'Tis Only My Opinion!™May 2016 - Volume 36, Number 5"The Economy & The Five "D's"The Current EconomyWhen one looks at the U.S. and/or global economy, it is very important to understand that nothing operates in a vacuum. In the current U.S. economy, these are a few of the facts that standout.

Fiscal & Monetary PolicyFiscal and monetary policy are two tools which both politicians and academics use to attempt to direct a sovereign’s economy towards a successful economic outcome. For years, the US and global economy have been subjected to progressive ideas espoused by John Maynard Keynes during the 1930s. The belief that fiat currency rather than sound money policies espoused by the Austrian economist, Ludwig von Mises, would provide the basis for long term growth has led to the current economic malaise where nations are struggling with major problems going forward. Currently, we see many nations struggling with excessive national debt, and economies that no longer get growth through expansion of debt. Japan and several European countries are now trying to use negative interest rate policies in a futile effort to spur growth. The politicians and Keynesian academics have now utilized most of the seasonal, substitution, and hedonic revisionary changes to various economic series to show the dumbed-down citizens and more importantly, the news media that the future is bright. Unfortunately, nations and the politicians cannot defeat the long-term effects of the five D’s. What are the five D’s you say, they are simply: Demographics, Defense, Dollar, Debt, Derivatives and Default. DemographicsIn the long-term, demographics is the major determining factor in the makeup of a society. The birthrate of each segment within that society will determine the future makeup of that society. Outside of a major war and/or a disease like the plaque wiping out a major portion of country’s population, the long-run future of the country and its society will be determined by demographics. For a stable society to remain, the reproduction birthrate of females should be about 2.2. In the U.S., the birthrate of “natural-born citizens” has fallen below 2. Immigrants both legal and illegal have birthrates substantially in excess of the natural-born citizens. When the birthrate of natural-born citizens does not equal that of the immigrants the overall society going forward will be significantly different. For example, the importation of Somali refugees that have a reproduction birthrate in excess of six will materially affect the education system as well as the welfare system of the area around Minneapolis-St. Paul. Another example is the importation of Muslim refugees into many parts of Michigan who are now demanding that Sharia law become the law in those Muslim areas. Christians and progressive liberals will find that their compassion towards refugees will lead to their becoming a minority in future years as they face the reality of demographics going forward. DefenseIn 1961, Pres. Dwight D Eisenhower warned in his final speech about the incestuous nature of the relationship of the "military-industrial complex", especially deficit spending, the prospect of the domination of science through federal funding and, conversely, the domination of science-based public policy by what he called a "scientific.technological elite." Since World War II ended, there have been two major advantages that have enabled the U.S. to portray itself as the major player in the world. They are the US dollar being the world reserve currency and its military strength. Unfortunately, the politicians have created rules of engagement which have prevented the military from winning any war since World War II. The US’s military strength under the Obama administration despite massive military expenditures has now fallen to a position where it is unlikely to prevail on a one-front war and would have a hard time fighting a two-front war. For example, according to a recent speech by Col. Alan West, President of the National Association for Policy Analysis ...

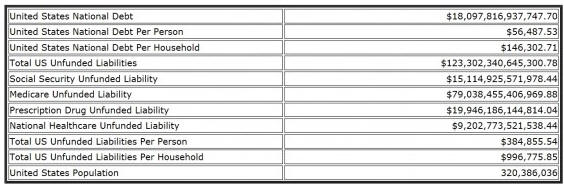

However, the real problem that the military faces in the successful prosecution of any military effort is the "rules of engagement" which the politicians have placed upon their forces. Not since WWII has the U.S. had a successful, long-term win ... and the major impediment has been that the politicians and the public have been unwilling to accept "collateral losses". DebtJohn Maynard Keynes advocated the use of the credit of the nation to assist in the recovery of an economic cycle. Keynes also advocated that when the economy recovered that the debt incurred needed to be repaid. It is the second part of his argument that politicians and academics espousing the Keynesian philosophy have forgotten. As a result, in the United States as of now the stated national debt stands in excess of $19 trillion of which about $13 trillion is owed to others than U.S. government entities. Of course, the stated national debt does not include any of the GAAP unfunded liabilities including the nations commitment to pension funds, health and welfare commitments, etc. In the US Treasury’s Consolidated Financial Report (CFR) published by the U.S. Government’s Accountability Office (GAO) report as of September 30, 2014, the unfunded liabilities were reported as $123.3 trillion. Of course, four of the five largest departments did not receive clean audit reports.

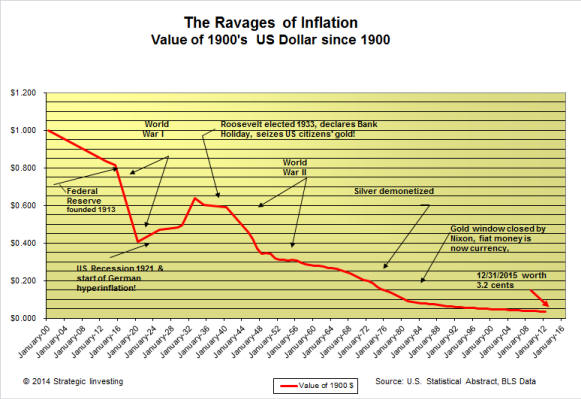

In the latest CFR GAAP report ending as of September 30, 2015, Treasury Secretary Lew reported that the discounted value of the federal government's unfunded liabilities stood in excess of $45 trillion. Moreover, three of the four largest departments of the US government did not receive a clean opinion as their accounting was so poor that an opinion could not be given. These included the Department of Defense, Department of Agriculture and the Department of Housing and Urban Development. It should be obvious that the size and complexity of the federal government and the lack of internal accounting controls simply make it impossible to determine the real amount of its actual debt and GAPP unfunded liabilities. An economy that is only generating $18 trillion in GDP simply cannot service the existing debt and unfunded liabilities without a major reset. Politicians have obviously flunked basic math and have promised their constituents more than can be delivered. The U.S. DollarWhen the U.S. Constitution was written currency was understood to have a value in either gold and/or silver. Article One states the government was prohibited to "make any Thing but gold and silver Coin a Tender in Payment of Debts." This restriction of bills of credit was extended to the Federal Government, as the power to "emit bills" from the Articles of Confederation was abolished, leaving only Congress with the power "to borrow money on credit." In The Coinage Act of 1834, the 15:1 ratio of silver to gold of the Constitution was changed to a 16:1 ratio by reducing the weight of the nation's gold coinage. This created a new U.S. dollar that was backed by 1.50 g (23.22 grains) of gold. However, the previous dollar had been represented by 1.60 g (24.75 grains) of gold. The result of this revaluation, which was the first devaluation of the U.S. dollar, was that the value in gold of the dollar was reduced by 6%. The U.S. has gone bankrupt several times since the U.S. Constitution was adopted. The last, or fifth. bankruptcy was the closing of the gold window by President Nixon in 1971. The remedy of devaluation of the dollar and/or its bankruptcy has been utilized by U.S. politicians almost since the country's founding in 1776. The following chart which is based upon the reported Consumer Price Index of the federal government shows that a $1.00 which was redeemable in either gold or silver in 1900 has been devalued through inflation to today's approximate 3 cents and is only redeemable in paper.

If, however, the deflator was based upon the way the Consumer Price Index was calculated prior to 1980 the 3.2 cents shown in the above graph would be significantly lower. Since the Bretton Woods agreement shortly after World War II, the US dollar has served as the Beas world's reserve currency. This is enabled the United States to borrow at favorable interest rates and for significant portion of the countries paper money to be used in international trade, i.e., petrodollars. It is estimated that over 50% of the US currency outstanding is held overseas. As a result, an increase in the money supply is not seen as a direct inflationary compliment. However, the rest of the world is growing weary of the US dominance as well as its inability to balance its books. Countries have found ways to chip away at the US role as the world reserve currency. Currency swap agreements are being used to reduce the US reserve currency position. Within the last month, Saudi Arabia has entered oil trade agreements with both China and Russia that eliminates the U.S. dollar as the currency of record. With the Chinese renminbi being added to the IMF bread basket of currencies, and China's growing inventory position in gold, it would not be surprising to see a major reset in world financial markets in the near future. DerivativesDerivatives are financial instruments whose characteristics and value depend upon the underlying asset which is typically a commodity, bond, equity or currency. Examples of derivatives include futures and options. They are generally used to protect against fluctuations in value or to pry profit from Perry’s in an activity or to and/or decline. The financial world tends to think of derivatives as net values whereas nominal values become important when fraud or a major upheaval in the price of the asset or the bankruptcy of one party to the derivatives begins a global meltdown. PhD theorists will say gross is irrelevant because Finance 101 said so, while the market practitioners will point to Lehman, counterparty risk, and less than infinite collateral to fund sudden implosions of weakest links in counterparty chains, and say that it is gross (which until a recent revision of BIS data had been documented at over $1 quadrillion) that mattered, gross which matters, and gross which will always matter until finally everything inevitably collapses in a house of missing deliverable cards. Are you not impressed with how easily revisions are made to data to obfuscate the real situation? Just prior to the demise of Bear-Stearns and Lehman Brothers in 2007, the Bank for International Settlements, in its latest derivatives survey, reported a record $613 trillion in notional value of derivatives outstanding in the over-the-counter markets and derivatives exchanges as of June 30, 2007, an increase of $159 trillion, or 35%, in 12 months. Of particular interest was the $51 trillion in credit derivatives, which have increased more than tenfold since 2004. The FDIC reported a staggering $173 trillion in derivatives at U.S. commercial banks as of Sept. 30, 2007, a figure which was 16 times the $10.8 trillion in total assets of the commercial banks, 27 times their $6 trillion in loans outstanding, and 157 times their $1 trillion in equity capital. A loss equivalent to just 0.63% of that derivatives total would be enough to wipe out all the equity in these banks. The BIS did not like to report that $1.143 quadrillion of derivatives were floating around in the world financial system so like all good bureaucrats ... the BIS simply changed the definition in 2012 of what constitutes a derivative and voila, $400 trillion in derivatives magically disappeared. Really? As of December 31, 2015, the nominal value of global OTC derivatives has grown to $482 trillion according to the latest report of the BIS. But remember, the Basel III accords changed the definition of global OTC derivatives.

Using the previous definition, some analysts estimate that the $1 trillion level is still appropriate. DefaultRecently we have seen an uptick in default of corporate bonds,

municipal bonds, and bonds guaranteed by sovereigns like Puerto

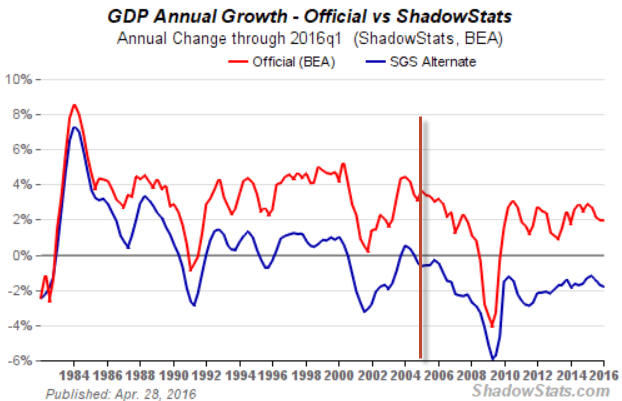

Rico. How is the Economy really doing?Gross Domestic PGross Domestic Product (GDP) is one of the broader measures of economic activity and is the most widely followed business indicator reported by the U.S. government. Upward growth biases built into GDP modeling since the early 1980s, however, have rendered this important series nearly worthless as an indicator of economic activity. The popularly followed number in each release is the seasonally adjusted, annualized quarterly growth rate of real (inflation-adjusted) GDP, where the current-dollar number is deflated by the BEA's estimates of appropriate price changes. It is important to keep in mind that the lower the inflation rate used in the deflation process; the higher will be the resulting inflation-adjusted GDP growth.

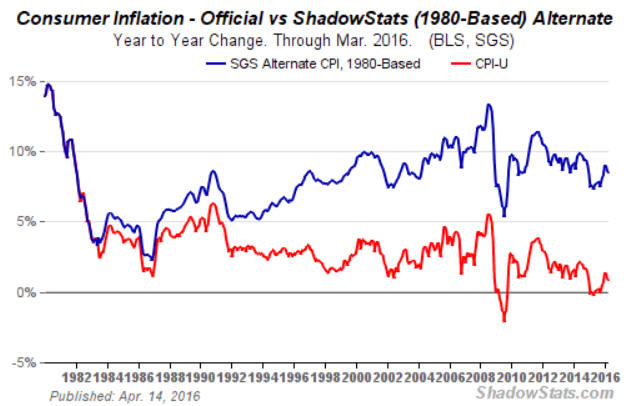

The Ministry of Truth changed the methodology for calculating GDP in the second quarter of 2014. On an annual basis the change at approximately 3% to the annual growth rate of the series and the United States was the very first country to use the new methodology. By highlighting GDP, the Ministry of Truth obfuscates gross national product (GNP) and the national income accounts which are a double entry bookkeeping system. Consumer Price IndexThe consumer price index was intended to be a measurement of consumer inflation -- traditionally reflected measuring the cost of maintaining a constant standard of living, as measured by a fixed-basket of goods. After 1950, the theory of a "constant level of satisfaction" began to replace the "true cost of Living" measurement. As a result, the theory of substitution to maximize the "utility" of money gained credence. In 1982, the first major change to the consumer inflation statistics was made. With many items including wages, pensions, government payouts for social security etc., rising, in the early 1990's politicians again moved to change the nature of CPI by making "hedonic" quality adjustments which were instituted in 1994. In June 1996, another major change to methodology was instituted to reduce the rate of inflation.

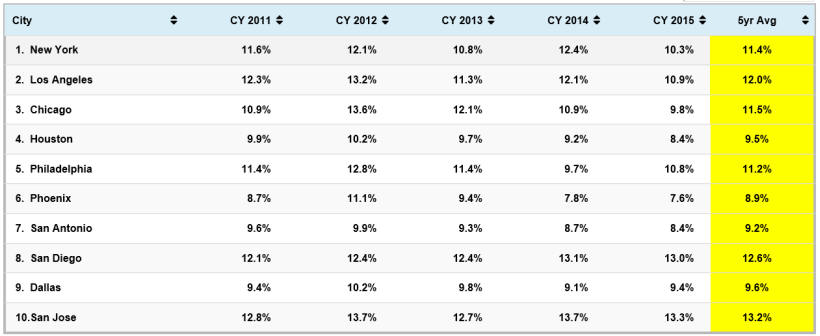

Since the June 1996 changes, the CPI has been changed 23 times and in every case, the reported CPI was lower after the change was made in that month. The Shadow Stats blue line in the above chart is based upon the methodology from 1980. It shows an inflation rate currently in excess of 8% annually rather than the 1% rate from the Ministry of Truth. The Chapwood Index of Prices looks at the top 50 metropolitan areas in the U.S. and twice a year actually buys 500 of the same items and then publishes a report. The results of the Chapwood Index for the past five years for the top 10 metropolitan areas is shown below:

It should be obvious from these two studies from Shadow Stats and Chapwood that governments' measurement of the consumer price index is seriously flawed. UnemploymentThe latest Employment Situation report from the Ministry of Truth reported that only 160,000 new jobs were added in April 2016 which was below expectations. Full-time employment fell by 253,000 with the Total Employed declining by 316,000. The April 2016 unemployment rates were little changed: U.3 at 5.0%, U.6 at 9.7% and the real unemployment rate according to Shadow Government Statistics stood at 22.9%.

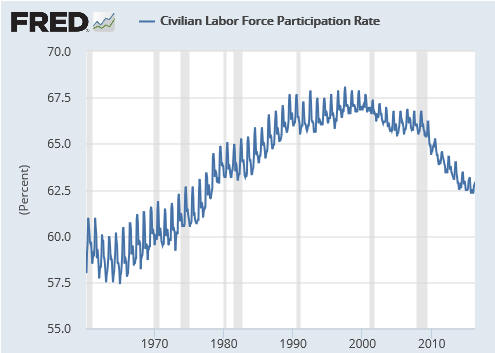

Pick your number ... but if you really want to count all the unemployed, 22.9% is closer to the truth. If you look at all the workers between the age of 18-65, over 25% are not working. Moreover, the labor participation rate is at a level not seen since before 1980 as shown in the following graph.

The Ministry of TruthThe Ministry of Truth's data as seen in GDP, CPI, and

unemployment series above paints a picture that is somewhat

different than the real world in which we exist. Over time, the most important factors determining our

economic future or that of any nation will be determined by the five

D's.

ConclusionThe Ministry of Truth's data about the state of the economy is

seriously flawed. As noted at the beginning of this essay, raw facts

fail to depict a growing economy despite historic low interest

rates. It is also important that the civil service protections be revised so that incompetency can be quickly removed as well as the unfunded liabilities of their pension system is brought under control. Over the long-term, the five D's control the destiny of a sovereign nation. Hopefully, the Sixth D -- "Disaster" does not raise its head and destroy the sovereign nation. But then - 'Tis Only My Opinion!Fred Richards www.adrich.com Corruptisima republica plurimae leges. [The more corrupt a republic, the more laws.] -- Tacitus, Annals III 27 'Tis only My Opinion! Archive Menu, click here. This

issue of 'Tis Only My Opinion was copyrighted by Strategic Investing in 2016. |