![]()

Believe it or not, it is ultimately the voters who have allowed their Congressional Representatives and Senators to pass laws that created the current mess. Of course, that is what you get when people try to vote for programs without a sound financial basis or when the voters have become accustomed to free lunches. Eventually, the game is over!

Perhaps, that is the current situation in the U.S. where a fiat currency and politicians have ignored the lessons of history. The current mess did not suddenly appear but has been building for many years.

In my opinion, there are two major recent events passed by Congress that provided the basis for the current deleveraging of the financial system. Set above and contributing to the entire mess is a private corporation (the Federal Reserve Bank) which can increase and decrease interest rates and through the use of various mechanisms also manipulate the money supply to move markets using a currency with no real value except the "confidence" which people believe that it represents.

The first was the debasement of credit standards resulting from the broadening of the Community Reinvestment Act of 1994 during the Clinton Administration. The first CRA was enacted in 1977 and affirmed the obligation of federally insured depository institutions to help meet the credit needs of communities in which they are chartered, consistent with safe and sound operations. The act also charged the federal bank regulatory agencies, including the Federal Reserve, with implementing the CRA through regulations and with examining banks and thrifts to determine whether they meet their CRA obligations. Since the CRA's enactment, the implementing regulations have been substantially amended three times--in 1989, 1995, and 2005.

Chairman Bernanke of the Federal Reserve discussed the CRA Act in a speech before the Community Affairs Research Conference on March 30, 2007 in Washington, D.C. As Bernanke noted, the debate surrounding the passage of the CRA in 1977 was contentious, with critics charging that the law would distort credit markets, create unnecessary regulatory burdens, and lead to unsound lending. Too bad, the social engineers did not heed the warning.

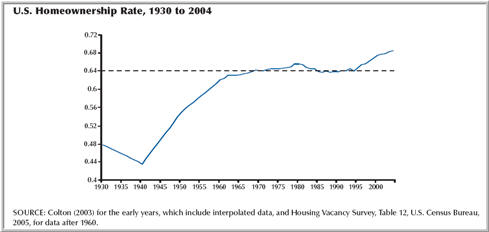

Banks and other lending institutions were forced to make loans in low-income neighborhoods and were required to lower their lending standards under penalty of fines and other so-called regulatory measures. As a result of the changes in the 1994 Act, banks and mortgage lenders were suddenly able along with changes by both Fannie Mae and Freddie Mac to offer various types of loan packages to not only well-qualified buyers but also to those who previously did not qualify for home loans. By the end of 2006, home ownership had climbed to slightly over 69% before the bubble burst.

The result of the desire to provide the American dream to everyone by lowering credit standards was to create a massive deleveraging of the credit system as homes prices dropped, foreclosures increased and the securitized mortgages were victims of non-transparency as Level 2 or Level 3 assets.

According to Meredith Whitney of Oppenheimer, "Homeownership grew from a base of 64% to a peak of 69.2% while mortgage securitization volumes grew annually from $35b in 1993 to over $900b in 2005 and 2006. Since the onset of the credit crisis over 14 months ago, less than $100b worth of mortgages have been securitized and accordingly, homeownership stands at 68%."

It was also beginning in 1995 that the concept of refinancing and withdrawing home equity began to be fashionable. As home prices rose and interest rates dropped in 2001 and on, the pace of refinancing and equity withdrawal increased. In a 15 year span from 1990, the median home price in the U.S. almost doubled. The prices in areas like California, Florida, Nevada, Arizona and the NYC Metro area increased substantially more than the so-called flyover area. Today, the largest problems of falling prices are in those areas.

During the past 15 years, we have seen median prices of homes increase substantially peaking in June 2007. The FED's policy of low interest rates during the early part of this decade enabled the home builders to drive the economy following the technology bubble bursting in March 2000.

Household debt service increased as a percent of disposable income during the period as shown in the following chart.

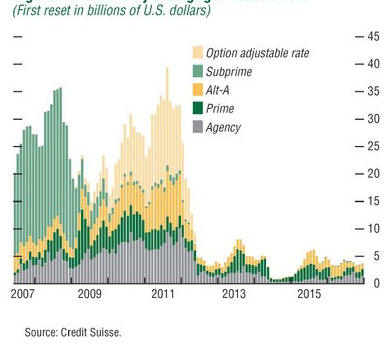

A large percentage

of mortgages were done with teaser rates and homeowners are now facing both

falling prices and resets. The following chart illustrates that the real

problem remains in the future.

Although building permits have fallen significantly, the housing crisis will continue until prices have reached clearing levels. The supply of houses for sale remains at elevated levels and the series fails to include many homes that are not listed by banks and/or are in various stages of foreclosure. In addition, many potential sellers are not placing their homes on the market because of deteriorating conditions ... hoping for a better price in the future. The following chart shows the supply situation correlated to monthly sales rate.

A major flaw in the CRA as amended was that it enabled the regulatory authorities wide discretion in how the CRA was administered. Many politicians on both sides of the aisle were complicit in allowing the regulators changes which became the infamous Alt-A loans, no-doc loans and ARM's loans, otherwise known as adjustable rate mortgages.

Banks were penalized for not opening enough branches or increasing their percentage of loans and loan originations from disadvantaged areas. Banks were also penalized if it was perceived that the interest rates charged in minority neighborhoods were excessive. Groups like ACORN were only too pleased to point out those institutions not meeting the revised standards.

Fannie Mae and Freddie Mac were also loosening their credit standards and when securitization of large tranches of mortgages became popular, the risk managers of financial institutions lost sight of who the ultimate counter-party to those transactions became.

The second was the repeal in 1999 of the Glass-Steagall Act which separated commercial and investment banks by the passage of the Financial Services Modernization Act of 1999, known as the Gramm-Leach-Bliley Act. In April 1998, Sandy Weill's (formerly Chairman of American Express) Travelers Insurance, which owned Salomon Smith Barney, merged with Citicorp. Mr. Weill's flaunting of the Glass-Steagall Act did not bring criminal penalties as too many Congress members and Senators were supported by Weill's and his friends political contributions.

The Glass-Steagall Act was passed in the 1930's to prevent the same kinds of structural conflicts of interest that were endemic during the 1920's, the interlocking shareholder and board of director interests that allowed power and self-interest to be concentrated. Unfortunately, as mega-banks were created and shareholder interests were institutionalized, many of these institutions from rating agencies, mortgage brokers, investment brokerages, banks, and mortgage servicing groups became more and more concentrated. A ratings downgrade that affected a company with an interlocking directorate could very easily receive special treatment.

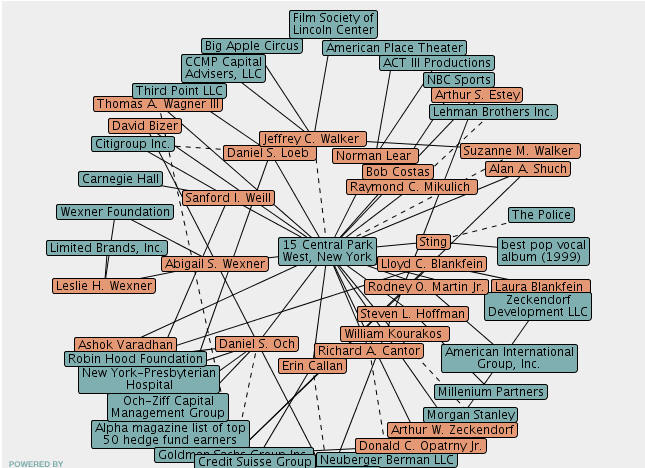

Take a look at the masters of the universe who sank millions into trophy properties just before their companies collapses. Apparently there were many at 15 Central Park West, a spectacular, new condo development on Manhattan's Upper West side.

Now I am not suggesting that any of these people did anything illegal. One of the major differences between the Wall Street players when I was at 40 Wall Street and today is that then most were partnerships and not shareholder owned, let alone with non-affiliated or public shareholders. As a result, the leverage used to make deals was significantly lower because if a partner deemed a deal too risky, he could scuttle the transaction in a multitude of ways. Today, those making the decisions at most firms see the company totally differently because they are using OPM, or other people's money, not their own.

As the value of homes became questionable in 2007, the stage was set for a massive correction in the financial industry. Home building had actually begun to level off beginning in the summer of 2006 but it took almost a year before the strain was noticed when Bear Stearns had problems in its two hedge funds.

On March 28, 2007, Bernanke said:

"that the problems in the subprime market would only reduce somewhat the effective demand for housing. At this juncture . . . the impact on the broader economy and financial markets of the problems in the subprime markets seems likely to be contained,"

It was obvious that the FED chairman was clueless. On May 17, 2007, Bernanke said,

"The subprime mess is grave but largely contained. While rising delinquencies and foreclosures will continue to weigh heavily on the housing market this year, it will not cripple the U.S. economy."

Despite reassurances from both Treasury Secretary Paulsen and FED Chairman Bernanke that "the problem was largely contained" in testimony before Congress in July 2007, the so-called "mark-to-market" valuations of Tier 2 and Tier 3 assets were being questioned.

A year later, the magnitude of the problem is becoming apparent to the politicians, academics and investors. The amount is simply beyond comprehension for most minds, Between October 9, 2007 and September 12, 2008. Here are some of the individual losses by market cap:

It is staggering when you look at it all together, and when you realize that the companies still standing, like Bank of America (BAC) and Citigroup (C), have seen bigger market cap declines than some of the institutions that have gone under (Lehman Brothers) or that had to be bailed out (Fannie Mae, Freddie Mac).

The massive losses in real estate and capital values will affect local, state and federal revenues for years to come.

Governments will find it extremely difficult to continue to fund not only required expenditures but certainly earmarks and non-essential projects. The forthcoming bankruptcies of many municipalities and counties could well reduce and/or eliminate pensions currently enjoyed by public employees. A taxpayer revolt could happen.

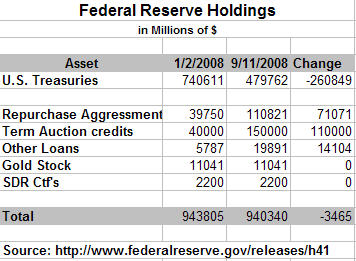

At the beginning of this year, the five largest investment banks in the U.S. were Merrill Lynch, Goldman Sachs, Lehman, Morgan Stanley and Bear Stearns. The FED's repo pool stood at about $160 billion and today is almost $450 billion. The development of various new lending arrangements which opened the door to investment banks, Fannie Mae, Freddie Mac, the Federal Home Loan Banks, and others to obtain capital infusions from the FED has materially inflated the money supply and seriously deteriorated the quality of the FED's balance sheet.

The following table illustrates the changes in the FED's assets during 2008 through September 11th. The table does not include the Lehman, Fannie Mae, Freddie Mac or AIG transactions. When those commitments are added, the necessity for the Treasury to borrow money to lend to the FED is understandable.

The Investor's Business Daily® compiled a partial list of the bailouts and guaranteed loans in the September 18th issue:

|

$29 billion to Bear Stearns to keep it from going belly up. | |

|

$200 billion from the Treasury to acquire and recapitalize Fannie Mae and Freddie Mac. | |

|

$85 billion in a guaranteed two-year term loan from the Fed insurance giant AIG, which includes an 80% stake in its equity for the U.S. government. | |

|

$1.2 trillion pushed into the banking system by the Fed over the last year and a half to keep the credit crunch from getting worse. | |

|

$500 billion in miscellaneous other guarantees and bailouts still on the federal government’s books. |

During the past two weeks, there have been extraordinary changes in our financial structure. The FED along with JPMorgan Chase and Goldman Sachs as well as Morgan Stanley have survived. Today, Bear Stearns, Merrill Lynch and Lehman have basically ceased to exist as the credit crisis rolls along.

The FED is definitely in a bind. When the U.S. Treasury has to sell Treasury bills to lend to the FED to fund commitments, the situation has become dire. On Wednesday, the Treasury auctioned $45 Billion and is back for more. If one of those auctions fails, the game is over.

The fiat world community knows that the risk is systemic to the entire financial system. Overnight, according to a Bloomberg report today, central banks including the FED, the Bank of Japan, the European Central Bank, the Swiss National Bank, the Bank of Canada and the Bank of England pumped into the system over $247 billion in an attempt to calm the markets. The result will only be to increase inflationary pressures while the system continues to deleverage. The world is not facing a liquidity problem but rather a solvency crisis.

Lowering interest rates won't help nor will injecting massive amounts of liquidity. When trust is lost, the only solution is for transparency and no system built upon a fiat currency really can afford transparency ... because the emperor has no clothes.

So who is to blame?

Start with Congress, add in the greed of citizens who were not educated enough to realize that "something for nothing" does not last forever, and home buyers that purchased homes that they could not afford.

Politicians who believed that a fiat banking system built on trust could be used to buy votes and academics who taught that a little bit of annual inflation was needed to keep the economy moving forward and citizens employed.

Bankers that failed to understand risk and investors who believed ratings compiled by organizations whose shareholders had serious conflict-of-interests with lending institutions (interlocking directors and ownership controlled both the rating agencies and the lending institutions) were also culpable.

The U.S. Treasury for refusing to provide audited financial statements including that of the U.S. gold stocks for over 50 years. The Congressional Budget Office for not providing realistic assessments of the cost of Social Security, Medicare, Medicaid and the risks associated with the bailout of the GSE's.

Finally, the FED with its unrealistic interest rates and the regulatory agencies including the SEC and CFTC who failed to enforce the rules which were already on the books about short-selling and risk management.

In the end, everyone is to blame ... unfortunately, rather than letting the market sort out the winners and losers, the solutions currently proposed and implemented will end up not solving the problem but completely changing the economic and financial world which made the U.S. the dominant power in the world. The end could well be a country well on its way to advanced socialism and a third-world country status with a currency shunned by foreigners around the globe.

As Stalin said, "When we hang the capitalists, they will sell us the rope we use." The current alumni of Goldman Sachs and JPMorgan Chase seem destined to prove Stalin right!

Fred Richards

September 18, 2008

Corruptisima republica plurimae leges. [The more corrupt a republic, the more laws.] -- Tacitus, Annals III 27

This issue of 'Tis Only My Opinion was

copyrighted by Adrich Corporation in 2008.

All rights reserved. Quotation with attribution is encouraged.

'Tis Only My Opinion is intended to provoke thinking, then dialogue among

our readers.

![]()

![]() 'Tis Only My Opinion! Archive Menu

'Tis Only My Opinion! Archive Menu

Last updated - September 18, 2008