As the self-imposed U.S. debt default date of August 2, 2011 approaches without a viable plan from either the House or Senate that stands a snowballs' chance in July of passing, it is quickly becoming obvious that neither party in Congress has any clue about the real problem.

Not just in the United States but throughout most Western countries, politicians have simply failed to understand basic mathematics along with basic accounting principles. Facing a demographic shift from the Baby-Boomer generations both here and abroad, politicians have simply promised more than can be delivered through the social welfare programs currently in place.

The current "statutory federal debt ceiling" in the U.S. is $14.29 trillion and the U.S. Treasury is currently using every tool at its disposal to stay under that limit but is quickly running out of options. While attention is currently focused upon the statutory debt limit, the real problem is the size of the GAAP debt and the increasing level of unfunded liabilities.

Politicians and the media are focused on just the tip of the problem when in actuality, it is the total government debt including unfunded liabilities that needs addressing.

Depending upon which discount rate one assumes, the unfunded liabilities plus the "statutory federal debt" lies north of $65 trillion and perhaps, is as high as $150 trillion according to various sources.

There is not a scenario in history where the economy can grow to support the level of debt currently held not only in the U.S. but in many Western countries. Politicians have simply not been able to understand the costs of various programs which they have enacted. There are only three options:

|

major restructuring of all current government programs, | |

|

default (repudiation), or | |

|

hyper-inflation. |

The time for making a choice is getting short.

To understand the current debate about the debt limit, (also known as the debt ceiling), an understanding of the history and current status of the debt limit is helpful.

The U.S. Constitution gives Congress the power of the purse strings, not the Executive Branch. Before the federal government can spend money, Congress must authorize the spending and it must be initiated in the House of Representatives. If the federal government spends more than it collects in revenue from taxes or other sources, it must borrow that sum by issuing bonds or other securities.

Before World War I, only Congress could authorize bond issues. In 1917, the costs of the war were escalating at a frantic pace and in 1917, Congress enacted legislation to enable the Executive Branch through the U.S. Treasury Department to issue new bonds to cover cash-flow gaps for the spending programs that Congress had already authorized. However, to prevent runaway debt issuance, Congress placed a statutory limit on the outstanding debt of the Treasury. Today, that is known as the statutory debt limit, or debt ceiling.

Since 1917, Congress has always raised the debt ceiling as the federal indebtedness increased. Occasionally, political considerations have prevented raising of the debt ceiling on a timely basis and raised the specter of default as it has today.

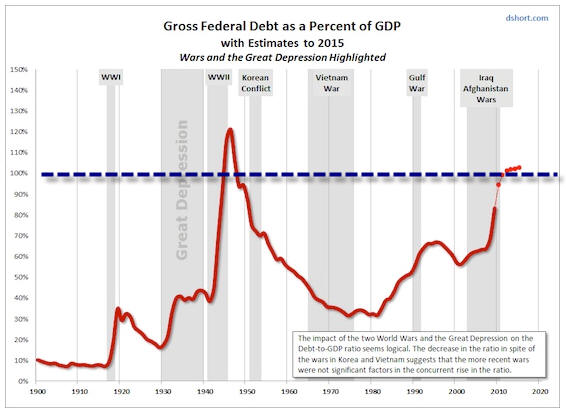

The following chart shows since 1900 the growth of U.S. Federal debt.

The Senate is controlled by Democrats who are reluctant to seriously reduce spending despite a major increase in the size of government since the Obama Administration began in 2009. While committed to reducing the spiraling cost of government spending, the Senate is unwilling to seriously reduce actual spending amounts without increasing taxes. The Senate would also like to move the next increase in the debt ceiling beyond the Presidential election in November 2012.

In the House of Representatives, the Tea Party members of the Republican Party are adamant about reducing spending without increasing taxes and amending the Constitution to force Congress to balance the budget. The Republicans only want a small increase in the debt ceiling to require Congress to readdress the spending/tax problem before the next election.

As a result, there is an impasse at the moment over the debt ceiling.

Raising taxes nor small reductions in the growth rate of spending will not solve the massive budget deficits including the unfunded liabilities facing the U.S. If all pre-tax corporate income of U.S. corporations was taxed at 100%, the "reported deficit" in the U.S. in FY 2011 would still be over $800 billion.

It is not surprising that the growth in the federal debt parallels the growth in U.S. government spending as shown in the following chart. Politicians are always willing to promise more than their constituents are willing to pay for on a current basis. "Kicking the can down the road" has a long historical life throughout civilizations but ultimately creates a condition that causes the civilization to disintegrate.

After a civilization begins to debase its currency or issues a fiat currency, the die is set. The only question is a matter of time ... months, years or centuries. When the Federal Reserve came into existence in 1913, its mandate was to

"to help counteract inflationary and deflationary movements and to share in creating conditions favorable to a sustained higher level of employment, a stable dollar, growth of the country, and a rising level of consumption."

The following chart shows the relationship between gross federal debt and GDP from 1900 to the present with estimates to 2015. Since the formation of the Federal Reserve System in 1913, the gross federal debt has managed to increase and currently is approaching 90% of GDP.

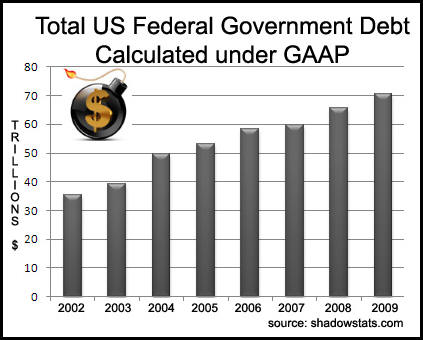

While the growth of federal debt looks bad, it is actually much worse since none of the above analysis and charts show the actual GAAP liabilities. Moreover, since the U.S. Government Accountability Office (GAO) will not issue a clean accounting opinion, even the $5.2 trillion deficit in FY 2010 rather than the $1.7 trillion bandied about by Congress and the media is suspect.

The following chart shows the total U.S. Federal Government Debt calculated under GAAP rules through FY 2009. John Williams of ShadowStats suggests that another $5.2 Trillion was added in FY 2010 and that at the end of FY 2011, the number will be in excess of $80 Trillion. Moreover, the cost of the ObamaCare legislation is not included in Williams' estimates.

In any event, the total federal government debt is substantially greater by far than the $14.3 statutory debt ceiling currently being debated.

Since 2009, the spending of the federal government has increased at the fastest rate in the last 60 years. During Bush's last year, the federal government only spent $2.982 trillion and generated a "reported" deficit of $458 billion. Three years later, the Obama Administration was on target to spend $3.8 trillion and generate a "reported" deficit of $1.6 trillion.

In the last three years, the Obama Administration increased spending by 27% and the "reported deficit" by 249%. Of course, the moribund economy despite billions of stimulus dollars was not generating sufficient tax revenues. However, spending was clearly the major culprit in increasing the deficit.

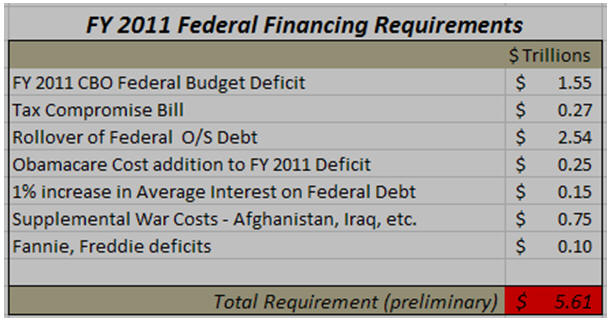

During FY 2011 in excess of 40 cents of every dollar spent by the federal government had to be borrowed. Coupled with a shortened maturity schedule that the U.S. Treasury had used to reduce its interest costs and deficit spending, the U.S. Treasury was faced in FY 2011 with a massive financing problem as shown in the following table.

Not only is the U.S. Treasury facing huge deficits going forward but sovereign debt problems throughout the world have grown significantly during the 21st century.

There is simply too much debt!

All of the proposed solutions for solving the problem fail the elementary math test. Economic growth coupled with demographic shifts clearly will not solve the problem. Increasing taxes without offsetting spending reductions also will fail. The only solution is major reductions in spending program along with more equitable taxation policies which don't strangle investments.

In Eco 101, the elemental fact should have been learned. The basic formula for calculating the GDP is:

As John Mauldin and David Walker have pointed out multiple times along with myself, the result of cutting "G", or government spending, is unfortunately a reduction in GDP. Increasing taxes reduces "I", or investment made by industry, which also affects GDP negatively.

Further, consumer spending in the U.S. is increasing slowly, if at all, on a real basis. As a result, most of the GDP components are under pressure.

Professor William Sahlman of the Harvard Business School stated in April 2011 the following which took many in his audience by surprise:

"You can not believe anything you read in the New York Times and the Wall Street Journal, they all lie!"

When disinformation is repeated over and over, it begins to have legitimacy in the world. Hence, the public's perception of the real world is often at variance with it.

| Description | Public Perception | Reality |

| Gross Domestic Product | $15 Trillion | $15 Trillion - $3.6T Gov't spending |

| Federal Deficit | $1.6 Trillion | $5.0 Trillion GAAP |

| Statutory Debt | $14.3 Trillion | $60 - $150 Trillion GAAP |

| Inflation rate (CPI) | 1-2% | > 10% |

| Unemployment rate | 9.2% | >23% |

The real problem with the public perception data is that it does not provide the person used to 10 second sound-bites any understanding of the magnitude of the problem facing the country. As a result, temporary rather than long-term solutions continue to be patched together in an attempt to "kick the can down the road."

There is simply not enough resources to pay for the Ponzi schemes like Social Security, Medicare, Medicaid and various pension programs at the various governmental levels. Even assuming an 8% increase in GDP annually for 10 years, the GAAP deficits remain in the $3-5 trillion range.

This is simply unsustainable!

Current members of Congress do not have the political will to seriously cut back total spending and government regulation while providing incentives to entrepreneurs and businesses to invest in job creation. The FY 2011 deficit is about $1.6 trillion ($5.2 trillion on a GAAP basis) and Congress can only agree on cutting less than $60 billion. It is obvious that they do not understand the problem.

Their political games will cause a downgrade of the AAA rating for U.S. Treasuries even if the current statutory debt limit is increased in time to prevent a default.

The metrics used to judge the credit worthiness of the PIIGS (Portugal, Ireland, Italy Greece and Spain) when applied to the U.S. shows clearly that our AAA rating is just a figment of someone's imagination.

Three rating agencies have already downgraded the U.S. bonds. They are China's Dagong Global Credit Rating Co. (A+), and Weiss Ratings (C-) and Egan-Jones Ratings Co. (AA+). S&P, Moody's and Fitch (the largest rating agencies) all have the U.S. bonds on negative credit watch.

All of the rating agencies as well as the IMF point to the excessive spending and the unwillingness to reduce total spending as reasons for a downgrade. The major rating agencies having been burned over the sub-prime toxic asset fiasco will be extremely careful going forward.

A downgrade will bring increased interest costs at all levels and further reduce consumer spending.

We are now seeing the ranks of the adults who survived the Great Depression and the veterans of the Greatest Generation quickly passing from view. Their sacrifice will be in vain if current voters refuse to tighten their belts and demand that their government also do so. Unless we immediately begin to take steps to restore this country to a constitutional republic, it will be lost.

As Benjamin Franklin said many years ago in reply to a citizen at the Constitutional Convention in 1787 when asked, "Well, Doctor, what have we got?" Franklin's answer was:

"A republic, if you can keep it."

The choice is between major pain now by reining in government spending or a complete collapse of the financial system going forward. Unfortunately, as we go to press, "kick the can over the cliff" appears to be the solution decided upon by Congress and the Obama Administration. Perhaps, with their choice, we are accelerating on the road towards losing the republic.

But then - 'Tis Only My Opinion!

Fred Richards

August 1, 2011

Corruptisima republica plurimae leges. [The more corrupt a republic, the more laws.] -- Tacitus, Annals III 27

This issue of 'Tis Only My Opinion was

copyrighted by Adrich Corporation in 2011.

All rights reserved. Quotation with attribution is encouraged.

'Tis Only My Opinion is intended to provoke thinking, then dialogue among

our readers.

![]()

![]() 'Tis Only My Opinion! Archive Menu

'Tis Only My Opinion! Archive Menu

Last updated - December 21, 2010