the Trump Administration to seek to make major changes to current programs in order to afford any new spending without a major increase in interest costs. The following charts shows how the U.S. tax revenue is obtained. As Trump has proposed reducing income taxes at both the personal and corporate levels, it would appear that something will have to give.

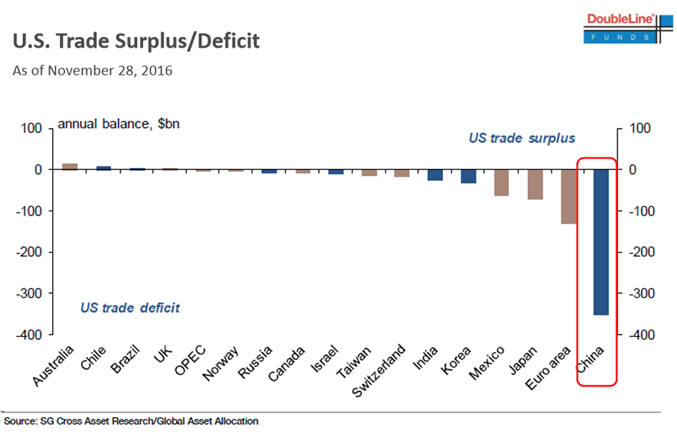

A prime focus of the Trump campaign was to return manufacturing jobs back to the United States. The following graph shows the trade deficit with several countries in 2016. Obviously, the major player is China and a significant cutback in trade with China will have many consequences.

Looking Ahead to a Trump AdministrationDuring the last six weeks the lame-duck Obama administration has served up thousands of pages of regulations and decisions which will probably be reversed during the first month of the Trump administration. The recent election in Italy places the future of the Eurozone community in question. With the Eurozone showing signs of strain among its members Straits and with Italy's banking system beginning to threaten the euros value it is possible that the Eurozone could be restructured significantly. Coupled with the recent crackdown on cash by India the outlook for fiat currencies throughout the world will favor gold investments going forward. Following the election of Trump in November there still appears to be members of the Republican Party as well as the Democratic Party who have not lined up behind Trump. However, Trump's dominant personality will be imposed on not just his own Republican Party but on relations between the US and the world. With his telephone call to the President of Taiwan Trump has made it clear that he will take a heavy hand in trade relations with China which during the past 50 years has enabled China to build up a huge trade surplus with the United States. The Trans-Pacific Trade Partnership negotiated by the Obama administration appears to be dead as Trump has indicated that it needs to be renegotiated. Policies that may be addressedDuring the past two decades, the federal government has enacted

many laws and regulations that citizens should be concerned about,

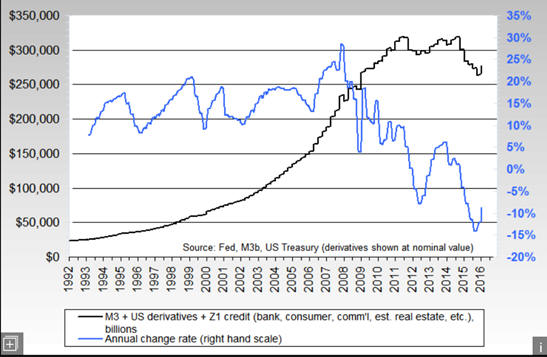

for example; 5. The elimination of the "To-Big-To-Fail" concept. The U.S. has not recovered from the 2008 meltdownThe recovery from the financial crisis of 2008 is largely a mirage. The credit derivatives market stands at about 1.7 times the level prior to the Lehman crisis if you ignore the reclassification by the Bank for International Settlements in 2010. According to the BIS reclassification statistics, total credit derivatives outstanding as of June 30, 2016 stood at $544.052 trillion which was down from the peak of $628.003 trillion at the beginning of 2014. Of course, the BIS also says ... don't worry, the nominal value as of June 30, 2016 only stood at $20.701 trillion. Of course, nominal only works if everyone is solvent. If one major player goes up in flames, the whole chain of derivatives suddenly becomes toxic. The following chart shows the relatively stable level of the U.S. money supply including credit derivatives as of June 30, 2016.

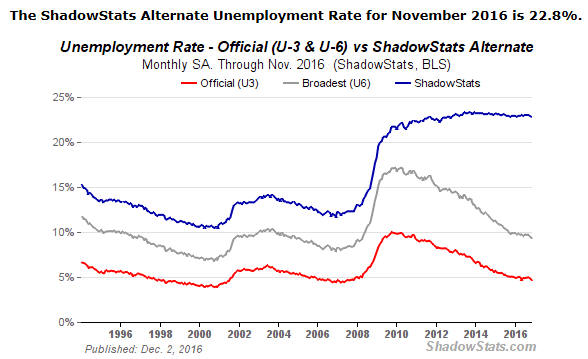

Since 2008, the financial and economic data continues to become less reliable and with all the adjustments and revisions to various series it is difficult for most of the population to understand what is really happening to their world. The following graphs from Shadow Government Statistics of GDP, CPI, and Unemployment illustrate what happens to data which is revised and subject to all kinds of adjustments by the Ministry of Truth.

Thoughts on interest ratesAs the US and the world stumble toward the next financial crisis. the Deep State will become desperate to harvest every nickel it can to rescue itself plus the cast of "systemically important" (Too Big To Fail) banks and related institutions like Fannie Mae and Freddie Mac which are about to once again be left holding colossal bags of worthless non-performing loans. The Federal Reserve's interest rate policies have also reduced the ability of pension funds and insurance companies to meet their obligations going forward. Most pension funds and insurance companies rely upon a ladder of bonds to meet their requirements. Since 2008, the low interest policy of the FED has resulted in a major decrease in the average earnings from the bond portfolio of about 3%. This shortfall will require either a decrease in the payout or an increase in capital requirements by these institutions. The Federal Reserve and other central banks will try to unwind their balance sheets in the "great unwind." However, the unwind will also have to deal with the huge infrastructure and military buildup which Trump has indicated he will propose as his term begins. It is expected that the Federal Reserve will increase the Fed funds rate currently at 0.25% at its meeting on December 14 by perhaps as much as 1/2%. As the chart shows, the FED has supplied almost free money since shortly after the Lehman bankruptcy in September 2008.

There will be an effect upon the yield of the 10-year U.S. Treasury note but it probably will not push the yield to the long-term resistance line as shown in the following graph. However, if the FED continues to raise the Fed Funds rate in 2017, the yield on the 10-year U.S. Treasury note could move above 4% and even higher.

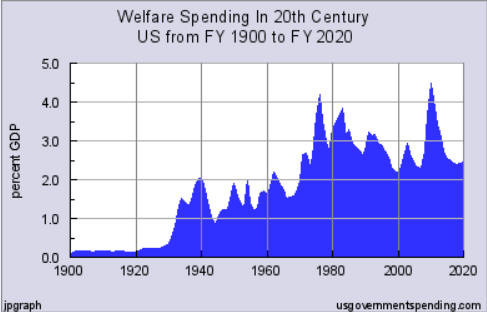

With interest rates on the increase, holders of bonds should be worried about the loss of value in their bond portfolios. Thoughts on healthcareOne of the more visible failures of the Obama administration was the passage of Obamacare which created many "unintended consequences". The majority of the bill was written by lobbyists for the medical, hospital and pharmaceutical industry. Is it any wonder that costs have continued to increase? As a result, healthcare has risen to about 20% of GDP whereas in many industrialized countries healthcare accounts for between 6 and 10% of GDP. In addition, healthcare consumed about 37% of all federal spending in fiscal year 2016. The Federal government spent 37% of every dollar it spent in total on Medicare and Medicaid last fiscal year. This rate of spending is increasing by roughly 9% a year. Within four years the increase will result in roughly $2 trillion a year of spending on these two programs alone and blow an additional $600 billion a year hole in the federal budget. For scale, $600 billion is roughly the size of all defense spending and that's the additional amount we will try to tack onto to what is already being spent today. This is not due to people getting older, it is due to medical monopolies that in any other line of work would land everyone involved in federal prison under the Clayton and Sherman anti-trust acts. Much of this difference in costs could be addressed by simply applying the Clayton and Sherman antitrust acts to the pharmaceutical, medical and hospital industries. The ability to cost-compare procedures between hospitals and doctor's groups has to be implemented. Today, the patient is almost totally out-of-the-loop in determining the cost. For a citizen to be charged $24,000 for a procedure that the insurance company only pays $6,250 is a simply a crime. There is absolutely no justification for it. From hospitals, to doctors themselves to pharmaceutical companies to medical supply houses and even insurance -- all of them are filled with monopolists, and a monstrous percentage of what each of these firms and individuals do as it pertains to how charges are generated, billed and collected is a clear violation the Sherman and Clayton anti-trust acts. At the present time, there are many instances where drugs cost 10 times the cost of identical pill in the United States versus the same cost in Mexico, Canada or elsewhere. Moreover, U.S. citizens are often arrested if they bring certain medical prescriptions into the U.S. which they have bought cheaper in other countries. Pharmaceutical companies charge their R&D development costs to the United States and the approval process of the federal drug and administration is often longer and more expensive than other countries. Congress should immediately enact a bill to require price transparency from all healthcare providers, especially doctors and healthcare organizations like clinics and hospitals. Individuals should be able to shop to find the best prices for procedures, exams or any other medical-related procedure and have access to insurance across state lines. Thoughts on Social Security, Medicare & MedicaidThe Social Security system is in trouble and most analysts believe that it will go bankrupt by 2025 if nothing is done. It should be obvious that Congress under President Lyndon Johnson put a fire under the Ponzi scheme when it raided the Social Security Trust Fund to pay for current operating expenses rather than raising individual and corporate tax rates. Each subsequent Congress has failed to address the fact that benefits are simply too extravagant and by adding Medicare and Medicaid promises have guaranteed the failure of the system. There is one possible ray of hope ... the fact that life expectancy might have peaked in 2014 and start to fall as noted in the recent analysis from the Centers for Disease Control. A decades-long trend of rising life expectancy in the U.S. could be ending: It declined last year and it is no better than it was four years ago. In most of the years since World War II, life expectancy in the U.S. has inched up, thanks to medical advances, public health campaigns and better nutrition and education. But in 2015 life expectancy slipped, an exceedingly rare event in a year that did not include a major disease outbreak. Other one-year declines occurred in 1993, when the nation was in the throes of the AIDS epidemic, and 1980, the result of an especially nasty flu season. In 2015, rates for 8 of the 10 leading causes of death rose. Even more troubling to health experts: the U.S. seems to be settling into a trend of no improvement at all. In any event, there are only a few ways to attempt to solve the old age benefit problem. Unfortunately, most of the proposals fail to acknowledge that the change to robotics will seriously reduce the number of actual workers who make payments into the system. There are only a few possible solutions ... all of which come with a political price to pay including. 1. Raise age to receive benefits 2. Reduction of benefits as AGI increases 3. Requalify all receiving disability benefits every five years. 4. Tax all benefits as ordinary income. Thoughts on WelfareThe growth of the welfare system in the U.S. should be of concern to all. Since the end of WWII, the growth of the welfare system and the trend to a dependency society has accelerated. In FY 2016 total US government spending on welfare — federal, state, and local — was “guesstimated” to be $1,032 billion, including $591 billion for Medicaid, and $467 billion in other welfare. Welfare spending, on programs for relief, unemployment compensation, and income support, started out at the beginning of the 20th century at 0.1% of Gross Domestic Product (GDP). It was not until the crisis of the Great Depression that welfare expenditures began their secular rise, reaching 2.1% of GDP by 1940. During World War II, welfare expenditures declined to about 1% of GDP per year, and fluctuated between 1 and 2% per year, depending on the business cycle. Health care expenditure amounted to about 1% of GDP. By the early 1960s, welfare cost about 2% of GDP. The Great Society programs started welfare on an upward path, so that after 1980 welfare spending fluctuated between 3 and 4% of GDP, spiking during recessions. In 1996 President Clinton signed a reform of welfare, and welfare costs declined from 3.4% of GDP during the 1990-91 recession to a low of 2.4%of GDP in 2000. In the 2001-02 recession welfare costs increased to 3.1% of GDP in 2003 and then declined to 2.5% of GDP by 2007. But the Great Recession of 2009-10 produced an explosion in welfare costs to a peak of 4.75% of GDP in 2010. Welfare costs are expected to decline to 2.66% of GDP by 2015 and down to 2.4% of GDP by 2020.

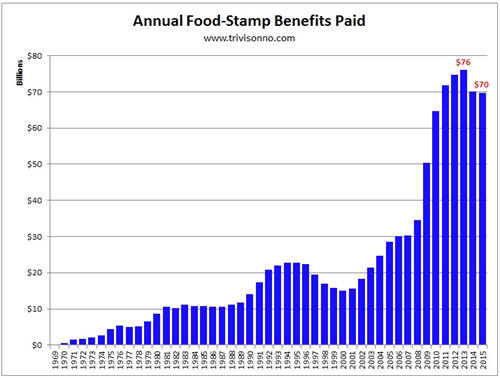

The Food Stamp program has grown significantly since its inception as shown in the following chart and in FY 2015 cost $70 billion.

The Aid to Dependent Children program and its successor, TANF, have effectively destroyed the nuclear family of the African-American community. Even today, many welfare recipients face loss of income if they work. Immediate Steps to be TakenOn the day after inauguration, President Trump without any further Congressional approval can:

That should shake up the status-quo. But then - 'Tis Only My Opinion!Fred Richards www.adrich.com Corruptisima republica plurimae leges. [The more corrupt a republic, the more laws.] -- Tacitus, Annals III 27 'Tis only My Opinion! Archive Menu, click here. This

issue of 'Tis Only My Opinion was copyrighted by Strategic Investing in 2016. |