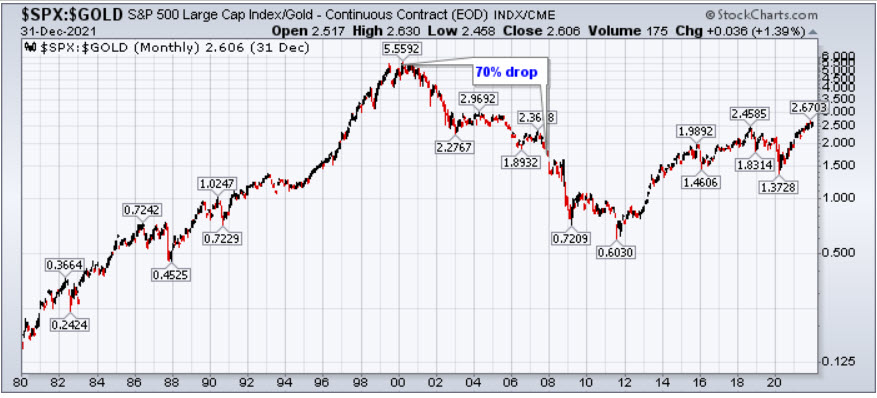

'Tis Only My Opinion!™January 2022 - Volume 42, Number 1False Flags --As the world's response to the pandemic continues to splinter and the population begins to doubt the official line of the "scientific & governmental communities", it is time to look again at the state of the U.S. and world economies. For the past 38 months, we have sat on the sidelines and watched the changes which have permutated around the economic and political mess since we decided to retire. Several of my readers have asked that I comment on the economic situation and the outlook for the coming years. This Opinion will concentrate first on where the economy is and then look at the forces that might create investment opportunities or calamities in the future. The pandemic response by most governments has caused a serious disruption in world trade, disrupted many middle and small class businesses with disastrous effects, school closures have affected the learning of students, created major supply shortages, and created fear in the public that governments use to increase their control over their populations. The Official Data does not reflect the real world!While the U.S. government does show an economy that is off the pandemic lows, it is still failing to show the real situation. As inflation continues to show up thanks to the Federal Reserve's policies, the public is deluded into thinking that the market is rising. However, when the major indices are priced in gold or oil, a different picture arises. As I learned early from one of my mentors on the street, the only thing that counts is "purchasing power."

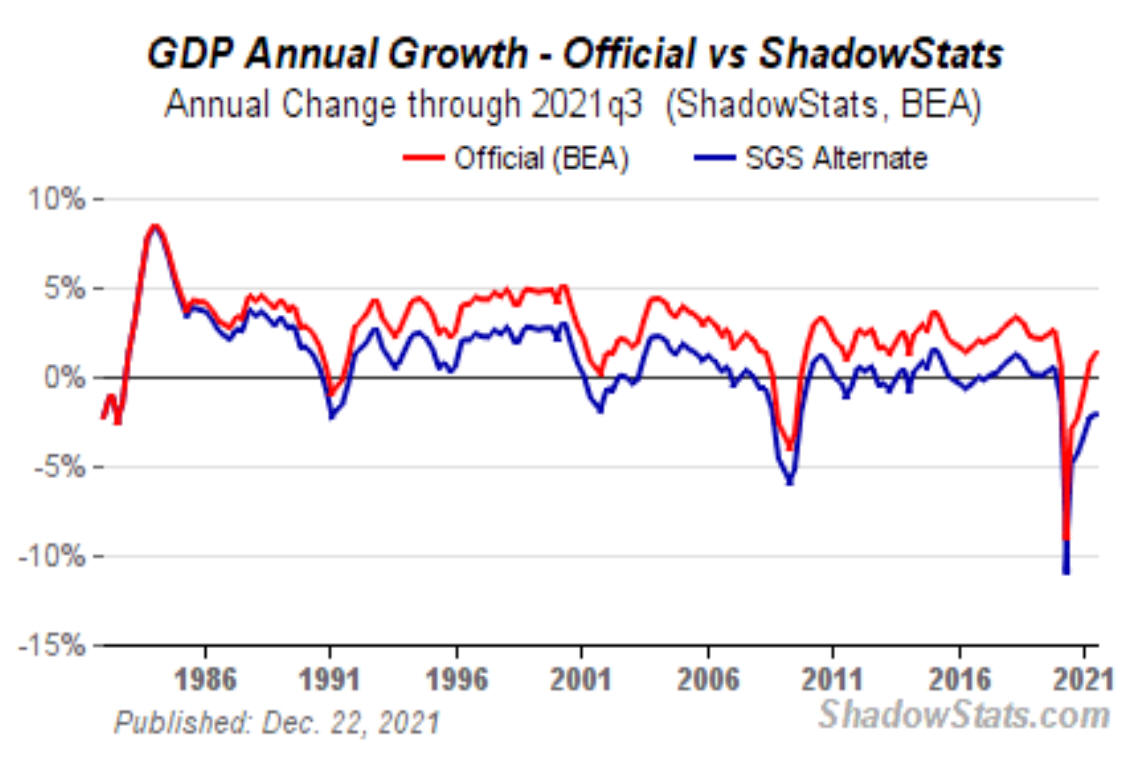

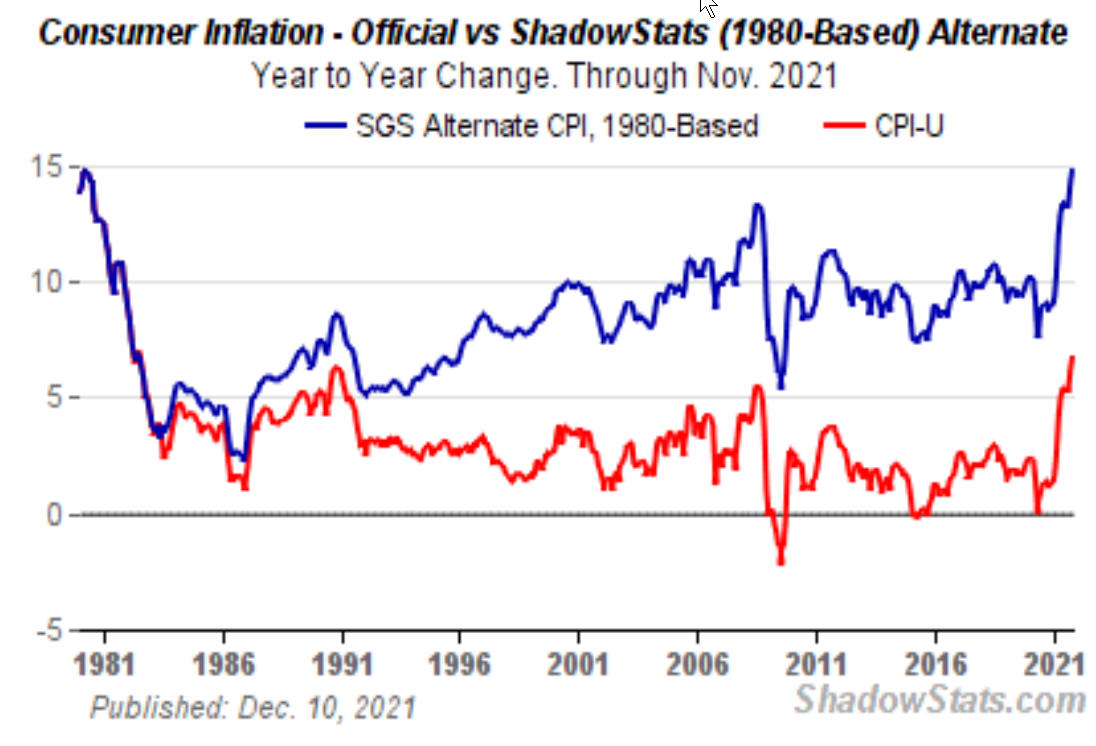

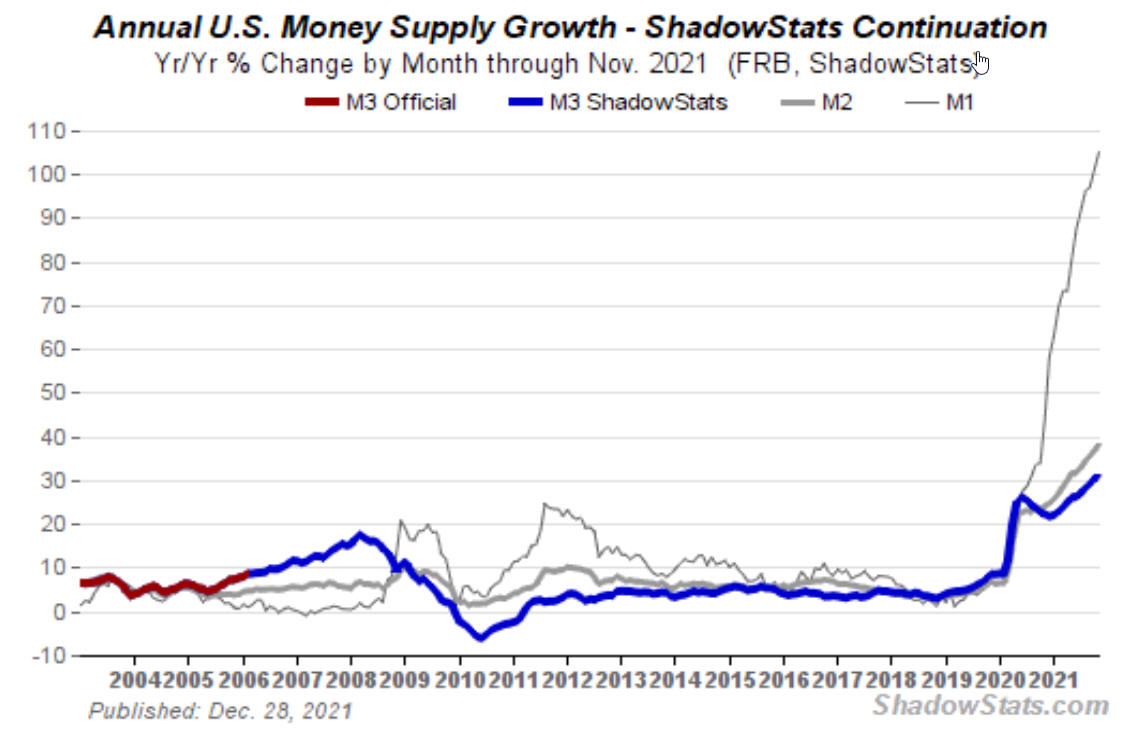

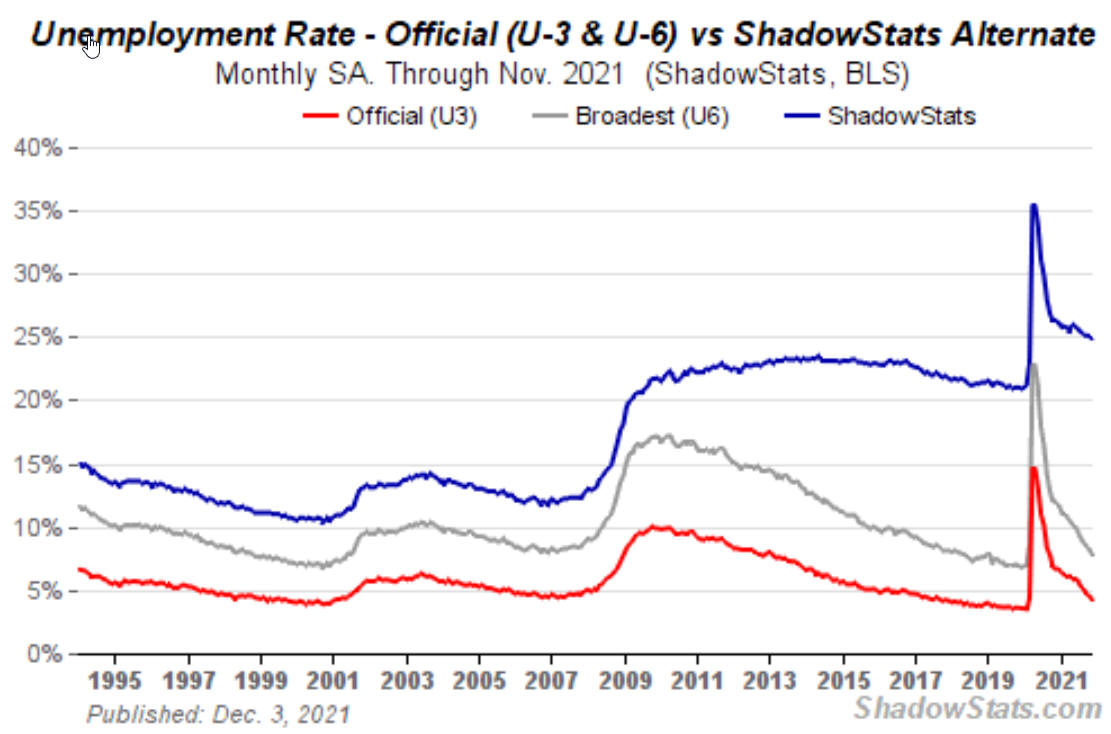

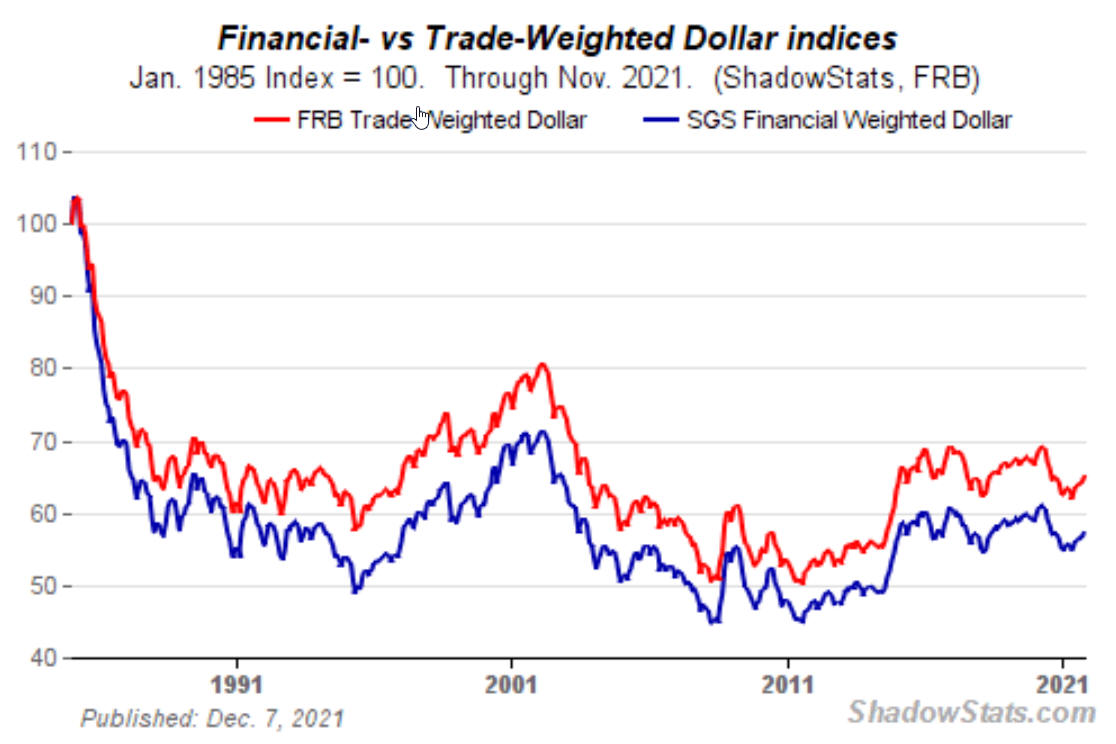

John Williams' Shadow Government Statistics is a better indicator of the real world and the following graphs shows the comparison of GDP, the Consumer Price Index, Annual Money Supply Growth, the Unemployment Rate, and the U.S. Dollar Index.

The U.S. Markets had a great year in 2021.Friday's closing and year-to-date prices of selected indices are shown below:

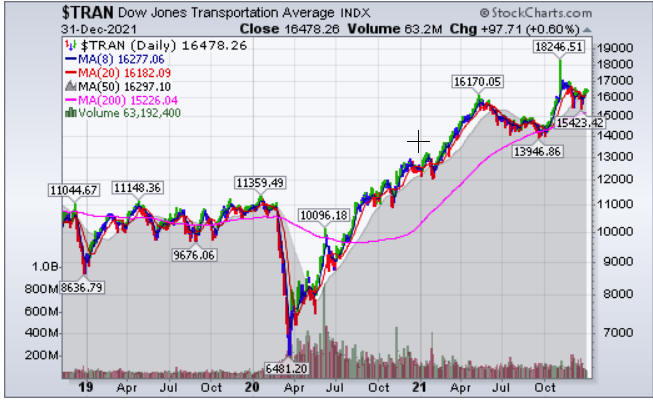

Charts of selected major indices for the past 38 months are shown below:

The FAANGNOSH StocksThe FAANGNOSH stocks have performed very well as shown in the table below.

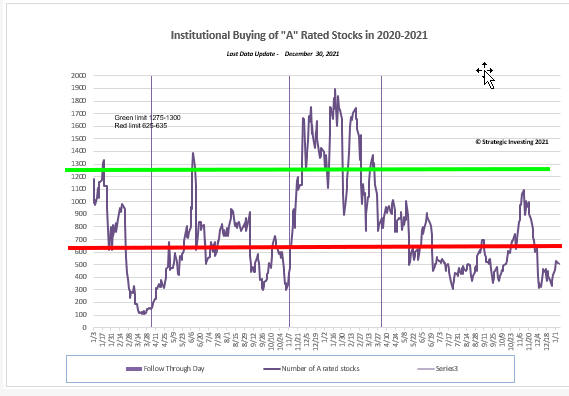

The question is why don't you have most of these stocks in your portfolio. The "A" Rated StocksDuring the past week, the "A" rated stocks gained ground but fell slightly on Thursday. However, the "A" rated stocks have not shown much strength in the last few weeks fluctuating below the red zone. One interpretation is that major institutions remain wary of this market and may be selling stocks into the market.

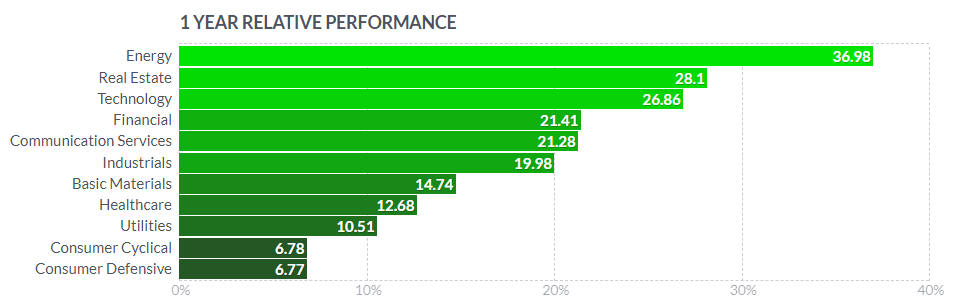

Group PerformanceGroup performance during 2021 was positive as shown in the following chart courtesy of finviz.com.

The Simple Timing Indicator (STI) is positive.The Simple Timing Indicator (STI) for both the NASDAQ and the S&P 500 turned positive this week as shown below.

However, the STI for the NASDAQ Composite is still below the 50 day line which should suggest that caution is advised about increasing long positions at this time. The VIX remains lowThe VIX continues to show little concern as seen in the following chart.

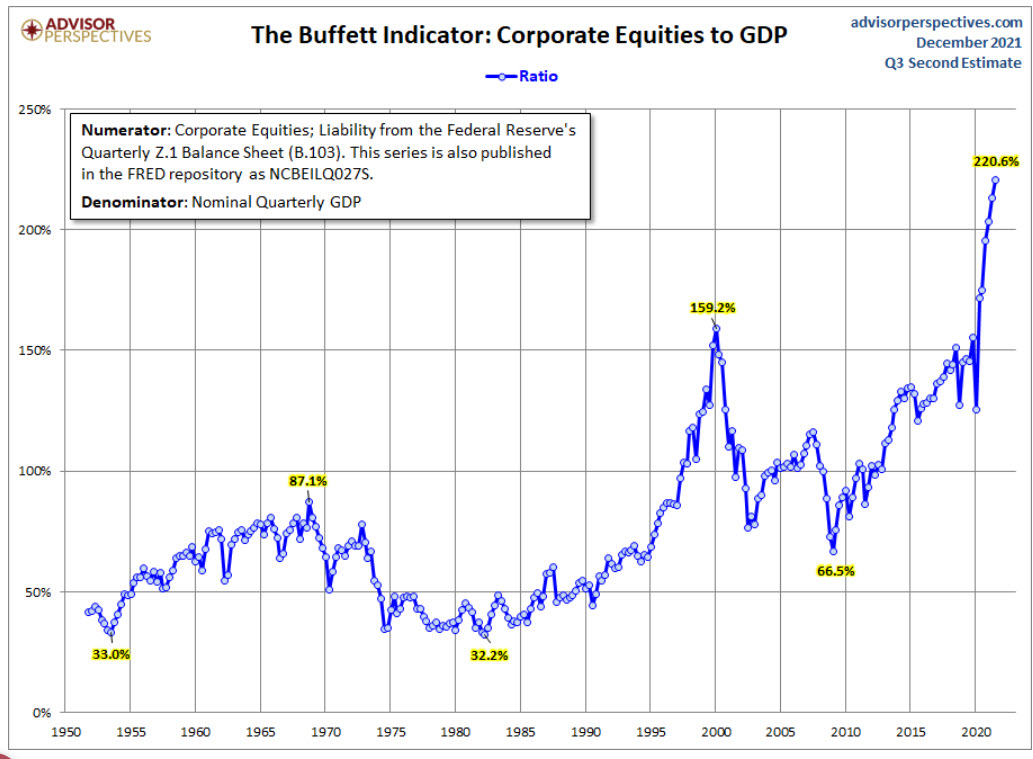

Looking ahead ...While there will always be opportunities to make short-term money trading in the markets if you follow the rules, the long-term is less clear. What's keeping the market indices aloft is that the 15 largest companies now account for 40% of the S&P 500 index’s market capitalization. Stock buybacks using almost zero interest debt and ETF balancing have played a major role in keeping the indices rising. The following graph is purportedly Warren Buffett's favorite valuation technique. The measure compares the inflation-adjusted market cap of the S&P 500 as a ratio to the economy. Given that earnings and economic growth correlate well over time, the ratio effectively points out valuation extremes. Currently, the ratio is nearly 250 well above the 159.2 from 1999 which fell during the decline to .66.5 during the financial crisis of 2018.

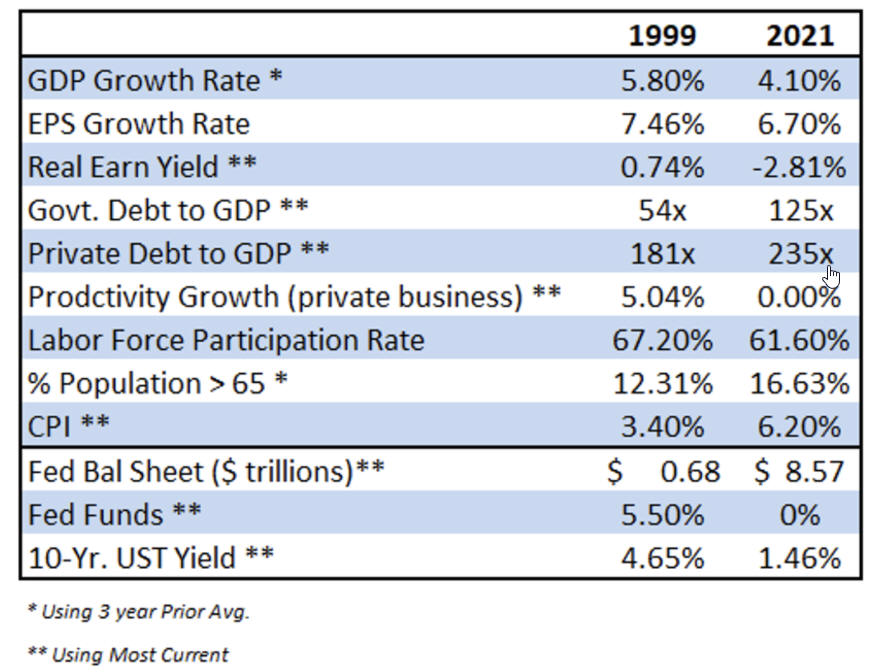

Since World War II, the U.S. dollar has dominated the world economy but with the U.S. stated cash debt now nearing $30 trillion and the real federal debt in excess of $200 trillion, the situation is fraught with danger. Of course, that figure does not include the state, local and semi-government debt ... nor private debt. The real question is when will the Minsky moment occur? The Fed openly – indeed aggressively – endorsed a blowout in federal spending last year and Congress couldn’t wait to shove what will likely end up being more than $10 trillion out the door to voters who increasingly resemble the Kool-Aid drinkers at Jonestown. Federal spending increased from an average of 21% of GDP over the last decade to more than 30% in fiscal 2020 and 2021 with much of it in the form of debt and with no prospects to pay for any of it. The socialist mantra of taxing the rich to pay for all of this ignores that fact that if the federal government taxes 100% of real earnings over $10 million per year, the government won't run for a quarter. With the Federal Reserve indicating that it will increase interest rates during 2022, every increase will not only slow down expansion efforts but also increase the debt load for all types of borrowers. The following chart shows where we stand versus the last major sell-off ... we are more vulnerable now than in 1999 to a significant downturn.

Following the disastrous withdrawal from Afghanistan, the strength of the U.S. military is questionable. The Biden administration efforts to have all the military vaccinated against the Wuhan virus and the wok mandates are further reducing the ability of the military to respond to actions by foreign players. Russia, China, Pakistan and Iran are capable of creating mischief on the world stage. The next great power conflict - perhaps triggered by a Chinese invasion of Taiwan, or a Russian invasion of Ukraine - coupled with uncertainty about what the "next war" will look like would change the dimetrics of the market. In space, China has apparently leap frogged the U.S. in military hardware. Furthermore, when was the last time that the U.S. actually won a war? However, if you acquire stocks with high IBD ratings of at least B+185 and set strict rules to keep your profits and/or losses under control, 2022 should be an interesting year. Just stay awake and set inviolate Action Points. Remember to: Keep It Safe, Simple and Stay Focused! But then 'Tis Only My Opinion! Fred Richards www.adrich.com Corruptisima republica plurimae leges. [The more corrupt a republic, the more laws.] -- Tacitus, Annals III 27 'Tis only My Opinion! Archive Menu, click here. This

issue of 'Tis Only My Opinion was copyrighted by Strategic Investing in 2022. |