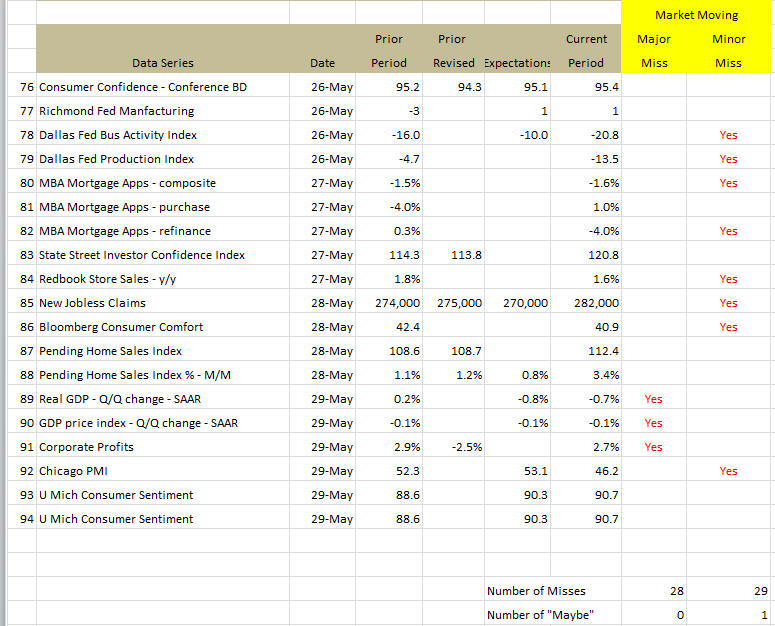

'Tis Only My Opinion!™June 2015 - Volume 35, Number 6"The eCONomy"Do you have a feeling that there is a major disconnect between the economy which you see on a day-to-day basis and that which is reported? If so, you are not alone and are not one of those who cannot discern the difference! Years ago, at that well-known school on the banks of the Charles River, the professor of the Business Conditions course made sure that his students knew that they could not trust the headline number but had to thoroughly understand all the data underneath and what the range of errors each data point had and the confidence level given to each data point. Of course, he had just retired as the director of the Bureau of Economic Analysis in 1960. I owe a great deal of my understanding about the reliability of the governments data to those lessons. Those pesky changesToday, we have a Ministry of Truth which obfuscates the real condition of the economy for political reasons. By using statistical games such as seasonal, hedonic and bench-point revisions, the Ministry of Truth hopes to prevent the low-information population from understanding the real world. Also, the Ministry of Truth will change the definition of a series to include items which at least are suspect and prevent a real comparison between two countries as the recent GDP redefinition accomplished. Hence, it is not major surprise when a month to month revision of a data series is occasionally over 25%. Yet, the market and politicians point to the headline numbers as "gospel." Of course, the inability of most journalists and even financial reporters to understand how these reports are compiled and the confidence levels therein also results in a bias towards taking the headline numbers as "the real world". In our review of the U.S. economic scene, we track many economic series on a routine basis. In our review, we compare the performance of each series against the previous data release and if available, also against the consensus estimates of economists surveyed by the MSM. Ignoring better technologyBoth John Williams of Shadow Government Statistics and Charles Biderman of Trimtabs Investment Research agree with me that much of the current economic series collection procedures are obsolete. By using better and more current data analysis now available through big data analysis procedures and commercially available data, a better understanding of the economic situation could be gleaned. However, that might cause a major reduction in employment in many government agencies The Expectations SpreadsheetWe analyze each new data series for its possible impact on the equity and bond markets in the U.S. and categorize the impact as either major or minor. During the past year, we have noted a definite deterioration in the number of data points which have failed to exceed either the previous report and/or the consensus estimate for the current report. In May 2014, the number economic reports that failed to equal or best the previous economic report and/or the consensus estimate stood just under 40%. The current report of the ninety-four (94) economic series tracked as of May 2015 is shown below:

Currently, almost 61% of those economic series (57 misses out of 94 series) either do not equal or exceed the previous report and/or the consensus estimate. Hence, one might logically conclude that the eCONomy is not doing well. ConclusionWhen data is unreliable and politicians are trying to sugarcoat the results of their policies, it should not be a surprise that investors make poor decisions. At the moment, we have a churning market at relative high levels looking at an eCONomy which is being painted in the best possible terms but can't hide the rot underneath. Almost 48 million on food-stamps, Obamacare reducing the number of full-time jobs and the middle-class becoming increasingly desperate is not the sign of a strong and growing economy. This is what the FED's money printing has achieved ... just an increase in the wealth of the 1% and for the 99% nothing or worse. Of course, they helped the TBTF banks to hold on a few more years but at what cost? The level of derivatives has grown, not decreased. Concentration of bank's deposits among the Big 5 has grown and the risk of a systemic collapse has increased as pressures upon the U.S. dollar's reserve role diminishes. I don’t think the real risk is whether the Federal Reserve will increase interest rates in the near future but whether they will institute a new round of quantitative easing and what might be the result. In any event, it is obvious that the MSM economists are basically cheerleaders and are using rose-colored glasses to report on the eCONomy … Hope versus Reality continues! But then - 'Tis Only My Opinion!Fred Richards www.adrich.com Corruptisima republica plurimae leges. [The more corrupt a republic, the more laws.] -- Tacitus, Annals III 27 'Tis only My Opinion! Archive Menu, click here. This

issue of 'Tis Only My Opinion was copyrighted by Strategic Investing in 2015. |