The U.S. government has a stated public debt of $14.2 trillion, unstated liabilities of over $120 trillion, a Gross Domestic Product of about $15 trillion, and a budget for FY 2012 that will spend $3 for every $2 in tax revenue.

It is quite clear that our elected officials have no concept of the problem and how to solve it when the most serious effort is to cut $60 billion, or $100 billion, from a current year deficit that is above $1.5 trillion.

Apparently, many politicians believe that no one will understand that federal spending has increased 25% since the Obama Administration began and that any reduction can be shown to "starve children and eliminate care for the elderly."

From my days as a turn-around consultant, we know that you can cut 10% and often more out of any organization and still do the job required just by eliminating waste and reducing jobs and/or positions which do not provide needed services for the organization to survive and prosper.

Some will say that government can only do certain things and that private industry should not provide for fire, police and defense. We shall quickly examine the budget to see if more than $500 billion could be cut out of the FY 2012 budget easily ... but be warned ... the political cries will be deafening.

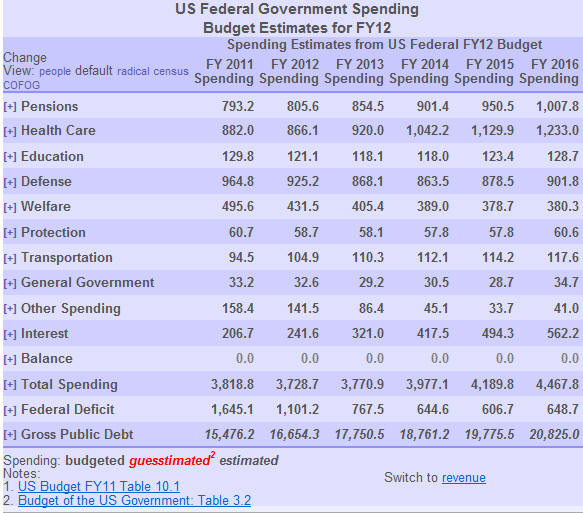

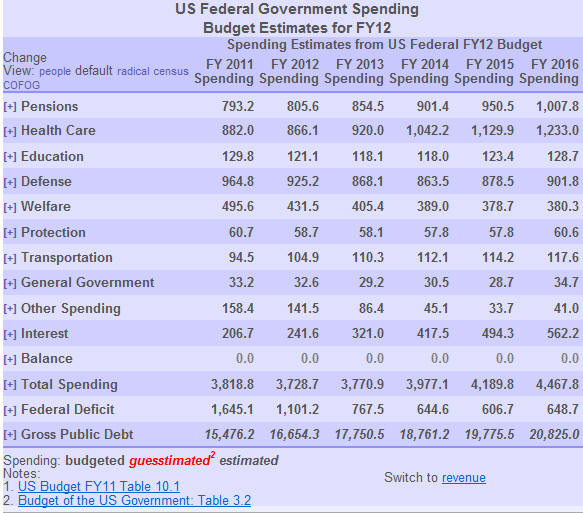

The first place to affect savings comes from realizing that in FY 2008, the budget projected outlays of $2.94 trillion. The FY 2010 budget showed outlays had increased to $3.72 trillion or by 27%. Many programs have automatic yearly increases written into the law which authorized them. All automatic increases should be eliminated in the FY 2012 budget. That will save almost $70 billion.

The FY 2012 budget currently being discussed asks for spending to remain at $3.73 trillion. When one realizes that the budget spends $3 for every $2 of tax revenue, the fiscal stability of the US is in jeopardy.

Since a financial crisis is facing the nation, we are faced with hard choices.

The response currently taken by the Federal Reserve and Congress is certain to inflate the currency and thus, make the current $14.2 trillion and unstated liabilities that approach $70 trillion manageable. Of course, that will destroy the reserve currency role of the U.S. dollar and usher in higher inflation. If we continue along this path, the standard of living within the US will fall at least by 25% and perhaps, more. Also, rather than being a nation of free individuals, we will have become wage-slaves to a federal bureaucracy.

During the recent America: Boom or Bankruptcy? symposium here in Dallas, David Walker of the Comeback America initiative made a statement which shows how even those who understand the seriousness of the financial problem facing the U.S. have a socialist mindset. He stated, "If we just eliminate all the deductions for mortgage interest, etc., which the U.S. government gives, taxes would increase $1.1 trillion and problem solved." To me, that statement implies that all of our income is derived from government largesse and our citizens are nothing other than wage-slaves.

Frankly, that nanny-state thinking is wrong ... and does not reflect the principles under which this nation was founded. What the citizen makes is due to his/her efforts and not the governments.

For a small window of time, the nation can undertake another course of action. It can look at all the spending of the the US government and take a hard, critical look to see if we are getting value for the tax dollars appropriated from our citizens and whether those programs are legal under a strict reading of the US Constitution.

The following table contains the FY 2012 Federal Budget Estimates:

President Dwight D. Eisenhower on January 17, 1961 warned about the consequences of an unfettered "military-industrial complex" as a threat to democratic government. Perhaps, the only thing that will produce the political will necessary to rein in military spending is a increasing federal deficit.

After the first invasion of Iraq following its incursion into Kuwait, President Bush was unwilling to push on to Baghdad and remove Hussein from power. Bush's mistake caused by the rules of engagement came back to haunt the U.S. later. It was just another lack of will earlier shown in Korea and later Vietnam when collateral damage and rules of engagement were damaging to those conflict's favorable resolution.

Today we are engaged in two "undeclared wars," Iraq and Afghanistan. The defense budget consumes about 25% of government spending although because of off-budget spending, the actual amount is probably higher. The following table shows the budget for the defense department.

As the world's largest debtor nation, should we be providing 150 of the 192 nations with foreign aid including Russia, China, Pakistan, Saudi Arabia, Iran and Venezuela? In FY 2011, the US provided $43.6 billion of foreign assistance and another $11.6 billion of military assistance aid for a total of $55.2 billion.

In addition, the US is maintaining military installations throughout the world in Europe, and the Far East. We are fighting wars in Iraq and Afghanistan under rules of engagement which prevent success, if not guaranteeing failure. By reducing military installations and troops from countries in Europe, Japan and Korea, the defense budget could be reduced by $40 billion. Withdrawing from Iraq and Afghanistan could further reduce annual spending by at least $100 billion.

The Sunni and Shi'a have been feuding since the 6th century and until their feud is resolved, the U.S. should not involve itself in the region. To try to instill democracy in a region that has never known it would seem to this observer to be task of Herculean effort and doomed to failure. The events of the past few weeks in Tunisia, Egypt, Libya, Yemen, Bahrain, UAE and Saudi Arabia would seem to reinforce that concern.

In one iteration or another, the U.S. has had a Department of Education (DOE) since 1867. However, the current cabinet level DOE began in 1980. DOE oversees a substantial budget amounting to $129.8 billion in FY 2011 and has a mandate to improve the quality of education as well as provide for equal access to educational opportunities. The DOE budget for FY 2012 and beyond is shown below.

Performance should be the key criteria for evaluating any governmental program. I submit that the DOE programs have resulted in failure.

In 1975 according to a study for the Paris-based Organization for Cooperation and Development, the U.S. was first in the world in both the percentage of its population that had a high-school degree and of those who also had a college degree. By 1995, just twenty years later, the US had fallen to 9th in the percentage of its population that graduated from high school and 7th along with Belgium in the number of college graduates.

Recently, the 2009 Program for International Student Assessment (PISA) test scores ranking proficiency of US 14-15 year olds in reading, mathematics and science literacy showed a serious decline in US students as they now ranked below the median of all students. The rankings were:

| On the science literacy scale, the average score of U.S. students (502) was not measurably different from the OECD average (501). | |

| 14-15-year-olds had an average score of 500 on the combined reading literacy scale, not measurably different from the OECD average score of 493. | |

| U.S. 14-15-year-olds had an average score of 487 on the mathematics literacy scale, which was lower than the OECD average score of 496. |

It would appear to me that the DOE has been a dismal failure. Not only has it supported teacher's unions but its federal mandates and the cost to state and local entities to comply with those mandates has been enormous.

As public schools have deteriorated, private and parochial along with home-schooling have increased. It is those areas where local control is seen that continues to improve and not the federal, centralized "one-shoe fits all" approach to learning. The fact that the non-public school systems are out-performing the public schools except in sports should be evident to most when looking at performance.

If we simply eliminate the DOE at the federal level and return control to local school boards while implementing both a college-based education track supplemented with vocational training, the savings could amount to over $100 billion a year at the federal, state and local levels. Just think of all the administrative positions that could be eliminated which are now required to provide reports on federal mandates.

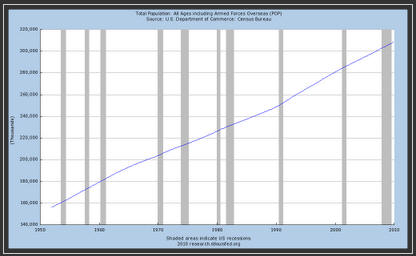

The US population is growing at about 1% per year as shown in the following chart.

All things being equal it might be logical to conclude that costs of the federal government should grow at about the same rate. It has not and has increased as a percentage of GDP to a level that is approaching WWII levels as shown in the following chart. Of course, the data in the following charts is from cash budget accounting and not GAAP accounting which would make the number considerably higher. For example, in FY 2010, the US cash budget deficit was reported at $1.294 trillion whereas the US Treasury GAAP deficit including all liabilities probably exceeded $4-5 trillion. Therefore, take the chart with a grain of salt.

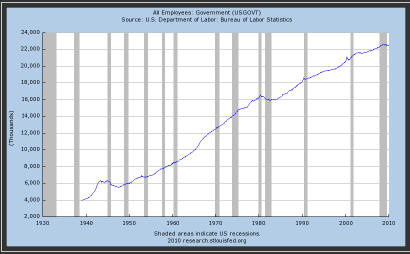

As the growth of government employees escalates while the private sector employment falls, pay scales and benefits of the government sector have gotten out-of-balance. The best available estimate for personnel costs of federal employees including benefits appears to be around $259 billion and many analysts think that is a low figure. The growth of government jobs is shown in the following chart.

With the exception of those military personnel whose rank is Captain or below and the equivalent in the other services, a reduction of 10% would be a significant step to reduce the bloated budget including members of Congress, the Judiciary and the Executive Branch.

The ownership of U.S. Treasury debt is shown in the following chart. About $5.5 trillion of the $14.2 trillion stated cash debt is owned by the US Government entities like the Social Security Trust Fund, etc., and/or the Federal Reserve System as of today.

Perhaps, someone can tell me the logic of paying interest to the Federal Reserve System which buys US Treasury paper by just putting "zero's into a computer." The elimination of interest to the $5.5 trillion held by the Social Security System (a known Ponzi scheme) and the Federal Reserve System would save about $250 billion.

Let's face facts ... if the Federal Reserve System fails and history shows not a single example of a central bank that has not failed, the U.S. taxpayer becomes the Fed's counter-party. The U.S. taxpayer is also the counter-party for the failure of Social Security, Medicare and Medicaid in the near future.

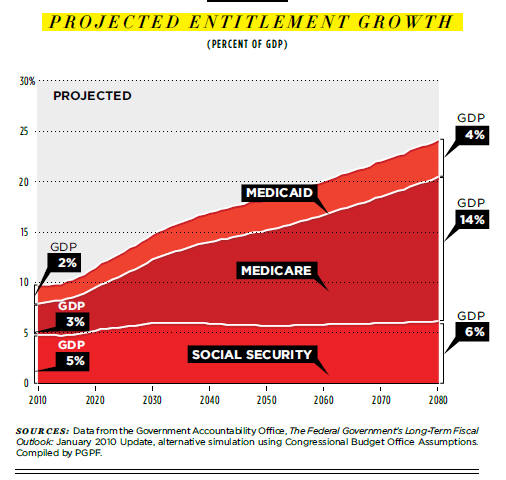

One of the major problems of addressing the federal debt and unfunded liabilities is the reluctance of our elected officials to tackle the unfunded promises which have been made as they vied for votes. Obamacare, Social Security, Medicaid and Medicare will have to be addressed and the nanny-state dismantled or adjusted as to benefits if we are to avoid a financial disaster in the future.

The following chart from the Peterson Foundation illustrates the impossible payments ahead ... and that which is impossible will simply not happen!

The way ahead is full of hard choices. Unfortunately, we have an electorate which does not understand the issues and politicians who will try to get re-elected rather than making the hard calls facing this nation.

We shall see if the nation is willing to sacrifice now or be destroyed in the near future. We might want to look at Greece or Rome or England's descent from being a super-power as our road-map to becoming a second-rate, or third-rate, country.

Let's look at our budget reduction scorecard:

| Description | Amount |

| Automatic Budget Increases | $ 70 billion |

| Reducing overseas bases in Europe & Far East | $ 40 billioin |

| Withdrawal from Afghanistan/Iraq | $100 billion |

| Foreign Aid | $ 55 billion |

| Department of Education | $ 40 billion |

| Interest on US debt held by Government and Federal Reserve | $200 billion |

| 10% reduction in Federal Worker Costs | $ 28 billion |

| Total Reductions | $533 billion |

Our taxation, immigration, environmental and regulatory policies have already ham-strung our ability to compete as a capitalistic society. Entrepreneurship is under attack despite all the platitudes put forth by academics and politicians.

We can no longer afford the programs which our federal and state politicians have placed on the taxpayer. It is past time when we take a hard look at every program and determine if the cost justifies the benefits and if the performance has meet the goals set forth at the programs inception. If not, those programs need to be eliminated.

Many of the government programs are beyond the constitutional limits placed upon government by the founders. The country is now being forced to look at the consequences of giving their elected representatives a free hand ... and whether the vision of the founders remains acceptable.

With politicians thinking that $4 billion, $10 billion, $60 billion are drastic cuts, the taxpayers have a problem. The real solution is when we have a balanced budget and that balanced budget can not be solely the result of increased taxes. Our elected officials as well as our citizens must get serious about the programs which are now in place. We simply can not afford them unless we move towards higher inflation and possibly, hyper-inflation.

But the decision is really up to the electorate and almost half of them have "no skin in game." Are we really on a "road of no return?" I hope not!

But then - 'Tis Only My Opinion!

Fred Richards

March 7, 2011

Corruptisima republica plurimae leges. [The more corrupt a republic, the more laws.] -- Tacitus, Annals III 27

This issue of 'Tis Only My Opinion was

copyrighted by Adrich Corporation in 2011.

All rights reserved. Quotation with attribution is encouraged.

'Tis Only My Opinion is intended to provoke thinking, then dialogue among

our readers.

![]()

![]() 'Tis Only My Opinion! Archive Menu

'Tis Only My Opinion! Archive Menu

Last updated - December 21, 2010