![]()

Has the Federal Reserve Bank achieved its mandate?

Chairman Benjamin S. Bernanke of the Federal Reserve Bank Board of Governors made his life’s study the economic and political causes of the Great Depression on which he has written extensively.

On Milton Friedman's ninetieth birthday, November 8, 2002, he stated:

"Let me end my talk by abusing slightly my status as an official representative of the Federal Reserve System. I would like to say to Milton and Anna: Regarding the Great Depression. You're right, we did it. We're very sorry. But thanks to you, we won't do it again."[

Despite his academic credentials, Dr. Bernanke has little real experience in business and/or the currency markets.

While I rarely agree with George Soros, I do agree with Jim Rogers. They both consider Dr. Bernanke totally inept and unable to take the necessary action to prevent the U.S. economy from moving into either stagflation and/or hyper-inflation.

However, he is now the titular head of the Federal Reserve Bank, a private bank chartered in 1913 by Congress following the bank crisis of 1907 which is often called the Wall Street Panic.

Moreover, I find his answer to the question Ron Paul asked about what caused inflation to be absolutely amazing. Bernanke answered that inflation was an increase in the cost of living or CPI. Now that is just nonsense. Inflation is an increase in the money supply without a commiserate increase in productive wealth. And guess who controls the money supply … it is the Federal Reserve Bank!

Bernanke’s study of the 1930’s is of little use now.

The economic situation of the U.S. is significantly different today than in the 1930’s and particularly when viewed on a global scale.

Just prior to 1929, the U.S. was the largest creditor nation in the world and the U.S. Treasury currency was backed by gold and silver. It was the largest producing nation in the world with vast natural resources. The nation was self-sufficient in energy. In 1930, the literacy rate in was 95.3%. The scholastic rankings for its eighth grade students placed the nation in the top 3 nations in math, science, and language tests.

Today, the U.S. is the largest debtor nation in the world and its currency is issued not by the U.S. Treasury but by the Federal Reserve Bank. The economy is now dominated by services not manufactured items and consumers account for over 70% of GDP. Today, the U.S. imports over 50% of our energy requirements while using a substantial percentage of the world’s energy production. The U.S. literacy rate is tied for 18th in the world according to the United National Development Program Human Development Report 2007/2008. Eighth grade students in the U.S. fall below the median for all nations when ranked in math, science and language tests.

The reality is that today’s U.S. economic situation is far removed from that of the 1930’s. The Federal Reserve’s monetary policy has increased its impact on the economy as the nation became more dependent on a fractional reserve banking system.

The Federal Reserve is beholden to no one but itself.

According to the late professor Murray N. Rothbard,

"The Federal Reserve System virtually controls the nation's monetary system, yet it is accountable to no one. It has no budget; it is subject to no audit; and no Congressional Committee knows of, or can truly supervise, its operations."

The Development of a Central Banking System

The first two central banks of the U.S. failed in 1807 and again in 1833. In the 1800’s the nation had both state and nationally chartered banks issuing their own currency. During the Civil War, the need for a uniform national currency became evident to many politicians and bankers. Following the Civil War, Congress imposed a 10% tax on all outstanding state bank notes which effectively made state banking unprofitable.

David Kidwell and Richard Peterson writing in their 1997 book, “Financial Institutions, Markets and Money”, 6th edition, by Dryden Press point out the following problems with the post Civil War banking system.

“There were two major defects remaining in the banking system in the post Civil War era despite the mild success of the National Banking Acts. The first was the inelastic currency problem. The amount of currency which a national bank could have circulating was based on the market value of the Treasury securities it had deposited with the Comptroller of the Currency, not the par value of the bonds. If prices in the Treasury bond market declined substantially, then the national banks had to reduce the amount of currency they had in circulation. This could be done be refusing new loans or, in a more draconian way, by calling-in loans already outstanding. In either case, the effect on the money supply is a restrictive one. Consequently, the size of the money supply was tied more closely to the performance of the bond market rather than needs of the economy.

Another closely related defect was the liquidity problem. Small rural banks often kept deposits at larger urban banks. The liquidity needs of the rural banks were driven by the liquidity demands of its primary customer, the farmers. In the planting season the was a high demand for currency by farmers so they could make their purchases of farming implements, whereas in harvest season there was an increase in cash deposits as farmers sold their crops. Consequently, the rural banks would take deposits from the urban banks in the spring to meet farmers’ withdrawal demands and deposit the additional liquidity in the autumn. Larger urban banks could anticipate this seasonal demand and prepare for it most of the time. However, in 1873, 1884, 1893, and 1907 this reserve pyramid precipitated a financial crisis."

The Wall Street panic crisis of 1907 caused the worst economic depression in the country’s history at the time. The panic of 1907 was triggered by rumors that two major banks were about to become insolvent. Later evidence pointed to the House of Morgan as the source of the rumors.

The public, believing the rumors, proceeded to make them come true by staging a run on the banks. Morgan then nobly stepped in to avert the panic by importing $100 million in gold from his European sources. Prior to 1913, Congress was opposed to any bill that allowed the nation’s money to be issued by a private central bank controlled by Wall Street.

After unemployment rose to 20% and several long-standing banks failed with the loss of millions of dollars of depositor funds, the stage was set for a change.

J.P. Morgan created the conditions for the Act’s passage, but it was Paul Warburg who pulled it off. An immigrant from Germany, Warburg was a partner of Kuhn, Loeb, Rothschilds’ main American banking operation since the Civil War. J.P. Morgan was also a House of Rothschild agent.

The need for a better solution to the financial stresses in the system helped the movement for banking reform to move forward.

In 1910, the Aldrich Plan was floated following a secret meeting at Jekyll Island to put a banking reform plan together. The problem was the Aldrich Plan allowed regional banks to be controlled individually and nationally by bankers which the Democratic Party was against.

In 1910, the Democrats won control of Congress and in 1912 Woodrow Wilson, a Democrat, became President.

In 1913, Congressman Arsene Pujo held hearings that indicated that the nation’s credit markets were under the tight control of a handful of banks. During the Pujo hearings, it was discovered that twelve banks in New York, Boston, and Chicago, had 746 interlocking directorships in 134 corporations. These were the “money trusts” which Wilson had railed against in his acceptance speech in 1913.

President Wilson advised that "a concentration of the control of credit ... may at any time become infinitely dangerous to free enterprise."

The legislation that eventually emerged was the Federal Reserve Act, also known at the time as the Currency Bill, or the Owen-Glass Act. The bill called for a system of eight to twelve mostly autonomous regional Reserve Banks that would be owned by the banks in their region and whose actions would be coordinated by a Federal Reserve Board appointed by the President.

The Board’s members originally included the Secretary of the Treasury, the Comptroller of the Currency, and other officials appointed by the President to represent public interests. The proposed Federal Reserve System would therefore be privately owned, but publicly controlled. Wilson signed the bill on December 23, 1913 and the Federal Reserve System was born.

The purpose of the Federal Reserve Act of 1913, was

"to help counteract inflationary and deflationary movements and to share in creating conditions favorable to a sustained higher level of employment, a stable dollar, growth of the country, and a rising level of consumption."

The gold and silver in the nation’s vaults were now owned by the Federal Reserve and not the U.S. Treasury. Elisha Garrison, an agent of Brown Brothers bankers, wrote in his 1931 book Roosevelt, Wilson and the Federal Reserve Law that “Paul Warburg is the man who got the Federal Reserve Act together after the Aldrich Plan aroused such nationwide resentment and opposition. The mastermind of both plans was Baron Alfred Rothschild of London.”

President Wilson and Representative Carter Glass were given credit for passing the Federal Reserve Act. William Jennings Bryan played a major role in gaining Republican support. Bryan later wrote:

“The one thing in my public career that I regret – my work to secure the enactment of the Federal Reserve law.”

Representative Glass would later also write:

“I had never thought the Federal Bank System would prove such a failure. The country is in a state of irretrievable bankruptcy.”

Eustace Mullins, in his book The Federal Reserve Conspiracy, wrote:

“The money and credit resources of the United States were now in complete control of the banker’s alliance between J. P. Morgan’s First National Bank, and Kuhn & Loeb’s National City Bank, whose principal loyalties were to the international banking interests, then quartered in London, and which moved to New York during the First World War.”

Three years after the initiation of the Federal Reserve, Woodrow Wilson said:

“The growth of the nation … and all our activities are in the hands of a few men … We have come to be one of the worst ruled: one of the most completely controlled and dominated governments in the civilized world … no longer a government of free opinion, no longer a government by conviction and the free vote of the majority, but a government by the opinion and duress of a small group of dominant men.”

The Confiscation of Gold and the Exchange Stabilization Fund

During WWI Congress passed The 1917 Trading With the Enemy Act. This act is still in place. Its article 5(b) states:

"That the President may investigate, regulate or prohibit, under such rules and regulations as he may prescribe, by means of licenses or otherwise, any transactions in foreign exchange for the export, hoarding melting, or earmarking of gold or silver coins or bullion or currency."

The depression swept Franklin Delano Roosevelt into office on March 4th, 1933. On Monday the 6th of March Roosevelt closed the banks for 4 days by declaring a national bank holiday. Even though it was an illegal act to do so the democratic congress went along with Roosevelt.

A month later, President Roosevelt issued Presidential Executive Order 6102 on April 3rd, 1933 by using article 5(b) of the 1917 Trading With the Enemy Act that effectively stole all the gold held by U.S. citizens.

The price given to its citizens was $20.67/ounce and shortly, thereafter, it was revalued at $35/ounce. Now I would characterize that confiscation move as grand theft.

Silver also suffered the fate of gold. On August 9, 1934 a Presidential Proclamation ordered all silver bullion surrendered to the Treasury within 90 days and a 50 percent tax was levied on any profits from the sale of silver. The sellers were paid 50.1 cents per ounce.

The confiscated gold was eventually placed in the custody of the Exchange Stabilization Fund (ESF) whose legal basis was the Gold Reserve Act of 1934. The Gold Reserve Act of 1934 authorized the president to revalue the dollar in relation to its existing statutory gold equivalent. This set the dollar's value at 59.04 percent of the par value as set by the Gold Standard Act of 1900, resulting in a gold "profit" of $2,806 million through devaluation of the dollar.

Darryl Robert Schoon in his book, “How to Survive the Crisis and Prosper in the Process,” illustrates the history of currency and the demise of the American economy after WWII.

“President Dwight D. Eisenhower was Supreme Commander of the Allied Forces that defeated the fascist powers in World War II; and, as a war hero, he was believed to be an ideal candidate for the Republican Party in the 1952 presidential elections.

Eisenhower was elected but while serving as president, Eisenhower clearly saw the forces that would someday be responsible for America’s loss of power; for it was during Eisenhower’s presidency that the erosion of America’s economic wealth began.

Prior to Eisenhower’s presidency in 1952, the US was the wealthiest nation in the world. As the largest industrial power, the US enjoyed a positive balance of trade with its partners. Before Eisenhower assumed office, the US had gold reserves totaling almost 22,000 tons, the most gold any nation had ever possessed.

When Eisenhower left office, however, it is uncertain how much gold remained; because after 1954, the US never allowed a public audit of its gold reserves. As the US then sold more goods abroad than it bought, US gold reserves should have increased. Instead, they declined. In one year alone, 1958, US gold reserves were reduced by 10 %.

The powerful forces that controlled America were spending so much of America’s wealth on overseas military and corporate expansion that gold was flowing out faster than trade could bring it in. Indeed, the profligate spending responsible for America’s loss of gold and consequent debt began during Eisenhower’s presidency.”

It should be noted that Schoon’s data fails to include any of the gold and silver which were obtained by the U.S. government from the German and Japanese hoards following WWII as documented in Sterling & Peggy Seagrave’s book “Gold Warriors: America’s Secret Recovery of Yamashita’s Gold” and Tom Bower’s book “Nazi Gold: The Full Story of the Fifty-Year Swiss-Nazi Conspiracy to Steal Billions from Europe’s Jews and Holocaust Survivors.” What the disposition of all this gold was is unknown. We do know that a large portion of Yamashita’s hoard was used to finance covert operations of the CIA for many years.

As amended in the 1970’s, the ESF can be used to purchase or sell foreign currencies, to hold U.S. foreign exchange and Special Drawing Rights (SDR) assets, and to provide financing to foreign governments. All operations of the ESF require the explicit authorization of the Secretary of the Treasury ("the Secretary").

U.S. citizens were granted the privilege of owning gold again on August 14th, 1974. However, Executive Order 6102 has not been repealed and the U.S. government could at any time again confiscate all gold held by U.S. citizens.

In the mid-eighties, Representative Ron Paul served on the Gold Commission in the House of Representatives. Paul wrote:

"If it gets bad enough, they’ll declare a national economic emergency. They’ll take over the banks, all business and industry. They may even try to confiscate our gold. I served on the Gold Commission for eight or nine months while I was in Congress along with fifteen other members. I brought up the subject of confiscation. The power to confiscate gold is still on the books as the law of the land. I urged the full Commission to recommend Congress repeal the power to confiscate gold in an economic emergency. We pushed it to a vote and I was the only one that voted to recommend to Congress that we never again contemplate taking the gold of the American people. The fifteen other members voted it down. The power is still there on the books, and they can do it any time they wish."

In the late 1980’s, Dr. Franz Pick wrote a book entitled “The Triumph of Gold.” Dr. Pick wrote the following:

"Today there are some 49 countries which forbid ownership of gold by their citizens, but do allow holding gold coins for numismatic purposes. Even the Soviet Union and Eastern countries legally tolerate the acquisition of numismatic gold coins. For these are the only gold holdings that could be kept in your safe deposit box without any fear of confiscation."

The Controversy about E. O. 11110

Forty-five years ago, John F. Kennedy signed Executive Order 11110 on June 4, 1963 which returned to the U.S. Treasury Secretary the power to issue silver certificates or as some suggest, to remove them from circulation by not issuing them.

Economic activity during the Eisenhower and Kennedy administrations were growing and a demand for silver used to mint coins grew. In order to conserve the Treasury’s silver stock and the price of silver increased, E.O. 11110 was signed to enable the Treasury Secretary to reduce the number of silver certificates in circulation and thus, increase the stock of silver that could be used to mint coins and hence, not required to back currency.

To conserve the Treasury's silver needs, the Silver Purchase Act and related measures were repealed by Congress in 1963 with Public Law 88-36. Following the repeal, only the President could authorize new silver certificate issues, and no longer the Treasury Secretary. Public Law 88-36, signed by Kennedy himself, also permits the Federal Reserve to issue small denomination bills to replace the outgoing silver certificates (prior to the act, the Fed could only issue Federal Reserve Notes in larger denominations).

The Federal Reserve Bank

Many U.S. citizens believe that the Federal Reserve Bank is a part of the U.S. government. However, that is false. The Federal Reserve Bank is owned by its member banks and their shareholders. If you trace the shareholders of those banks to their control positions, you will find that the ultimate shareholders are either English, French and/or German organizations.

Perhaps, the confusion in people’s minds about the status of the Federal Reserve Bank is because the Board of Governors is approved by the Congress. However, that basically begs the question of how a person is nominated for the Board of Governors and to whom the nominee is beholden for the nomination.

In effect, the Federal Reserve Bank is in business for the banking institutions and not in the business of protecting the public. Whether it rebates its profits to the U.S. Treasury or not is immaterial.

The Federal Reserve’s monetary policy objectives as set form in Section 2A of

The Federal Reserve Act of 1913 as amended states:

The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy's long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.

[12 USC 225a. As added by act of November 16, 1977 (91 Stat. 1387) and amended by acts of October 27, 1978 (92 Stat. 1897); Aug. 23, 1988 (102 Stat. 1375); and Dec. 27, 2000 (114 Stat. 3028).]

As Section 2A states the objective of the Federal Reserve System was to promote “maximum employment, stable prices, and moderate long-term interest rates.”

Has the Federal Reserve System achieved those goals?

At the beginning of the 20th century, the U.S. dollar was convertible into either gold and/or silver irrespective of whether the institution that had issued the currency was a state or national bank. Even after the formation of the Federal Reserve, the U.S. Treasury continued to issue currency that could be converted into either hard asset.

Maximum Employment

The Bureau of Labor Statistics (BLS) is responsible for determining using a variety of sources the employment level in the U.S. The BLS prepares two surveys which are used to determine those levels; the household survey and the establishment survey.

During the last fifteen years, several changes have been made to the way these series are calculated. As a result, historical data and comparison with the unemployment rates of other countries must be carefully analyzed rather than just relying on the reported data.

In addition, the BLS has developed the Birth/Death rate adjustment (B/DA) which purports to measure individuals who are in jobs that can not be counted.

In 2007, the B/DA provided the total increase of jobs in the economy during the year as shown below (See Appendix I).

In fact, for the household survey, the B/DA adjustment was 3.9 times the actual increase in total jobs for 2007.

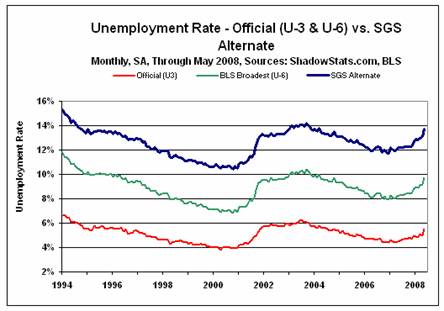

The BLS actually calculates two unemployment rates on its Employment Situation Summary. In Table A-12, it reports both U-3 (red line) and U-6 (green line) shown below. John Williams of Shadow Government Statistics has developed his Alternate Unemployment Rate (blue line). It reflects current unemployment reporting methodology adjusted for SGS-estimated "discouraged workers" defined away during the Clinton Administration added to the existing BLS estimates of level U-6 unemployment.

Based upon the above chart, it would seem that there is considerable disagreement on what the unemployment rate truly is. Hence, the question of whether the Federal Reserve has managed to provide “maximum employment” would seem to be murky, at best.

Price Stability

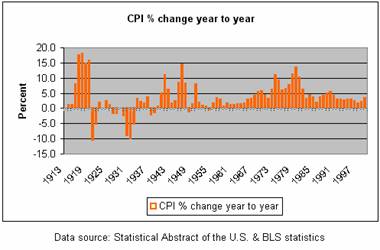

Since the Federal Reserve System was also charged with maintaining “stable prices”, it might be useful to determine how successful they have met that objective. The basic series to measure price stability is the Consumer Price Index or CPI. One of the major problems with the CPI is that the methodology for calculating the CPI is flawed. When a series has many seasonal and hedonic changes in a short time period all of which when initially changed reduced the CPI reported, there is a serious concern that the data is not reflection of reality. The change in the Consumer Price Index beginning in 1913 as officially reported by the Bureau of Labor Statistics is shown in the following chart.

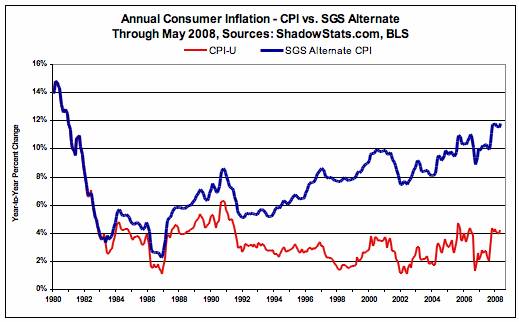

The following chart from John Williams and Shadow Government Statistics shows the difference in the official BLS data (red line) and the Consumer Price Index (blue line) if calculated using the methodology which was used in 1980 before many of the changes began.

It is hard to argue that the official BLS data understates the reality of inflation which has faced the consumer since 1980.

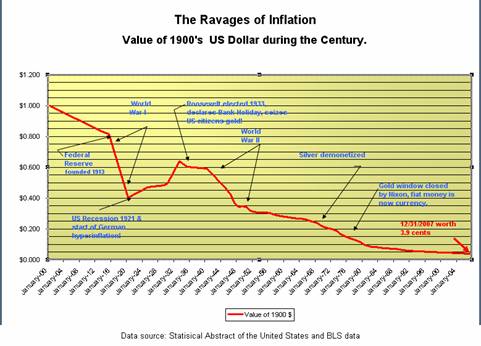

The following chart (see Appendix II) shows using the official Consumer Price Index data from the Bureau of Labor Statistics the effective value of the U.S. dollar since 1900. Inflation which occurred during the first 13 years of the 20th century was largely caused by the Wall Street Panic of 1907 which decreased the dollar’s value by about 15% in those years.

The above chart is based upon the U.S. Department of Labor, Bureau of Labor Statistics data which has been changed many times since 1980 in the way the data has been calculated.

If you apply the inflation data from Shadow Government Statistics to the value of the dollar, the 1980 dollar is worth even less that the 3.9 cents shown by the official data. But even more important, the current dollar is only a fiat currency backed by little more than hot air.

The reader has to conclude that for the most part, the Federal Reserve’s monetary policy has not led to stable prices and during recent periods, monetary policy has accelerated the inflation rate.

Interest Rates

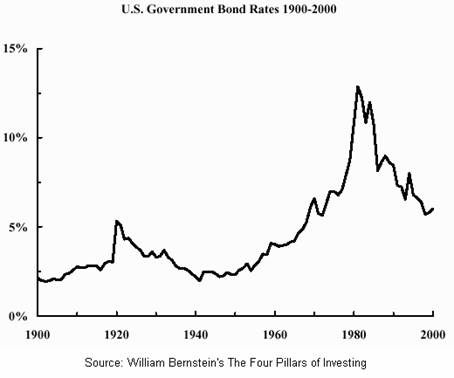

We shall now turn to the examination of “moderate long-term interest rates.” The following chart from William Bernstein’s The Four Pillars of Investing shows the U.S. 30 year Treasury Bond Yield from 1900.

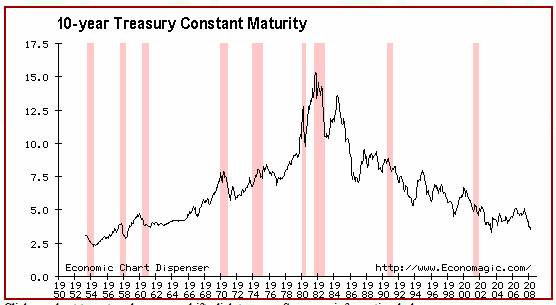

The following chart shows the 10-year Treasury Constant Maturity interest rate since 1950. With the exception of the late 1970’s and 1980’s, the Federal Reserve’s monetary policy had maintained interest rates at rates below 6% for the 10 year Treasury bond. The shaded bars represent recessions declared by the National Bureau of Economic Research’s business cycle dating committee. The designation of a recession often occurs months after it has begun.

As the chart shows, the yield on the 10 year Treasury has been above 5% for the majority of time since the 1950’s. Whether that level is what constitutes “moderate long-term interest rates” is, of course, open to interpretation.

However, it is my contention that because the Federal Reserve System basically sets the level of liquidity in the system, the chart clearly suggests that the area above the 5% level since 1950 is definitely greater than the area below the 5% level. If 5% is moderate, then clearly since the 1950’s, the Federal Reserve System has not maintained “moderate long-term interest rates.”

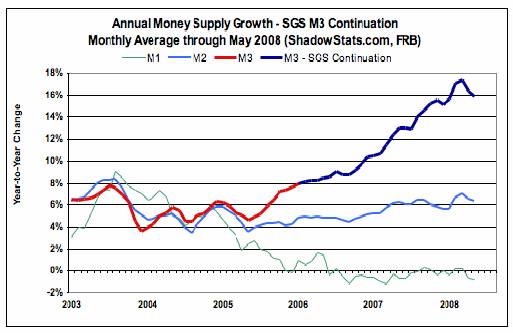

In 2006, the Federal Reserve in a “cost-cutting” move decided to cease publishing the monthly M3 data. Probably, the real reason for the official demise of M3 was that the growth of non-bank lending had basically overwhelmed the Federal Reserve’s ability to control M3. It could perhaps try to control M1, MZM, and M2 but not M3. Nevertheless, the growth of M3 has exploded and is now running in excess of 16% per year during 2008 which is almost double the rate of M3 expansion in 2006.

John Williams of Shadow Government Statistics and others are able to calculate the M3 data easily and the following graph shows the growth of the three major monetary series since 2003.

With the unfolding of the sub-prime crisis and the unwinding of non-regulated derivative trades beginning in June 2007 when Bear Stearns folded two hedge funds, the financial crisis continues to grow despite many attempts to reduce its impact.

The Collapse of Bear Stearns

The swift collapse of Bear Stearns in March 2008 was fueled by rumors just like the Panic of 1907 was fueled by rumors. However, there is something very different about the Bear Stearns demise that stinks.

Ellen Brown in her May 13th article “The Secret Bailout of JP Morgan:” quotes John Olagues, an authority on stock options in a March 23 article boldly titled “Bear Stearns Buy-out … 100% Fraud”. Olagues suggests that it was J.P. Morgan Chase that was in trouble, not Bear Stearns.

“Olagues maintains that the Bear Stearns collapse was artificially created to allow JPMorgan to be paid $55 billion of taxpayer money to cover its own insolvency and acquire its rival Bear Stearns, while at the same time allowing insiders to take large “short” positions in Bear Stearns stock and collect massive profits. For evidence, Olagues points to a very suspicious series of events, which will be detailed here after some definitions for anyone not familiar with stock options:

A put is an option to sell a stock at an agreed-upon price, called the strike price or exercise price, at any time up to an agreed-upon date. The option is priced and bought that day based upon the current stock price, on the presumption that the stock will decline in value. If the stock’s price falls below the strike price, the option is “in the money” and the trader has made a profit. Now here’s the evidence:

On March 10, 2008, Bear Stearns stock dropped to $70 a share -- a recent low, but not the first time the stock had reached that level in 2008, having also traded there eight weeks earlier. On or before March 10, 2008, requests were made to the Options Exchanges to open a new April series of puts with exercise prices of 20 and 22.5 and a new March series with an exercise price of 25. The March series had only eight days left to expiration, meaning the stock would have to drop by an unlikely $45 a share in eight days for the put-buyers to score. It was a very risky bet, unless the traders knew something the market didn’t; and they evidently thought they did, because after the series opened on March 11, 2008, purchases were made of massive volumes of puts controlling millions of shares.

On or before March 13, 2008, another request was made of the Options Exchanges to open additional March and April put series with very low exercise prices, although the March put options would have just five days of trading to expiration. Again the exchanges accommodated the requests and massive amounts of puts were bought. Olagues contends that there is only one plausible explanation for “anyone in his right mind to buy puts with five days of life remaining with strike prices far below the market price”: the deal must have already been arranged by March 10 or before.

These facts were in sharp contrast to the story told by officials who testified at congressional hearings on April 4. All witnesses agreed that false rumors had undermined confidence in Bear Stearns, making the company crash despite adequate liquidity just days before. On March 10, 2008, Reuters was citing Bear Stearns sources saying there was no liquidity crisis and no truth to the speculation of liquidity problems. On March 11, the Chairman of the Securities and Exchange Commission himself expressed confidence in its “capital cushion.” Even “mad” TV investment guru Jim Cramer was proclaiming that all was well and the viewers should hold on. On March 12, official assurances continued. Olagues writes:

“The fact that the requests were made on March 10 or earlier that those new series be opened and those requests were accommodated together with the subsequent massive open positions in those newly opened series is conclusive proof that there were some who knew about the collapse in advance . . . . This was no case of a sudden development on the 13 or 14th, where things changed dramatically making it such that they needed a bail-out immediately. The collapse was anticipated and prepared for. . . .

“Apparently it is claimed that some people have the ability to start false rumors about Bear Stearns’ and other banks’ liquidity, which then starts a ‘run on the bank.’ These rumor mongers allegedly were able to influence companies like Goldman Sachs to terminate doing business with Bear Stearns, notwithstanding that Goldman et al. believed that Bear Stearns balance sheet was in good shape. . . . The idea that rumors caused a ‘run on the bank’ at Bear Stearns is 100% ridiculous. Perhaps that’s the reason why every witness was so guarded and hesitant and looked so mighty strained in answering questions . . . .

“To prove the case of illegal insider trading, all the Feds have to do is ask a few questions of the persons who bought puts on Bear Stearns or shorted stock during the week before March 17, 2008 and before. All the records are easily available. If they bought puts or shorted stock, just ask them why.”

Massive Liquidity Injection in March 2008 – All Time Record

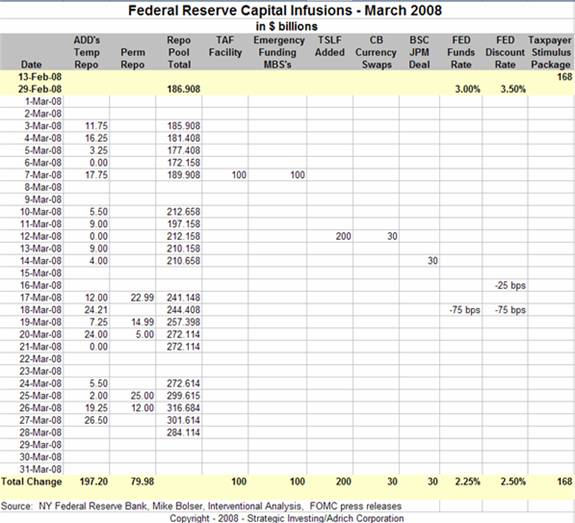

In the month of March 2008, the Federal Reserve System injected more liquidity in a single month than in any previous five year period in history to avoid a complete melt-down of the system.

The repo pool surged from a level of approximately $185 billion to $385 billion. In addition, the Federal Reserve added a $100 billion Term Auction Facility (TAF), and a $100 billion emergency funding arrangement for Mortgage Back Securities (MBS), a $200 billion Term Securities Lending Facility (TSLF), increased its currency swap arrangement with other central banks by $30 billion, and cut the Fed funds rate and discount rate.

In addition, it financed the takeover of Bear Stearns by J.P. Morgan to the tune of another $29 billion.

The gargantuan addition of liquidity into the system somehow makes a mockery of Senator Everett Dirksen’s cynical quotation:

“A billion here, a billion there, pretty soon it adds up to real money.”

You have to wonder how Senator Dirksen (1896-1969) would react to these numbers.

Despite the huge injection of liquidity in March 2008 by the Federal Reserve Bank which was in excess of $680 billion, the banking system of the U.S. continues to deteriorate.

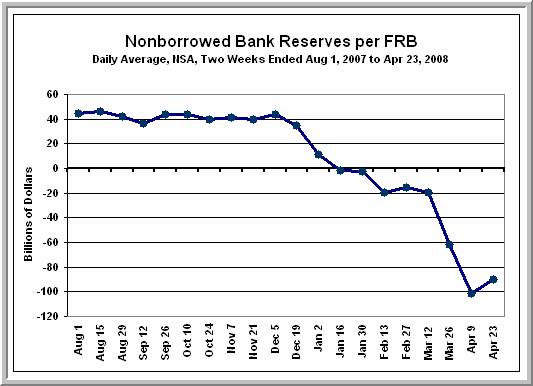

Non-borrowed Bank Reserves as of April 2008 had fallen into negative territory for the first time since the early 1930’s which basically means that the entire U.S. banking system is in default. As John Williams of Shadow Government Statistics points out, the Federal Reserve System solution will only increase inflation.

“The news continues to be bleak, as central banks keep pushing liquidity into the system. As shown in the accompanying graph, the Fed now reports non-borrowed bank reserves at something close to $100 billion. These funds obviously have little to do with banks meeting their reserve requirements, but more generally reflect the Fed’s net lending of cash and assets of approximately $140 billion as a liquidity infusion for troubled banks.

With the ability to create money and its mandate to protect the banking system, the Fed has both the wherewithal and the will to bailout the financial system. The cost of such salvation, however, will come in the sharp rise of inflation in goods and services, as a monetary inflation starts to kick in.”

The Derivative Problem

Derivatives were originally developed to hedge risk. Theoretically, you tried to hedge your position risk by obtaining counter-party insurance.

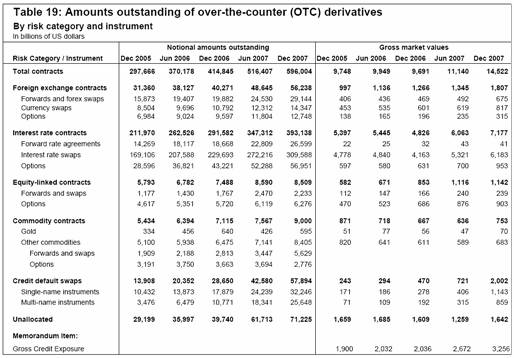

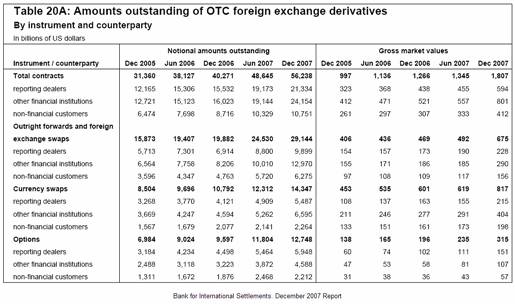

The situation has now gotten completely out of hand. For example, in a world where the total GDP is about $50 Trillion, the Bank of International Settlements has just reported that the notational value of all outstanding derivatives now totals approximately $1.144 Quadrillion. The latest report as of December 2007 from the BIS also disclosed the largest gain in derivatives outstanding since the report began.

As Jim Sinclair of Mineset.com observes:

“As of the last report it appeared that both listed and OTC derivatives was under $600 trillion. Now listed credit derivatives alone stood at $548 Trillion. The OTC derivatives are shown as $596 trillion notional value, as of December 2007. One can only imagine what number they are at now.

Well we hit a QUADRILLION. We have more than $1000 trillion dollars in all derivatives outstanding. That is simply NUTS because notional value becomes real value when either counterparty to the OTC derivative goes bankrupt. $548 trillion plus $596 trillion means $1.144 quadrillion.

It would be an interesting piece of research to see what the breakdown is of listed derivatives according to exchange to see if it adds up to the reported number. Spin is now everywhere.

This means that no OTC derivative house can be allowed to go broke. This means that whatever funds are required to rescue failing international investment banks, banks and financial entities will be provided.

Keep this economic law in mind. Monetary inflation proceeds price inflation and is its primary cause in economic history from Rome to present.

Nothing can stop the juggernaut of price inflation heading towards every nation like a runaway freight train down a mountain.”

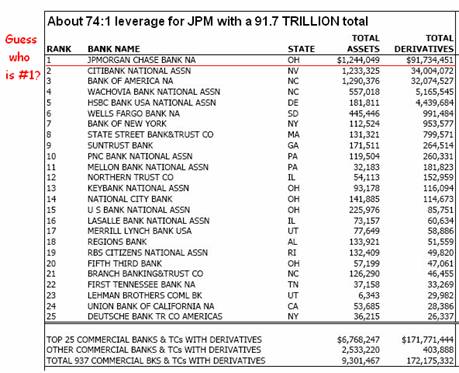

As we saw in the collapse of Bear Stearns, the ultimate counter-party is the U.S. Taxpayer. Still the derivative position of Bear Stearns was significantly less than any other major bank and/or investment bank as seen in the following data from the Office of the Comptroller of the Currency.

![]()

Bear Stearns is not even in the top 25 holders and it was closed despite a leverage factor in the 30’s. It is interesting to note that J.P. Morgan Chase is #1 at $91.7 trillion of notational value and a leverage ratio of 74:1 according to the Comptroller of the Currency.

Perhaps, the real reason the Federal Reserve stepped in and brokered the deal with J.P. Morgan Chase was that the counter-party to a significant portion of the Bear Stearns derivatives was J.P. Morgan Chase and if it had to make good on the Bear Stearns paper, it would have also failed.

And just who is the largest shareholder of the Federal Reserve System … as if you did not know? It was J.P. Morgan Chase. Do the pieces of the puzzle fit?

CONCLUSION

If you asked many economists about the performance of the Federal Reserve since its founding, the majority will said that it has done a credible job. On the other hand you have to wonder how bad things could have been if they had not performed as well as they have.

Since 1913, it is apparent to me and hopefully, to most readers that the Federal Reserve System has failed in meeting any of its reasons for existence. Hence, based upon the lack of performance, the charter of the Federal Reserve System should be revoked immediately.

It would seem that based upon a Congress that refuses to allow nominations for three open seats on the Board of Governor’s of the Federal Reserve System that President Bush should implement Executive Order 11110 and begin the dismantling of the powers of the Federal Reserve System.

The current credit crisis sweeping the global financial markets is largely the result of liquidity injected by the Federal Reserve System and other central banks without a regulatory system in place that provides transparency.

Clearly the opening of the discount window to non-banks has gone beyond the framework which existed for the Federal Reserve System since 1913. The current proposal increasing the powers of the Federal Reserve System to regulate not only banks but other financial entities is clearly another power grab by the Federal Reserve System. Quite frankly, allowing the fox into the chicken coop does not augur well for the chickens.

It is long past time to consider that the performance of the Federal Reserve is wanting and to develop alternatives which can restore the value of the American dollar.

Clearly, a fiat currency has not led to a strong dollar. As Nathan Rothschild observed in 1838, when the issuance and control of a nation’s money are in private hands, the laws and the people who make them become irrelevant.

It is past time to reduce the role of the Federal Reserve and the simplest way is just to abolish it.

Fred Richards

June 2008

Corruptisima republica plurimae leges. [The more corrupt a republic, the more laws.] -- Tacitus, Annals III 27

This issue of 'Tis Only My Opinion was

copyrighted by Adrich Corporation in 2004.

All rights reserved. Quotation with attribution is encouraged.

'Tis Only My Opinion is intended to provoke thinking, then dialogue among

our readers.

![]()

![]() 'Tis Only My Opinion! Archive Menu

'Tis Only My Opinion! Archive Menu

Last updated - July 6, 2008

Appendix I – Birth/Death Rate Adjustment

Appendix II – U.S. Dollar