'Tis Only My Opinion!

January 2006 - Volume 26, Number 1

![]()

![]()

As 2006 is an election year in the U.S., one can expect Congress to be reluctant to reduce spending programs and to take effective measures to curb the federal deficit by increasing taxes.

There are several areas that I believe the nation needs to address. In this Outlook 2006 issue, we will try to identify some of those needs and to suggest solutions which will probably not be politically correct.

|

|

The Middle Eastern mess |

|

|

Terrorism and its implications for the economy |

|

|

The real state of the economy |

|

|

Investment strategies for 2006 |

The fight against terrorism has eroded a portion of the personal rights and liberties which American citizens have fought and died. The defeat of the Patriot Act in the Senate could be the beginning for a rational effort to separate the politically correct approach to fight terror toward measures which might be more effective.

Despite the ACLU's protestations, the terrorist incidents since 1990 have been primarily carried out by religious extremists and most often, those have been by Islamic radicals. Failure to acknowledge this fact and to refuse to profile individuals has wasted huge amounts of manpower and funds while doing little to actually increase safety.

The Wahhabi leaders of Saudi Arabia continue to teach, support and provide financial funding to various Islamic groups throughout the world. The Wahhabi movement is based upon a strict interpretation of the Prophet Muhammad teachings. The Wahhabi helped recapture Mecca in 1803 from the Ottoman Turks. After the Turks recaptured Mecca in1803, Mecca remained part of the Ottoman Empire until 1901 when the Wahhabis again helped Saudi amir Abd al-Aziz al-Saud to recapture Riyadh in 1901.

The Saudi royal family today is highly dependent upon maintaining a workable arrangement with the Wahhabi movement leaders. Failure to do so could conceivable lead to the downfall of the Saudi royal family.

The one major fundamental thought to keep in mind about the Wahhabi movement is their belief that the ways of Muhammad and his community at Medina are the only acceptable models for all Muslims. Any Muslim and/or infidels who do not follow those practices are heretics and apostates and should be dealt with according to the Wahhabi's strict interpretation of the Prophet Muhammad.

Since 1973, the Saudi government spent approximately $87 billion to promote Wahhabism in the U.S. and the Western Hemisphere according to a 2002 article in FrontPage Magazine by Susan Katz Keating.

In their view, the Wahhabis are the only true believers and all others should either convert or be destroyed.

Says Bernard Lewis, widely recognized as the foremost Western scholar on Islam: "In time, in the Muslim view, all mankind will accept Islam or submit to Islamic rule."

Religious fanaticism enables them to create suicide bombers.

Since before the Old Testament was written, the Middle East has seen conflicts between warring tribes and civilizations. In recent times, countries outside of the region have drawn artificial boundaries in the region. Upon the dissolution of the Ottoman Empire in 1918, the current borders of Iran, Iraq and most of the Middle East were drawn with the Treaty of Sevres. Again in 1946, following the holocaust in Germany, the state of Israel was carved out of the region when the British decided to withdraw from the Palestine Mandate.

Fulfillment of the 1947 UN Partition Plan would have divided the mandated territory into two states, Jewish and Arab, giving about half the land area to each state.

The artificial boundaries created and the displacement of persons who lived in the region has led to a significant amount of unrest. Today, we have many Islamic clerics and radicals continuing to call for the destruction of the Jewish state. Throughout the Middle East, we have the Kurdish people demanding independence for the Kurds residing in Syria, Turkey, Iraq and Iran.

With a sizeable portion of the US military within Iraq and the recent election favoring a Sunni government that would like us to leave in the near-term, perhaps, it is time to step back and take a fresh look at the Middle East.

The recent elections in Iran have brought another terrorist into power in the world's fourth largest exporter of oil. The ramifications of the Shiite radical election could make the Saddam Hussein's reign look relatively benign. Iran also has nuclear ambitions as well as the knowledge to develop chemical and biological weapons. I would expect that the mullah's as they try to impose their middle-age concepts on the population might resort to further baiting of the international community to forestall a revolution from within. Certainly, Iran's support of terrorists has not abated despite the events in Iraq.

From 1949 to 1997, the U.S. taxpayer has contributed about $84 Billion in aid to Israel. Adding the cost of the deficit financing during that period, the real total to the U.S. taxpayer is about $135 Billion. A more recent study suggests that through FY 2005, the U.S. taxpayer has contributed about $96.7 Billion in aid of which only $11.4 Billion was military aid. This study does not attempt to add the interest cost required by the deficit financing to the total.

The above amounts, however, fail to recognize the amounts that individuals and charitable organizations have also sent to Israel during the past 50 years.

The population of Israel is about 6.4 million and only about 75% of the population is of the Jewish faith. Hence, the Jewish population is only about 4.8 million. Of the total population, only about 650 thousand are over 65.

For the next year or until all U.S. troops are removed from Iraq and Afghanistan, provide every Israeli citizen of Jewish faith under the age of 65 a free airline ticket and visa to the U.S. plus a $250,000 loan to be used for any purpose in the U.S. Upon obtaining U.S. citizenship, the $250,000 loan would be forgiven.

This proposal would allow the U.S. to obtain the intellectual power which the Jewish people have and would help to increase the creative minds in American.

The U.S. should encourage the breakup of Iraq and portions of Turkey, Syria and Iran into a Kurdish state. While we should not use force to accomplish this realignment, we should use our diplomacy and powers of the purse to accomplish the fact.

During the first 130 years of its history, the U.S. economy ebbed and flowed in the wake of a number of bank panics. The Panic of 1907 led to the formation of the Pujo Commission to study the country's financial situation. As time went on and with the Democrats in control of both the House and Senate, the Owens-Glass Financial Reserve Act of 1913 was passed.

The original purpose of the legislation was:

To provide for the establishment of Federal reserve banks, to furnish an elastic currency, to afford means of rediscounting commercial paper, to establish a more effective supervision of banking in the United States, and for other purposes.

It was the other purposes that has changed the American economy.

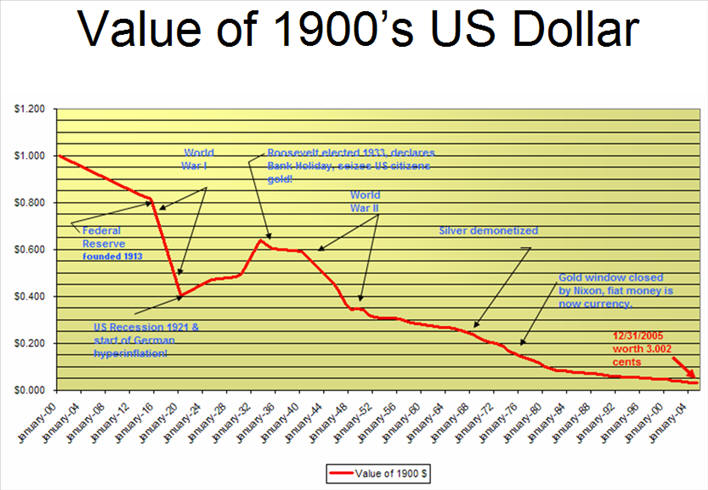

The U.S. economy has gone bankrupt three times during the past century. The first time was in 1913 with the formation of the Federal Reserve which transferred the power to create money from the U.S. Treasury to the Federal Reserve system which was largely owned by foreign banks. The second bankruptcy occurred in 1933 when President Franklin D. Roosevelt declared a bank holiday and seized gold owned by U.S. citizens. This gold was then placed in the Exchange Stabilization Fund which has been used to manipulate markets and prop up foreign governments including Mexico. The third bankruptcy occurred when President Nixon closed the gold window because of a run on gold initiated by France in 1976.

As a result of these bankruptcies and inflation fed into the system by the Federal Reserve over the last century, the dollar has fallen from a currency which could be exchanged for hard assets in gold and silver bullion into a fiat currency. Each note bears the inscription "This note is legal tender for all debts, public and private."

There is a close correlation between energy consumption and gross domestic product. The following NASA composite photo shows a good view of the world's energy consumption and hence, global GDP.

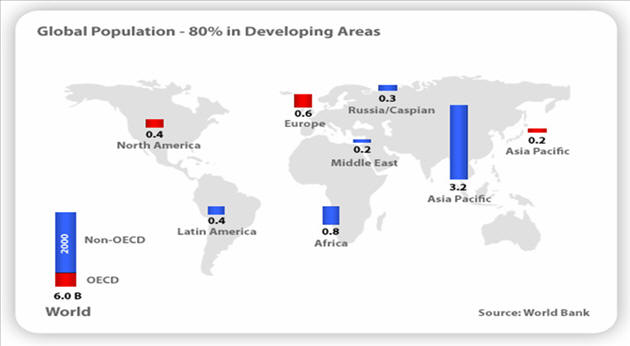

In Outlook 2005, we examined aging and birth factors that will be driving the world's economic growth in the coming 50 years. The World Bank has indicated that 80% of the world population lives in the developing regions.

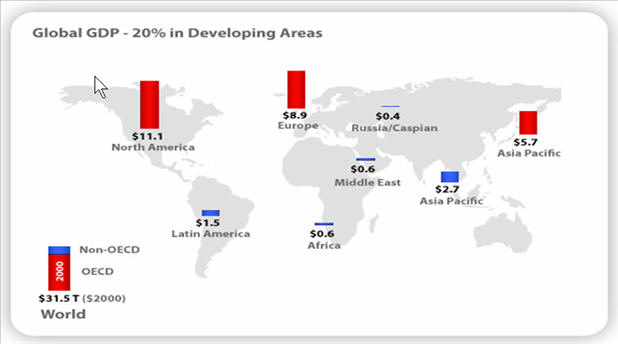

Global GDP in 2005, however, was concentrated in those regions of the world that only had 20% of the world's population.

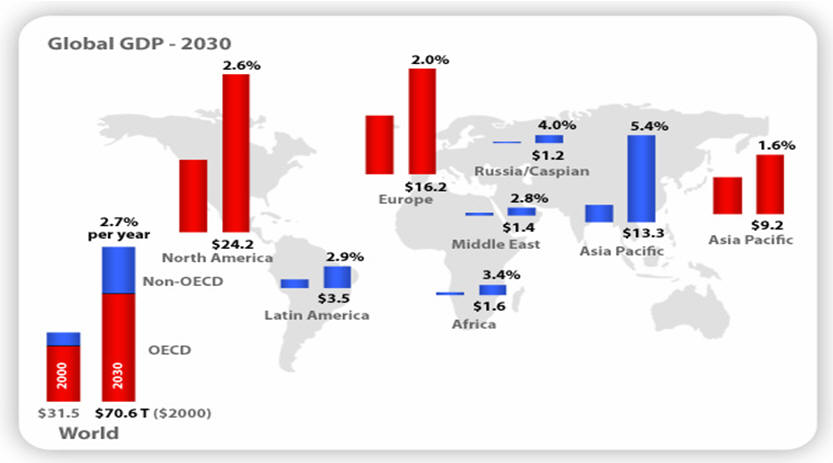

The World bank also projected that outside of the Asia Pacific area by 2030, global GDP would not change significantly between the various regions.

The G-8 countries are and should remain the economic powerhouses of the world through 2030. The following charts shows the G-8 countries.

Absent from the G-8 countries are three notable groups. China who currently has the fastest growing GDP. It also has 2 million people worth over $40 million each on the mainland. During the next 20 years, it is expected that 500 million people in China will be moving from rural areas into urban areas. The economic challenge of such a move is mind-boggling as that is the largest migration in history. India, the world's largest democracy is also not in the G-8. However, it's citizens and financial institutions are the largest holder of gold in the world. The Islamic world with its vast oil wealth and uneducated populations is also not included. The religious fanaticism of many of Arab political leaders could provide the spark to ignite another major war.

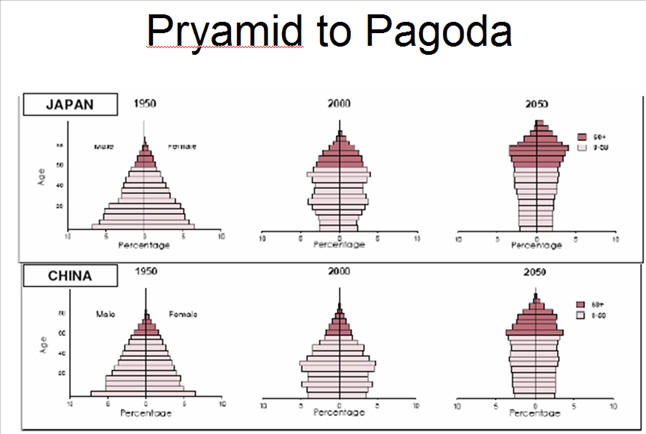

Population aging is arguably the single most important trend in the world today. Population ageing is also unprecedented in that it has never happened before in the history of mankind. The process is pervasive in that, in one way or another, it affects every individual, no matter where they live. Finally, the process is enduring and irreversible. The United Nations notes that the young populations of "unlikely to occur again".

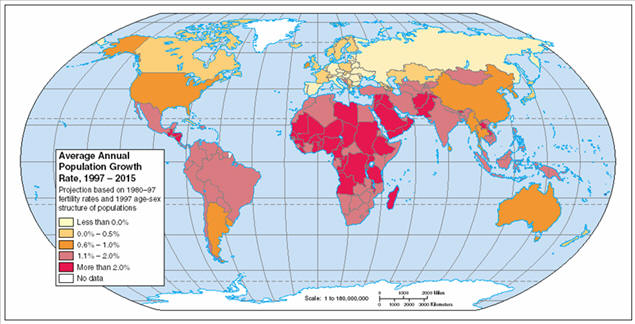

The chart above shows that the less-developed countries will have the greatest population growth in the next ten years. Since most of these high-population growth areas are also areas where famine and poor education exist, the pressures upon the politicians in those areas to focus their citizens attentions other than on internal policies will be great.

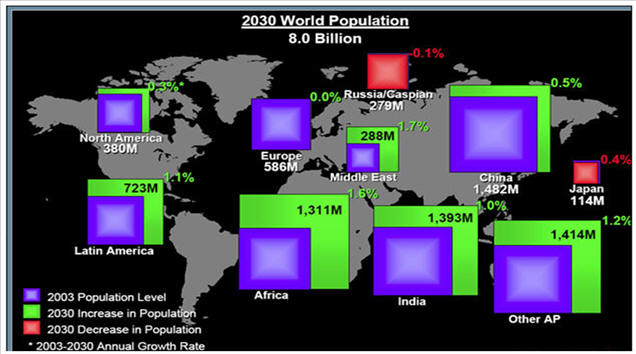

The chart above shows the expected growth of the world's population by 2030. Europe, Russia and Japan are expected to lose population because of the low birth rate and an aging population. While Japan's age pyramid is well-known, the restricted birth rate of China will also cause problems. The problem is also especially acute in South and North Korea.

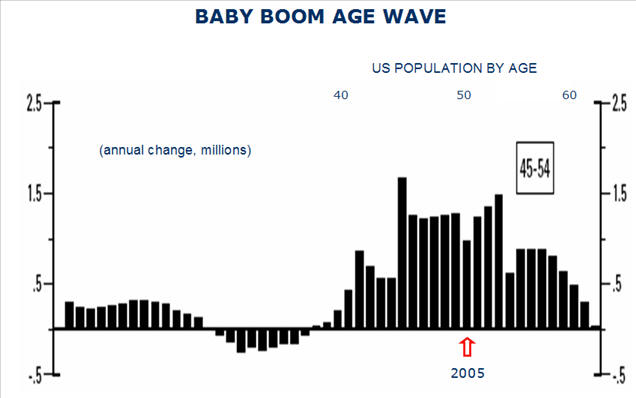

The Baby-Boomer generation is now just beginning to reach the age of retirement as shown in the following chart.

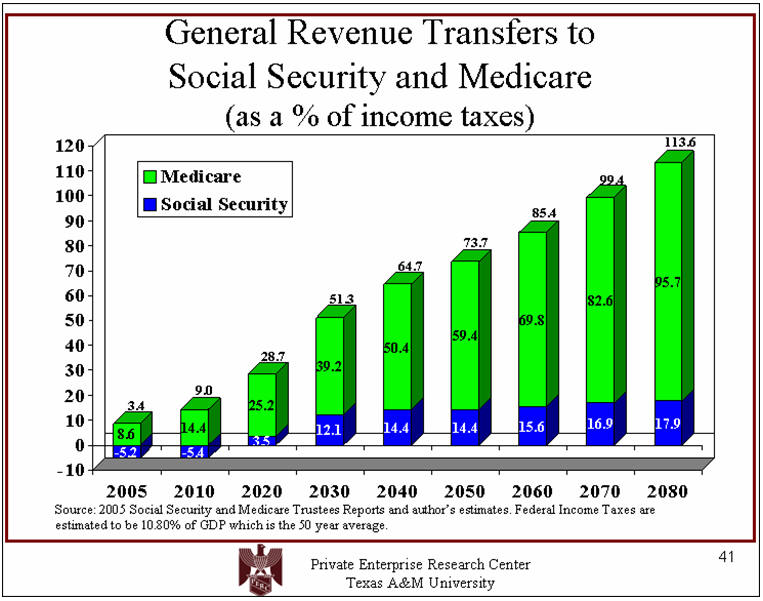

Not only do the Baby-Boomers have the votes to impoverish their children and grand-children, their current spending habits will certainly guarantee it. A recent study by the Private Enterprise Research Center at Texas A&M University details the current mess. Clearly by 2080, social security and medicare if not changed will be broke as will the entire country.

An economy in which people earn less than they did the year before, spend more than ever, and save less than nothing is not solid.

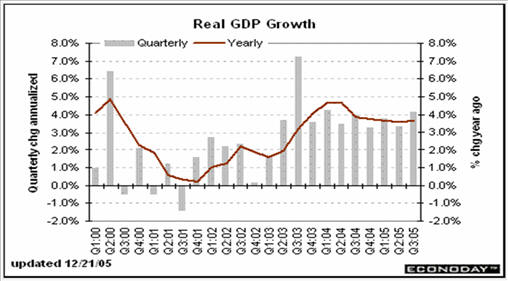

The US economy continues to chug along helped by accounting devices which would send accountants in the private sector to jail. According to the Federal government's BEA figures, GDP rose in FY 2005 to $12.6 trillion, an increase of 6.6% without a correction for inflation. The US economy in 1975 was less than $2 trillion as shown below.

When adjusted for inflation, the increase drops to about 3.7%. A significant portion of this gain can be attributed to hedonic and productivity increases, both of which are dubious in my view.

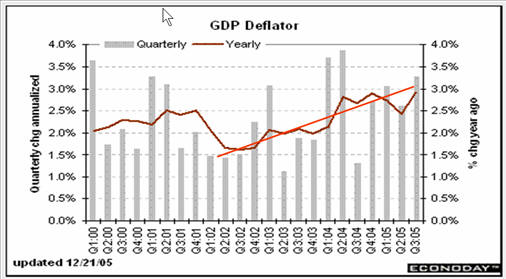

The GDP deflator used by the Ministry of Truth as shown below still shows an increase in the inflation rate.

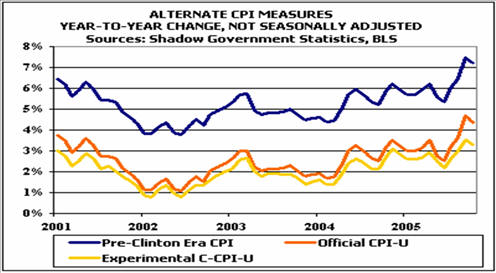

Governmental statistics are largely suspect because of the various changes made which bear little relation to the real world. The CPI numbers are a case in point as are the productivity numbers. Yet, their impact upon GDP is very important.

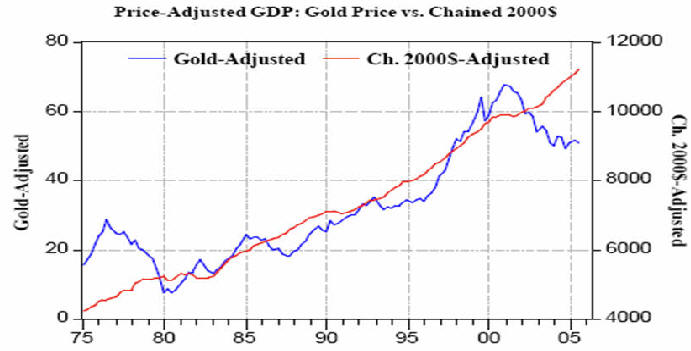

For many world investors, the gold has been a major store of value and its price is often interpreted as a window into the true inflation rate of an economy. If rather than using the CPI deflator, you adjust GDP by the price of gold, you will see a very different picture than the chart shown above.

When GDP is deflated by the price of gold, we have a much different picture of the U.S. economy. Note that from the previous peak in gold which occurred in 1980 until the year 2000, the gold-adjusted GDP tracked closely with the Chained $ GDP. However, in May 2002, the price of gold began moving steadily higher and the relationship of the two series diverged as shown above.

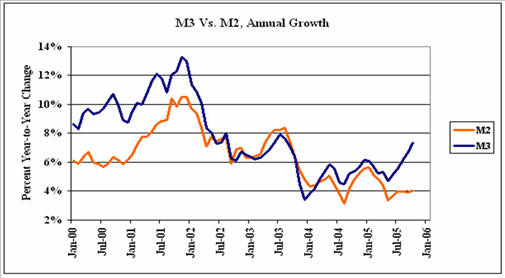

Inflation can be thought of as more money chasing the same amount of goods and services. One measurement of money supply is M3 which the Federal Reserve is going to cease reporting as of March 31, 2006. The recent growth of M3 as opposed to M2 as shown in the following graph illustrates, perhaps, one reason the FED does not want to report M3 any longer. It has begun to surge as opposed to the M2 numbers. Repurchase agreements and other modes of manipulation are in the M3 numbers but not in the M2 numbers.

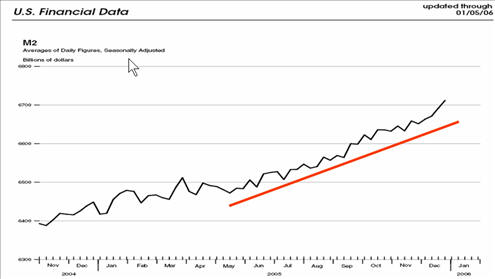

The daily growth rate of M2 since November of 2004 is shown below. Notice the almost constant trend line in 2005 that has begun accelerating in December.

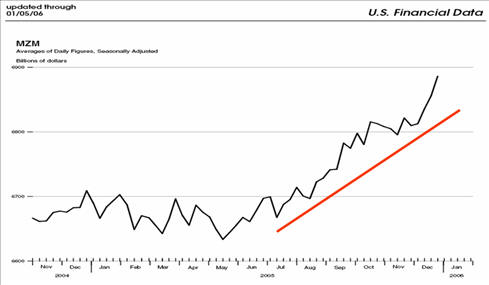

The burgeoning money supply in recent months can also be seen the the graph of MZM shown below.

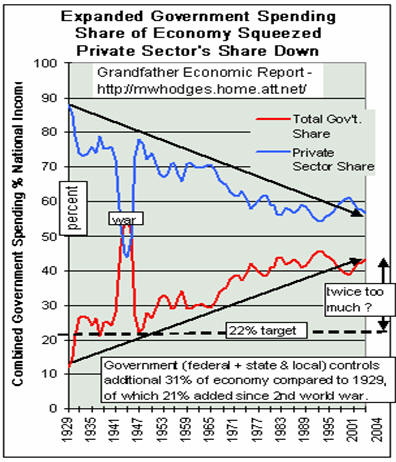

In 2004, the government share of the economy had risen to 43% and if regulatory compliance costs are added, the percentage would be even larger. Expanded government spending since 1929 has risen from about 10% to today's level. The following chart illustrates the trends between the private sector and government. The capitalist economy is close to becoming an endangered species.

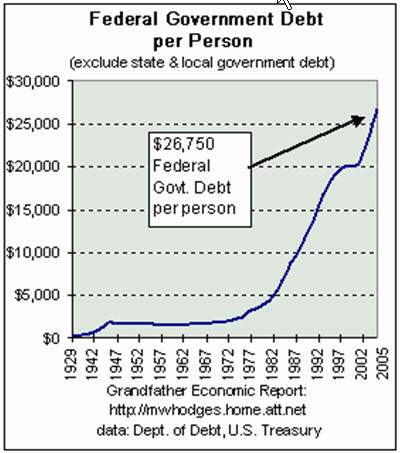

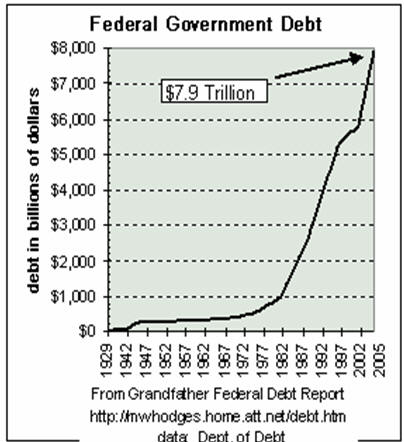

At the end of 2005, the Federal Government Debt per person stood at $26,750. Since 1977, the growth of that debt has risen almost exponentially. In 1979, the stated federal debt as a % of GDP had fallen to 32%. Today, the percentage has almost doubled. But contingent liabilities for social security, government pensions, medicare and medicaid are now in this figure. Various estimates place the current $7.9 trillion debt as being really somewhere between $45 trillion to $85 trillion. But, unlike Enron, the federal government doesn't have to report the real figures. The current debt ceiling will probably be breached in January 2006 . . but Congress will just raise it higher.

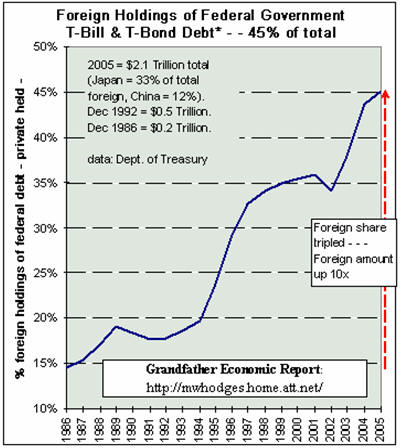

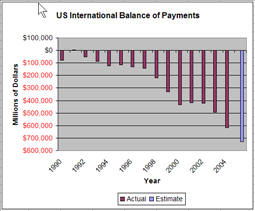

During the last 15 years, foreign interests have been increasing their holdings of our federal debt as shown below. As the percentage rises, it increases the risk of our dollar values. Moreover, if foreign governments decide to play economic hardball by selling their horde of U.S. debt, it could produce a financial disaster.

Since the removal of the gold and silver backing for our currency, the U.S. economy since 1977 has relied on consumer spending to continue and be the major engine of economic growth. As long as foreigners continue to support our consumptive spending by purchasing $2 billion a day of our debt with a currency that has only a fiat value, the economy will continue to "muddle-through." However, to finance that spending requires the U.S. to obtain about 80% of all world-wide savings in 2005.

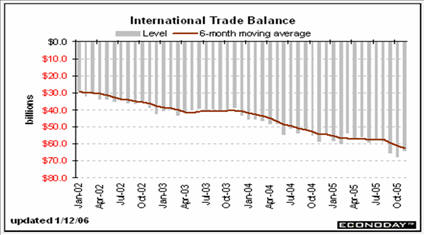

Perhaps, more important to the future of the U.S. is the trade deficit. As the U.S. has transitioned from a manufacturing to a service economy, the trade deficit has ballooned. While importation of energy products has impacted the trade balance, the reduction of exports has been another key factor as our manufacturing base has moved overseas. The last time the U.S. ran a trade surplus was in 1991. Since that time, the country has had a trade deficit every year and since 2000, the deficit has increased.

To finance the twin deficits of government and trade requires in excess of $2 billion a day from foreigners as the country now enjoys a negative savings rate.

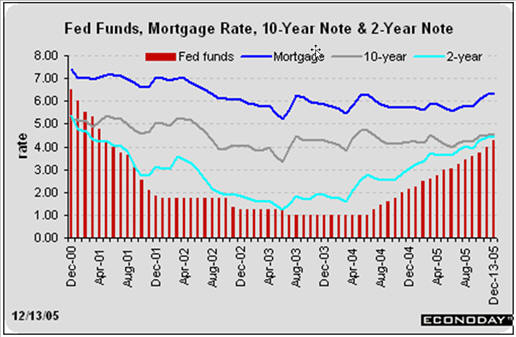

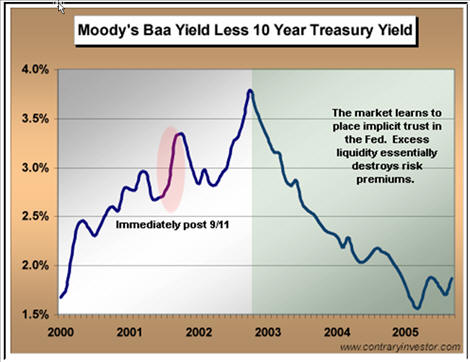

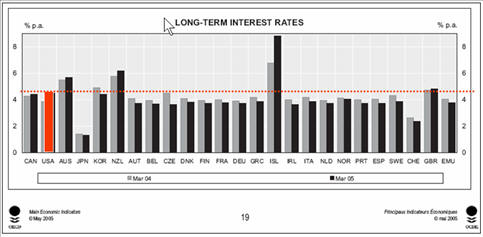

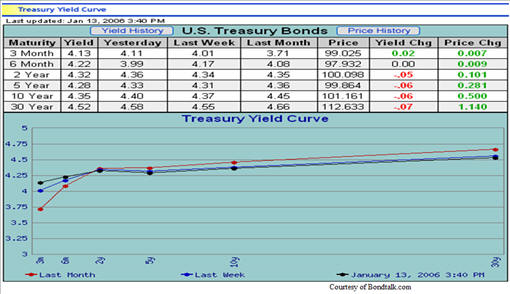

Interest rates are likely to move higher in the coming year. The FED has increased interest rates 13 straight times by 25 basis points. In 2006, the U.S. Treasury is likely to offer a 30 year bond. Of course, the minions in Treasury should have sold 30 year bonds before interest rates began their upward move. As the FED as moved interest rates higher, the spread between the 2 year and 10 year bonds have narrowed significantly. Also, junk bond spreads have narrowed considerably during the same period. Many analysts are suggesting that the risk premium in bonds has been almost eliminated. Of course, that means that U.S. Treasury bonds are only slightly better credit risks than junk bonds.

The U.S. has the highest 10 year interest rate of any major economy. Only former British Empire countries and Israel are showing higher rates from a year-ago period as shown below. The interest curve is now showing signs of inversion which is a predictor of a recession ahead.

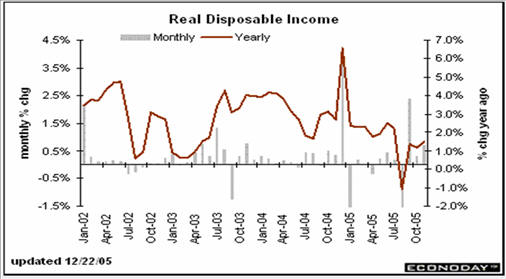

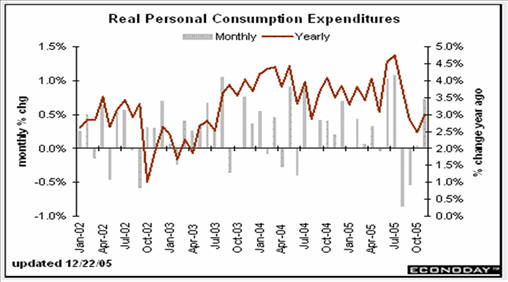

Personal income grew as shown in the following graph. Real disposable income only grew about 1.5% in the last twelve months ending in November 2005. Clearly, the consumer is under pressure as even the government's inflation numbers are higher.

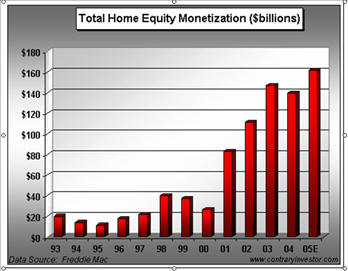

Personal consumption expenditures grew at an annual rate of 3.5% during the same period. Consumers reduced their home equities and increased their personal borrowing to continue their spending spree.

The result was obvious . . . a negative savings rate for the nation in 2005.

The Ministry of Truth massages the CPI and PPI indices to obtain political results. The mass-media is generally unwilling to look at anything but the head-line generating numbers. The Federal Reserve continues to trumpet the adage that inflation is under control. Of course, it is if you keep changing the way you calculate the CPI. Since 1996, the CPI has been tweaked 13 times. One of the reasons for the tweaking is to defraud social security recipients and others who have inflation-adjusted pensions from receiving their correct amounts. As a result, the following graph prepared by Shadow Government Statistics may be of interest. The inflation rate computed by SGS is almost double the Ministry of Truth numbers.

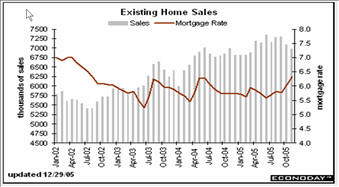

Since 200, the housing industry has created over 50% of all new jobs in the U.S. Refinancing mortgages has helped fuel the consumer spending spree. Housing debt has increased to the largest percentage in history. The question to be answered is: "Is there a bubble and is it leaking?

Robert J. Shiller index of housing prices in the U.S. since 1890 shows that during the past decade, housing for the masses is becoming more unaffordable.

To finance consumer spending and the increased housing costs, consumers have drawn down the equity in their homes. Total home equity monetization since 1993 has exploded since 2001 as shown below.

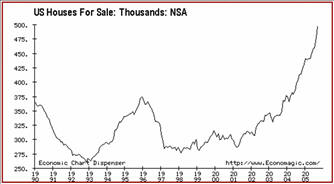

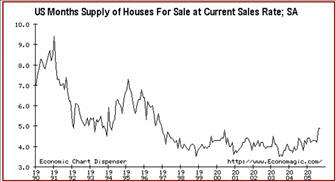

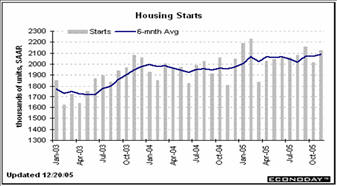

The peak of the housing market was probably around the middle of 2005. Since then as mortgage rates began rising, existing and new home sales have begun to fall. Also, median home prices have declined and the average a house stays on the market and the number of homes offered for sale has increased.

Builders meanwhile do not seem too concerned as housing starts remain high. However, there appears to be a shift from single-family units to multi-family units in the last three months.

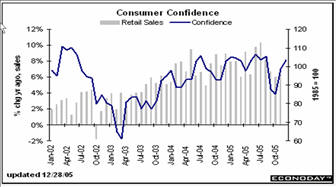

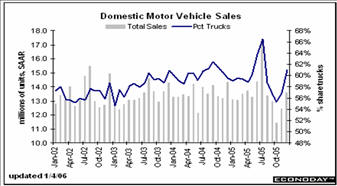

Despite an economic that reduces the consumer's standard of living each month, consumer confidence continues high although it has waned slightly in recent months. Helped by auto industry incentives, consumers continue to buy low gas-mileage trucks and SUV's. Gasoline prices spiked in September and October because of the hurricanes and damage in the Gulf to oil and gas facilities. Yet, in December, auto sales including sales of gas-guzzling trucks continued to rebound.

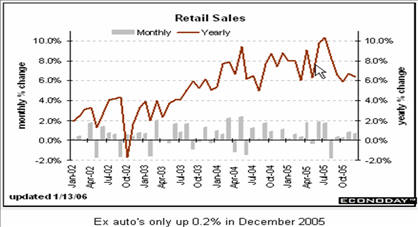

The consumer continued to buy during 2005 despite all the problems. Retail sales for the year were up almost 6% over 2004. However, if you remove the impact of transportation sales, retail sales were only up about 3%.

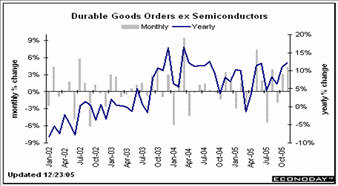

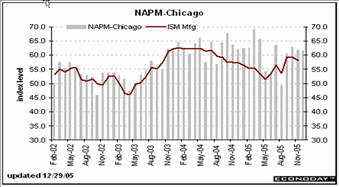

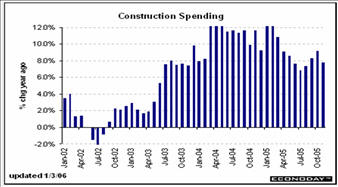

Although a major portion of the manufacturing sector has been moved off-shore, new orders and shipments in 2005 continued to grow at a positive rate. However, the rate of growth did fall off during the second half of the year. Durable goods orders continued an upward trend in the second half of 2005 largely as a result of the success of Boeing's new airplane orders. The NAPM index as well as the ISM Manufacturing report offer a slightly different picture than the durable goods orders. The last quarter of 2005 both indices appear to be losing momentum. Many analysts have argued that corporations will utilize the cash reserves which have been generated to invest in new plants and equipment. The chart on construction spending suggests that with capacity utilization in the U.S. holding below 80% that is just wishful thinking.

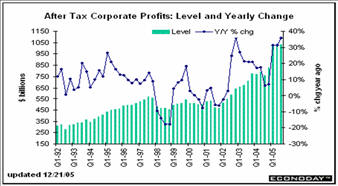

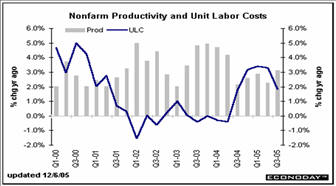

After tax corporate profits continued to surge to the highest levels in history added by the rise in commodity and energy prices. Moreover, the biggest use of excess corporate cash during 2005 was repurchase of corporate shares as that could increase earnings per share faster than investing in new plant and equipment. The same scenario is likely to occur in 2006. According to the FED, non-farm productivity has been responsible for some of the improvement in corporate profits as corporations have reduced staffing levels and out-sourced jobs overseas. Unit labor costs have only been recently increasing as wage benefit programs continue to increase at a higher rate than productivity gains. During 2006, it is expected that wage increases will begin to further increase unit labor costs.

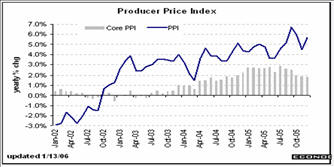

The producer price index is also manipulated by the Ministry of Truth. The PPI according to the Ministry of Truth only increased about 5.8% in 2005. Nevertheless, it continues to project higher costs in the future. The CRB index, however, for the same period gained over 21%. Clearly, there is a major difference between the two measures of producer costs.

The four promising technologies to watch are nano, biomass, nuclear, and hybrid vehicles.

Significant commercialization of nanotech is probably 5 to 10 years away.

Biomass on the other hand could be very interesting in the near future. Ethanol production is rising and new plants are lowering the costs of production. Biomass plants are now operating on turkey and hog waste. One test plant is now operating using raw sewage prior to treatment to make gasoline. As the technology improves, expect costs to come down.

If it was not a political or NIMBY problem, the nuclear industry should be providing most of the world’s electricity.The Department of Energy has a project with the name of SSTAR (small, sealed, transportable, autonomous reactor) which expects to build a portable nuclear plant to provide either 100 megawatts or 10 megawatts of electricity. The plant would operate for 25 years before it would need to be replaced. A 100 megawatt facility could provide the power for a city of about 100,000.

Although alternative fuels can decrease our reliance upon hydrocarbons for gasoline, the development of hybrid vehicles also provides a significant opportunity to reduce gasoline demand per mile traveled. At the moment, the replacement battery costs are very expensive. Nevertheless, hybrid vehicles could grow to 25% of the market this decade.

During the next five years, there will be some major shifts in markets. The percentage of retail sales occurring via the internet will continue to increase. Wal-Mart's entry into the grocery market could well change the distribution pattern and will affect the ability of old-line grocery concerns to compete. Open source software will become more prevalent. Market share of manufactured products will increase by foreign manufacturers.

Besides nano, biomass, nuclear, and hybrid vehicles, the following sectors would appear to have better prospects in 2006. The number one area to consider is those companies that produce products from below the ground. Other sectors would be computer manufacturers. medical software, medical equipment, foreign banks, investment brokers, enterprise software, internet content, internet e-commerce, and chipmakers.

Because of the rising cost of fuel and environmental regulations, the transportation industry is facing trouble. In the airline business, the cost of labor has pushed many of the airlines along with fuel costs into and/or near bankruptcy. Trucking and shipping are subject to increased operating and regulatory costs.

Agriculture also is facing critical issues with water rights and ground pollution costs. Good agricultural land is being lost to urban and suburban development. In many states, state environmental regulations are more harsh than the EPA’s. The rising cost of land and operating expenses has seen the profitability of farming come under serious pressure. During the past five years, the average age of farm operators has increased by 4.75 years.

Today, in many growing areas, land has been priced out of agriculture. As a result, many crops formerly grown in the U.S. now have to be imported. Also, the San Joaquin valley in California is also losing acres from the increasing salt levels. The level of the West Texas aquifer remains at critical levels thereby preventing thousands of acres in West Texas from being irrigated. In Idaho, environmentalists are demanding that all irrigation canals and dams on the Snake River be removed.

Because of environmental concerns, waste generating processes including metal plating plants, mining processes, etc., have been subjected to massive cost increases. Many industries have moved from the U.S. to foreign countries where the regulatory situation is not as complicated or expensive.

Cement plants, steel plants, and oil refineries are just some of the smoke-stack industries that find themselves in serious trouble.

Natural resource companies including ranching and timber as well as oil and gas extraction companies find themselves constantly in the cross-hairs of the environmental groups.

Health care is another area of concern. Not only is the share of GDP growing but the level of care is decreasing. Several countries have higher standards of care than the U.S. The American Academy of Anti-Aging Medicine (A4M), a medical society dedicated to the science of longevity medicine, reported that 90 percent of all healthcare dollars are spent on extraordinary care in the last two to three years of life.

Likewise, a total of 50 percent of the U.S. healthcare budget is spent on degenerative diseases of aging (Health Care & Finance Administration, 1996). The US percentage of GDP spent on healthcare has increased from 5% in 1950 to 15% in 2003. Clearly, the cost/benefit ratio to society is going to have to be debated as the percentage grows in the future.

During 2006, we believe that investors should be extremely careful about their investments. The possibility of a financial disaster has risen as competitive devaluations escalate throughout the world. Hence, we believe that the following are points to consider.

|

Maintain cash reserves overseas or in bullion. | |

|

Select only high-growth potential stocks earning profits. | |

|

Watch sector rotation carefully and avoid low relative strength stocks. | |

|

Look for dividend paying stocks. | |

|

Invest in commodity oriented stocks. | |

|

Avoid Bonds. |

Adjustable rate mortgages are about 80% of all outstanding mortgages. As interest rates move higher and if the economy does not improve greatly, the current delinquency and foreclosure rates will look tame by the end of the year. As a result, real estate prices except in selected areas will begin to come down causing further distress among home-owners that have over-extended themselves.

The COMEX and NYMEX markets are derivative plays without full transparency. Interest rate swaps have the potential for losses if a third-party is unable to perform. Both the gold etf and the silver etf are places to avoid as there is no provision for a full audit of their alleged holdings of bullion.

The exchanges have been known to change margin rates and other rules to prevent the exchanges from taking severe losses. Bunker Hunt and his family discovered that fact many years ago. The metals markets and particularly, the precious metals sector, are managed markets and as such operate without transparency.

With interest rates rising, the historic spreads between borrowing and lending can only be squeezed. As a result, profitability of financial stocks should be under pressure in coming months.

The SEC has confirmed that Fannie Mae has violated its accounting rules and that the GSE would have to restate its earnings from 2001 through mid 2004. The company's accounting "did not comply in material respects" with accounting rules for derivatives, financial instruments used to hedge against interest-rate swings, and for some transactions related to loans. Fannie Mae will record an estimated $9 billion loss in the 3rd quarter of 2004. That represents about 40% of the companies equity.

As they finance one of every five homes in the U.S., loan financing could become a problem in future months. The fall-out could also embrace both Freddie Mac and Farmer Mac and make the Savings and Loan bail-out look minor.

Besides the accounting problems cited in the SEC report, the low-income loan portfolio has a delinquency rate that is at all-time highs. The real question for investors in these stocks is how good are the underlying loans?

Unless you are willing to hold to maturity and don't concern yourself with receiving back inflated dollars, continue to hold bonds. Otherwise, don't.

There are always factors that could materially change markets. A major terrorist attack on U.S. soil could change the market picture and the economy quickly. If the U.S. dollar index falls below 80, the outlook for the role of the U.S. dollar as the world's reserve currency could be over.

Political tensions in the Middle East coupled with religious fanaticism throughout the Islamic world could ignite World War Four globally. As Russia flexes its new found muscle fueled by its newly found commodity wealth, look for its leaders to try to rebuild its former status in the world order. China may well try to further expand its influence area to include Taiwan and more of Southeast Asia.

If population growth in the undeveloped countries does not subside, the problem of feeding and caring for millions of destitute and illiterate people will grow.

During the next 10 years, possible trading blocs may emerge. China will dominate Asia including Japan and the Korean peninsula as well as Taiwan. The U.S. will dominate the North American continent plus Australia and New Zealand. Depending upon the outcome of the 18 elections to be held in South and Latin American in 2006, those area may or may not become part of the U.S. trading bloc. Russia will dominate Europe and its former satellites with the exception of the Islamic areas. The possibility of the European Union breaking up and restructuring is a definite possibility. Great Britain, Sweden, Finland and Denmark plus Spain, Portugal and Italy could well hold the key to the existence of the European bloc. In any event expect Russia to dominate the rest of Europe because of its natural resources and energy reserves. India will probably remain a world unto itself. The Islamic Nations in the Middle East as well as the northern part of Africa will become another trading bloc. The rest of Africa will exist on the largess of the rest of the world.

Over the years, these rules have proven important.

|

Stock selection is paramount to your investment success. | |

|

Market timing can improve your returns. | |

|

Position sizing enable you to maximize returns while maintaining diversity in your portfolio. | |

|

Successful investors always adjust to the changing business and political environment. | |

|

Never add to a losing position. |

Remember that the middle 80% of a move isn't bad.

If you only consider your wealth as measured in U.S. currency, you have failed as a successful investor. The dollar has lost about 33% of its value during the past two years when measured against other currencies.

If your portfolio in U.S. dollars was up 10% each year, are you really ahead of the game?

To be a successful, long-term investor, you have to understand both the problem of inflation as well as currency fluctuations. The failure to understand this problem has reduced many fortunes to only a shadow of their original size.

Fred Richards

January 2006

Corruptisima republica plurimae leges. [The more corrupt a republic, the more laws.] -- Tacitus, Annals III 27

This issue of 'Tis Only My Opinion was

copyrighted by Adrich Corporation in 2006.

All rights reserved. Quotation with attribution is encouraged.

'Tis Only My Opinion is intended to provoke thinking, then dialogue among

our readers.

![]()

![]() 'Tis Only My Opinion! Archive Menu

'Tis Only My Opinion! Archive Menu

Last updated - July 10, 2008