Will the "Peace Protests" and the UN waffling have any effect on Bush's decision? |

|

| During February, we have seen protests erupt in the U.S.,

Europe and many other parts of the world protesting the potential war with

Iraq? The media have not done a very good job of reporting who is

behind these protests but rather portrays them as a spontaneous response

to the Bush administration's policy to enforce the latest in a long line

of resolutions about the disarmament of Iraq. You only need to ask

those protestors one question . . . "When was the last time appeasement worked?" The United Nations is on the verge of proving it is totally irrelevant by its failure to act decisively on Resolution 1441. The following cartoon is about on target as the UN has shown during the past 12 years . . .

The course of action taken by France and Germany with assistance from Russia and China was dictated by several different areas of concern.

President Bush has stated unequivocally that his administration is committed to regime change in Iraq. The leaders of many nations in the UN have little understanding of the President's resolve in this matter. The two attacks on the World Trade Center by Islamic terrorists have created a whole new ball-game as far as this administration goes. As a result, UN members have frustrated, compromised, haggled and generally done everything possible to drag out the outcome. Don't you smile when a country as inept and irrelevant as Canada comes up at the last moment with another compromise resolution and seriously believes that the US might listen. Canada can not defend itself and its armed forces are no longer allowed to sit in on joint war-games with the US. However, about the only thing that the UN wrangling has accomplished is to allow the US to put a sufficient force in place to move swiftly upon receiving the order and to place the "go order" in a good weather window for our troops. Why, if I was not quite a cynic, one might suggest that it was all planned that way. |

|

The problems arising from waiting |

|

| During the past 90 days, the US has moved thousands of

men, tons of equipment and aircraft into the theatre of operations.

Some nations have been difficult about granting the US permission to

deploy troops through their country and have resorted to demanding

blackmail payments and/or assurances about territorial concessions after

the war is over. Turkey, Jordan and Saudi Arabia are the worst

offending nations. Austria has refused to allow US tanks to move via

rail through their country from Germany. We currently have ships

near Turkey waiting to unload but those ships will probably be diverted to

other locations beginning today based upon the action of Turkey.

Rather than moving the equipment and troops through the Suez Canal, it is possible that these troops and equipment will be off-loaded in Israel and moved directly through Jordan to the front. Now that movement could create a major geopolitical realignment.

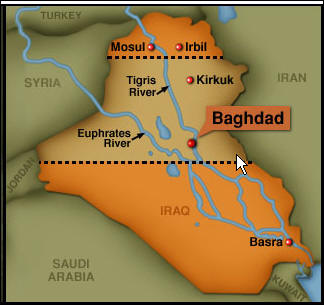

However, with a sufficient force in the field and without the prospect of a second front operating from the north out of Turkey, the forces are still available to move swiftly to a conclusion. There are currently five US aircraft carrier task forces and one British carrier in the theatre. A sixth US aircraft carrier task force is on its way and should be on station in two weeks unless it is diverted to the Korean problem. It takes about two weeks for troops from the US to get acclimated to the weather in the Mideast. As of today, the vast majority of fighting troops as opposed to support personnel have been on station for that period of time. The following map shows the major road system in Iraq.

It is my opinion that Bush will issue the order to move with or without approval from the UN. While it would be nice to have a resolution authorizing military action, Bush will not change his mind to replace Saddam Hussein and move US troops into Iraq even if the new resolution is vetoed. However, he will make sure that those vetoes are remembered. The vetoes if they occur will render the UN ineffective and possibly start the US down the path to revoking its membership in the UN. The UN will simply become a useless debating society until such time as it disappears. |

|

The changing Geo-political structure |

|

| As previously discussed in Opinion articles, the old

political alliances and free trade policies are in jeopardy. It

should be expected that after the Iraq situation is resolved that much of

the US military forces currently in Europe will either be returned to the

US or moved from Germany and Belgium. Also, it is likely that based

upon the South Korean political mess, we might withdraw our troops from

South Korea. As a result, it is possible to see the world being

realigned into new spheres of influence. The US will lead the coalition of North and South America with possible participation by Iceland, Greenland, and the British Isles along with New Zealand and Australia. China and Japan will dominate the Asian land masses including the Korea's, Siberia, Vietnam, and the Philippines. The European continent will unite Western and Eastern Europe including Russia. India may well be by itself while the Islamic nations will band together including some of the old Soviet Union states, Egypt, Malaysia, Indonesia, and other African Islamic nations. The rest of the African continent will simply continue in its rush to genocide and anarchy. Whether the rest of the world will continue to provide humanitarian aid to the sub-Saharan African nations is open to question. The half-century Israeli question will have to be solved but the cheapest solution is to move to the US and other countries of the hemisphere all of the Israeli citizens who want to come. This course of action would require a major shift on the part of the Israeli's but it would remove a centuries old thorn from the Mideastern equation. You may be wondering why? First, the US will have to cut its defense expenditures to meet the new fiscal reality. The cost of being the world's policeman is too expensive. Second, the demographics of world population and religious preference will dictate that subversion by immigration be curtailed. |

|

What's causing the dollar to fall? |

|

The US dollar has been under pressure since January 2002 when the trade weighted index peaked at about 120. Recently, it has fallen below 100 which amounts to about a 17% decline in the US dollar during the past 14 months. During the past six weeks, the US dollar index has been fluctuating in a very narrow trading range. It is my expectation that it will fall out of this trading range in March and a quick move to the 96 area is possible. It would not surprise me to see this index in the low 90's before the end of the year if not sooner.

There are a number of factors which impact the value of the US dollar.

During recent months, many Middle Eastern nations have initiated programs and/or policies to reduce their reliance upon the US dollar as a trading mechanism. Several Islamic nations have begun settling international trades in gold rather than the US dollar. Discussions continue among the oil-producing nations to settle oil sales in gold and/or Euro's rather than US dollars. A reduction of the US dollar role in international trade can only have a negative effect upon the value of the dollar. Our trade deficit continued to increase in 2002 to a record $435 Billion.

Agricultural interests as well as the few manufacturing companies still in business in the US understand that a falling dollar should improve export demand for their products. However, as quality picks up throughout the world and with a significant amount of trade restricted by political considerations, the impact of a falling US dollar on exports is unclear. Until the US government undertakes a major foreign trade initiative and takes steps to allow manufacturing companies to compete, it is doubtful whether export growth will provide the impetus to turn the US economy around. |

|

Government statistics fail to show realistic numbers. |

|

| Seasonal, hedonistic and productivity adjustments are used

to massage the federal governments statistics to hide the real state of

affairs from a public that only listens to 5 second sound bites.

Analysis of the raw data often shows a significantly different picture

from what the spin-doctors spout. Alan Greenspan continues to harp on productivity increases as showing that the economy is not in trouble. Changing the cost-of-living parameters nine times since 1996 has reduced the inflation rate. Washington and the Fed continue to assert that there is no inflation, or not much, in the US economy. Just who are they kidding. Commodity prices have been steadily rising for months. In fact the CRB index chart is one of the most steadily relentlessly upward moving charts as shown below.

By massaging the numbers lower on inflation, the cost-of-living increases for social security and many other costs can be kept down. The social security increase last year was just 1.3% according to the US government. But ask any senior citizen or housewife if that reflects the real world and the answer will be a resounding "No!" However, the rise in commodity prices reflects the real world. Inflation is already here . . . even if the statisticians do their magic act. An economy with retail sales flat or declining, increasing costs and low pricing power (that about describes the US economy today) can only do so much financial engineering in order to increase profits. With sales stagnant, costs increasing, corporate profits continue under pressure. Corporate profits are the live-blood of the Wall St. markets. With valuations currently high by historic standards and the outlook for the future either flat or declining, only hype will propel rallies in this secular bear market which has now lasted 3 years. |

|

The Estrada nomination |

|

|

The Democratic leadership in the Senate is attempting to change the constitution by failing to allow the Estrada nomination to come to the floor for a vote. Perhaps, you can find for me in the US Constitution the passage that says that 60 Senators are required to allow a vote on a nomination. As the drama unfolds during each boring hour on the Senate floor, one gets the sense in talking with the Latino voters here in Texas that they are not taking the filibuster graciously. In fact, the longer the filibuster goes on, the more Latino voters are looking to other parties for their voting cues. However, if the Republican leadership allows a cloture rule to be voted upon by the Senate prior to having sufficient votes in hand to winning that vote, both the Republican base as well as the Latino base will become energized and the 2004 elections could be very interesting. Majority leader Bill Frist needs to attack the filibuster with blunt force. He should call the Senate into session 24 hours a day, 7 days a week and bring cots to the Senate floor until the Democratic leadership cries "Uncle." If the Republicans don't win this nomination and/or it is withdrawn, the President's approval rating will tank and the opportunity to increase Republican majorities in the next Congress will become doubtful. |

|

Have we seen the end of the secular bear market? |

|

In the opinion of many Wall Street gurus, the invasion of Iraq will initiate a new bull market. Quite frankly, I have my doubts. Corporate profits eventually dictate the valuation of stocks. For the past three years, these same gurus have been promising improvements sometime in the near future but have failed to deliver. Remember that Wall Street is a sales-oriented business. When was the last time a stockbroker called a client to sell a stock like Lucent at $80, Home Depot at $50, IBM at $120, or GE at $50, ad nauseum. It is very rare.

Based upon the 4th Quarter 2002 earnings reports which show about a 30% decline over the 4th Quarter of 2001, the trend of corporate profits is down. Despite a drop in the market indices, the S&P 500 is not cheap. The S&P 500 P/E ratio based upon GAPP accounting standards is about 29, or about double the long-term trend line.

Unless profits increase, there is a chance that the S&P 500 index could fall to the 400 level if the P/E ratio just returns to the mean trend line. If you read carefully the guidance numbers which have been published in the last two months, the majority of CEO's do not see major improvement in corporate profits for the next few quarters at a minimum. In fact, a number of firms have dropped the concept of providing guidance as the crystal ball has become too cloudy. Since 2000, many firms have used financial engineering to make improve profits levels. Layoffs, downsizing, sending production off-shore to obtain lower costs and selling assets are some of the techniques used to obfuscate the corporate profit picture. However, these financial engineering techniques can not overcome the basic problem facing the US economy . . . a lack of robust GDP growth in real, non-inflationary terms. Until either corporate profits increase or price/earnings ratios return back to long-term trend lines or below, this market is vulnerable to further decline. |

|

Conclusion |

|

| In this era of uncertainty and partisan politics, how

should investors react? For starters, they should only be investing

in those few companies that continue to make increasing profits. Second,

they should monitor their positions frequently, if not, daily.

Third, they should have a portion of their portfolio in hard assets like

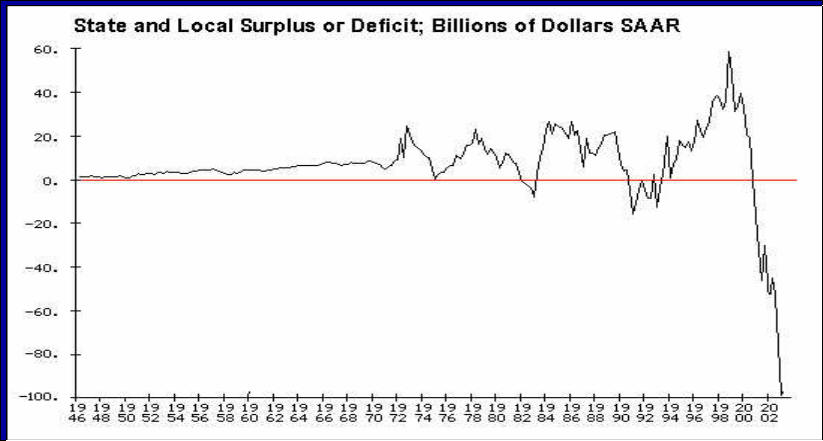

gold and silver or the equivalent. Liquidity should not be ignored. As our federal state and local minions try to continue the spending programs which they have enacted, the only response so far has been a clarion call to raise taxes. The following chart points out the extent of the problem facing just the state and local governments.

As the effects of the last three years have decreased state and local tax revenues the impact of decreased taxes has obviously taken its toll. However, rather than cutting programs, these governmental agencies have primarily resorted up to now on increasing debt levels while increasing taxes. California has probably reached the limit and is finding that many small to medium sized businesses as well as individuals are leaving the state. Only the continued influx of illegal immigrants from south of the border has let the California population increase during the past three years. If you have a choice, get liquid and don't take chances with your investment capital. No one can guarantee that an invasion of Iraq will not set off major terrorist attacks throughout the US and Europe. Are you willing to take that chance?

|

|

But then - 'Tis Only My Opinion! |

|

| Fred Richards March 2003 Corruptisima republica plurimae leges. [The more corrupt a republic, the more laws.] -- Tacitus, Annals III 27

This issue of 'Tis Only My Opinion was

copyrighted by Adrich Corporation in 2003.

Last updated - July 6, 2008

|

|