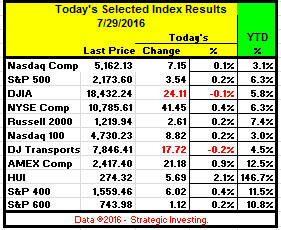

'Tis Only My Opinion!™August 2016 - Volume 36, Number 8"Leaning to the Upside?"The Current Market as of July 29, 2016The S&P 500 gained 0.16% and the NASDAQ 0.14% in quiet and choppy trading as the market vacillated around yesterday's closing levels before managing to close slightly above that level. Volume on both the S&P 500 and the NASDAQ was slightly higher than Thursday. Most major indices remain well above their 50-day moving averages.

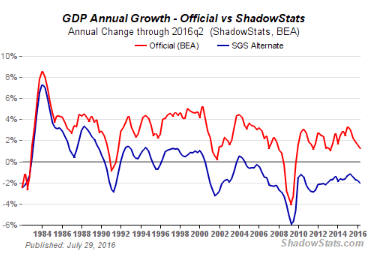

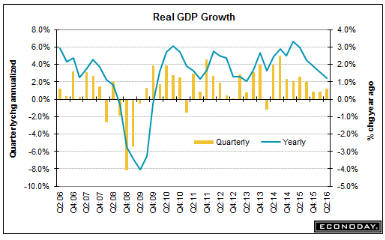

The Ministry of Truth (MOT) revised lower its estimate of GDP for the 1st and then suggested that the 2nd Quarter 2016's initial was slightly higher at 1.1%. Hence, all is well with the market? But isn't the U.S. really in a recession? Did you forget that the calculation for GDP was revised in the 2nd Quarter of 2014 ... those revisions added another 3% to the GDP calculations on an annual basis. John Williams of Shadow Government Statistics data ignores the multiple revisions to how GDP has been calculated by the Ministry of Truth since 1980 suggests that reality is much different that the hype put forth by the Keynesian economists.

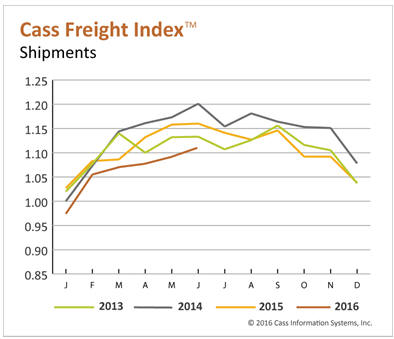

Moreover, the CASS Freight Index continues its downward trend. And if freight isn't moving, the economy is not growing. It is really as simple as that. While some of the decline can be attributed to Obama's war on coal, the trend remains down on a y/y basis.

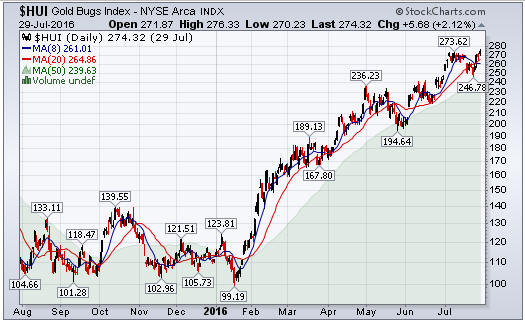

Still most indices except the DJIA and the Transports were in the black today while the Gold Bugs Index (HUI) gained 2.1% to lead the indices. The continued increase in this index while the equity indices move higher is out-of-character. It is doubtful if a new paradigm is underway.

Gold was higher as the U.S. dollar came under pressure thanks largely to a weak U.S. Economic outlook.

The economy is in terrible shape and headlines this week show that once again. Two headlines in particular that are most disturbing are: "Deutsche Bank Profit Plunges 98% And The Worst Is Yet To Come," and "Ford Plunges After Warning, We Don’t See Growth, Warns US Auto Industry Has Plateaued." War drums are beating louder with warnings continually coming for Russia and China against the United States. The Russians and Chinese have announced a joint naval exercise in the disputed waters of the South China Sea. War tensions are rising and not receding. Not only is there an outflow from U.S. Mutual Funds in 2016 but an Exodus from European equity funds goes on as $76B pulled this year: The FT cited weekly flow data by EPFR, which showed that the exodus from European equity funds entered its 25th consecutive week, draining portfolios of $76B YTD amid uncertainties over the implications of the Brexit vote and a crisis in the Italian banking sector. Closing prices of selected indices are shown below:

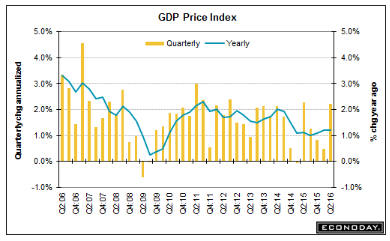

The Simple Timing Indicator (STI) for both the NASDAQ and the S&P 500 remain positive. Economic NewsThe Ministry of Truth (MOT) released its first estimate of GDP for the 2nd Quarter of 2016 estimating growth at a 1.2% rate as seen in the table below. Note that the Q2 estimate was significantly below the consensus guess. MOT's GDP Price Index shot up to a 2.2% inflation rate in the second quarter. Let's see ... energy costs lower, agricultural commodities falling ... the big driver must be rents.

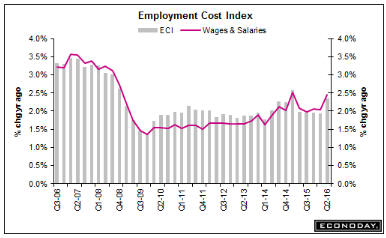

The Employment Cost Index for the 2nd Quarter 2016 held steady at 0.6% while the y/y comparison was up 2.3%. With a slight uptick in both the ECI and its Wages & Salaries component, Federal Reserve Chairwomen Janet Yellen believes that we are near full-employment. Really?

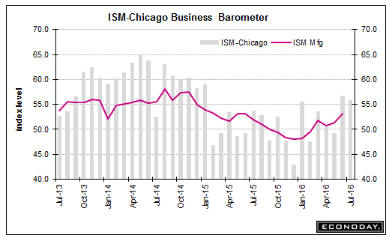

The Chicago Business Barometer Index for July 2016 declined from 56.8 in June to 55.8 .. formerly known as the Chicago Purchasing Managers Index.

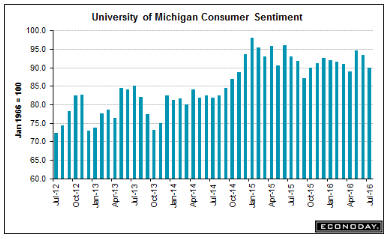

The final reading of the University of Michigan's Consumer Sentiment in July 2016 was about where it was at mid-July, at 90.0 and down a sizable 3.5 points from June's final reading of 93.5.

The Baker-Hughes North American Rig Count rose from 564 to 582 indicating that energy companies are more confident that oil prices are stabilizing. The rig count has increased five weeks in a row. Or is the increase simply that oil companies must pump even at these prices to meet their cash-flow problems?

ConclusionJust take a look around you. Tell me what is really growing except in isolated sectors. We have seen brokerage houses tout earnings "beats" but ignore GAAP comparisons on a yearly quarter to quarter basis. The effect of "buy-backs" and financial engineering continue to move the market higher along with historic low rates. A close look at both Citi and Bank of America financials and some of the notes from their reports should cause most investors to be cautious about TBTF banks. The real chance of the FED raising interest rates in 2016 remains close to zero. The rubber band continues to stretch but be careful when it breaks. Take advantage of the recent gains from the Brexit rebound but don't lose sight of having a action plan to hold onto most of your profitable trades before they become illusory. But then - 'Tis Only My Opinion!Fred Richards www.adrich.com Corruptisima republica plurimae leges. [The more corrupt a republic, the more laws.] -- Tacitus, Annals III 27 'Tis only My Opinion! Archive Menu, click here. This

issue of 'Tis Only My Opinion was copyrighted by Strategic Investing in 2016. |