Inflation, Stagnation, Deflation . . . Where is the US Economy headed? |

|

Depending upon one's political viewpoint, you can get many different possible answers to that question. Perhaps, the best unbiased answer is to look at history to determine if they provide any direction in this modern era. Since the beginning of recorded history, every experiment with fiat currencies has ended in failure. Since the closing of the gold window by President Nixon in 1971, the value of almost every currency in the world is based upon nothing other than confidence or a perception of relative value. Until January 2002, confidence in the U.S. dollar enabled this nation to continue to run increasing trade and capital account deficits as foreign governments and investors recycled dollars back into the U.S. Historians will probably disagree as to the reason that the U.S. dollar began its retreat at that time. The following factors might have contributed to the decline:

While we won't spend a lot of time analyzing these factors, the important point is that there are many reasons for foreign investors to lose confidence in the U.S. dollar. In 2003, it requires over $1.75 B per day to fund this years trade deficit. Until 2001, foreign interests were willing to recycle their trade and capital surplus dollars back to the U.S. In 2001, net foreign capital investment to the U.S. was about $300 B and dropped last year to $30 B. There are indications that in 2003 net foreign capital investment might be negative. To offset the recycle loss, the U.S. Treasury and the Fed can only increase further the rate at which the printing presses are running. The following chart of M3 shows the explosion of M3 in recent years.

The Fed created the stock market bubble by its doubling of M3 from the 1995 period. This huge increase was at least partially responsible for the stock markets blow-off. The real problem is that this country has exported its wealth creation capabilities off-shore. While striving for lower costs, managements and trade policy writers failed to see that the long-term result would be a lowering of the standard of living for U.S. citizens. In the past 24 months, we have exported 2.4 million high-paying manufacturing jobs overseas. When a GM welder loses his $20/hour plus benefits job, he rarely finds one at nearly the same level. The free-trade policy coupled with a short-term profit horizon has led many U.S. multi-national corporations to make decisions which have devastated the U.S. manufacturing base in the quest for lower costs. While a lower dollar is expected to help a few industries to export more goods and/or services, the end-result can only be a lowering of the U.S. standard of living. The premise that we will export more products overseas is false. For example, if a worker in India only gets $1 per hour, can they still buy U.S. products. It is highly doubtful.

|

|

Is the Japanese scenario a road map for the U.S.? |

|

There are some similarities between the Japan experience of the past 12 or 13 years and the U.S. as well as many differences. Perhaps, to me, the major difference lies in the fact that Japan is the world's largest creditor while the U.S. is the world's largest debtor. In fact, if it was not for the U.S. Treasury's ability to sell governments to the Japanese, the U.S. house of cards might already have imploded. One of the best discussions of the problems facing Japan that I have read recently is a book by Akio Mikuni and R. Taggart Murphy entitled "Japan's Policy Trap: Dollars, Deflation, and the Crisis of Japanese Finance." They try to answer to the following question, "Why has Japan been in the doldrums since 1990 despite interest rate cuts, easy money, and fiscal pump priming?" Of course, many economists and analysts in the U.S. are now trying to answer the same question relative to the U.S. economy. The authors suggest that Japan has a facade of political democracy but is not a market economy. During my years in the import/export business, the driving force behind the Japanese economy was not a desire to seek or even obtain profits but it was to build market share exclusively. Since profits were not important, the Ministry of Finance had a single goal: accumulating production capacity far in excess of domestic needs in order to promote exports and acquire claims on foreign countries. Achieving this goal required the suppression of the yen's value. The motive behind the policy was to ensure the survival of the elite and their continued control of key economic and political levers and following the loss of face in WWII, reducing foreign domination to manageable levels. Japan has been very successful in implementing this goal. However, the foreign claims that it has achieved from its trade surpluses are held in fiat dollars on deposit in American banks. Hence, Japan is at the mercy of the U.S. dollar and the dollar has lost 75% of its purchasing power since 1973. As a result, geo-political forces make the Japanese credits vulnerable being held in a fiat currency. The Ministry of Finance has refused to permit the floating exchange rate to function properly since 1973. If it had, Japan would have converted the dollars to yen and imported more goods and services. By failing to allow the yen to appreciate, the U.S. escaped the discipline of external deficits. Now Japan can not monetize its huge dollar holdings because they far exceed the need for yen domestically. This is the policy trap in which Japan now resides and has produced the deflation scenario. In the late 1980's. the Ministry of Finance expanded credit that exceeded the expansion of the real economy in a failed attempt to break out of the yen/dollar policy trap. That credit fed the equity and real estate bubbles which have basically brought the country's largest banks to the point of failure through the accumulated bad loans. Last week, the Ministry of Finance authorized a $17.5 bailout of Resona, the 5th largest bank in Japan. Today, Mitsui is rumored to be on the verge of bankruptcy. During the past five years, the government has attempt to increase public works spending to no avail. A large percentage of this money has simply been put on deposit rather than being spent. So far, in 2003, the Bank of Japan is reported to have spent over $45 Billion to prevent the yen from rising against the dollar. The dollar's fall against the yen is about the lowest of any currency in the world.

|

|

The U.S. dollar crisis won't go away! |

|

| The following chart shows the relationship between the

Euro and the US $ for the same period.

China has been the big winner during the same period relative to the U.S. dollar by tying the renminbi to the U.S. dollar.

By keeping the renminbi tied to the dollar, the Chinese are able to export their deflation to the U.S. while keeping their factories employed. Of course, they are now facing some of the same problems confronting Japan . . . their banking system is largely under-water from bad loans. However, the primary motive, once again, is to keep their citizens gainfully employed and to protect the elite of the Communist party from the discipline of the market place. However, unlike the Japanese, the Chinese have begun a deliberate move to reduce their foreign currency reserves which largely consisted of U.S. dollars until six months ago when they undertook to move 25% into Euro's and 15% into Gold in the near term. There is some indication that unless the renminbi is untied, the U.S.'s largest creditor may become China rather than Japan. Now that is a geo-political lever! |

|

Since January 2002, the U.S. trade-weighted dollar has dropped about 24% |

|

If you were a foreign investor and/or government and had assets in the U.S., how would you fell if you had lost 24% of your investment dollars. The record low interest rates which you received on your bond portfolio also were giving you concern. How would you protect your investment capital? That's right, you would sell them and take the money somewhere else. The following chart of the U.S. trade-weighted dollar indicates the seriousness of the problem.

If the 92 level doesn't hold, and based upon action this week, it appears doubtful, the dollar could be headed to the 80 level despite the threat of IMF and Central Bank intervention. A few months ago, we suggested that if the dollar broke the 102 level, it might take six months to get to the 92 level. It only took six weeks. Hence, I am hesitant to make any further predictions about the speed which the fiat currencies can fall. For that is what the U.S. dollar has become . . . a fiat currency whose value is based strictly on confidence in its value. For many reasons, the U.S. dollar and by implication, its economy have lost value in the eyes of foreign investors.

|

|

Is there a historical relationship between the value of the dollar and gold? |

|

|

Over many decades, there has been an inverse relationship between gold and the value of the U.S. dollar.

Chart courtesy of Goldsheet Mining Since the U.S. trade-weighted dollar can hide the relationship of gold with other currencies, the following chart shows the movement of gold versus our major trading currencies. As the dollar has fallen in value, gold has risen significantly more percentage-wise than against the yen, Euro and Swiss franc.

Chart courtesy of World Gold Council

|

|

What will be the reaction of gold to the dollar falling? |

|

|

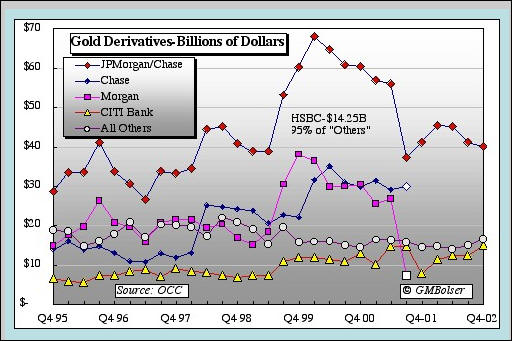

As the value of the dollar continues to slide, the historical relationship between gold and the U.S. would indicate that the price of gold in U.S. dollars should increase. But whether that will happen simultaneously or not is questionable. As the gold derivative crisis intensifies, the financial system stress increases and the Central Banks including the Federal Reserve and the bullion banks with huge stakes in the fiat currency game are certain to use every method at their disposal to try to contain the risks to the world financial system. Efforts to bring more transparency to the derivative markets have been meet with resistance. However, Easy Al recently admitted that the derivative markets were a concern to the Fed. The growth of derivative paper in the banking system throughout the world and the counter-party risk potential should have old-time prudent central bankers with bad nightmares. The IMF's directives on the accounting treatment for swapped and/or leased gold would send the IMF's officers to jail under the Sorbanes-Oxley Act but since they are a quasi-governmental organization . . . it is not material. Let's look at the growth of the derivative mess for a moment. The following chart shows the derivative exposure of major U.S. banks of which JP Morgan Chase is the largest.

As of May 30, the market cap for JP Morgan Chase was only $65.6 Billion and just the gold derivative exposure was $40 Billion. And then you can add the interest rate derivative exposure which is several times the gold derivative exposure. Of course, the net derivative exposure could be less but the point is that in the case of JP Morgan Chase, the counter party risk is huge by any measure. The problem facing the Fed and the bullion banks is that the derivative bomb must be contained or the financial system will be in chaos. As a result, it should come as no surprise that the price of gold is manipulated. Recently, the intervention has caused the Fed to enter into the market via Repurchase Agreements to enable their proxies to use the index futures and options markets as the mechanisms to support both the stock markets and to contain the price of gold.

|

|

The secret weapon . . . the Fed's Repo Pool |

|

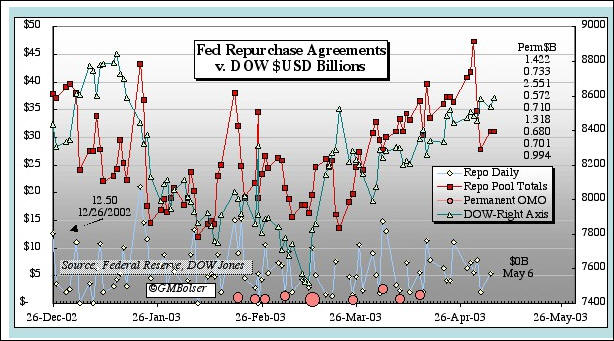

Mike Bolser has discovered an interesting relationship between the Fed's Repo Pool and the level of the Dow Jones index as shown in this chart. His article on Repurchase Agreements can be viewed here.

According to Mr. Bolser, there are several interesting patterns seen in the above chart of the RP totals and DOW.

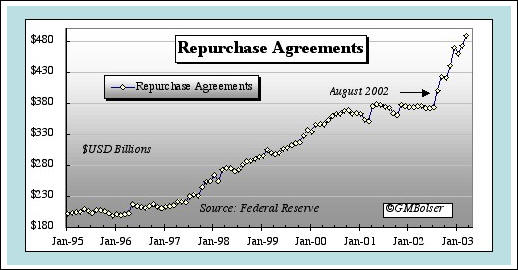

Nearly all Wall Street pundits attributed the DOW’s March 2003 gain to the “Iraq War Rally”. The above examination suggests there were also other powerful factors at work. Since 1995, the growth in the Fed's use of Repurchase Agreements has been significant and coincides with the initialization of Robert Rubin's strong dollar policy.

|

|

How should a conservative investor play this market? |

|

| History proves that no fiat currency has

survived once confidence is lost. Japan is facing a historic

decision relative to its holdings of U.S. government debt. It is

stuck between deflation at home and the fear that a rising yen will create

political unrest. Yet, by failure to reduce its holdings of U.S.

government debt, it stands to lose vast amounts of perceived wealth.

In fact, all of the U.S. creditors are facing this reality. According to Ron Linam, the world is crazy,

While that might be extreme, since January 2002, foreign investors have lost between 15 and 25% of their investment in the U.S. depending upon their home currency. American investors thus have a choice. We will see inflation at some future point. The only way to successfully hedge is to own either gold, silver, or stocks in those companies or to move U.S. funds into other currencies. |

|

Conclusion |

|

|

As the day of reckoning comes closer and the burgeoning federal, state and local debts suggest that the time frame has been reduced, a prudent investor will free up paper assets and redistribute funds into assets that will not be vulnerable but which will still be available to take advantage of investment opportunities in the future. Despite the G-8 meetings, there exists a serious distrust of American motives throughout the world. World War III has begun and it is being waged not totally on the military battlefield but on the fiscal one. It is time to understand that the world is changing, the geo-political lineup is also changing, and confidence in the U.S. dollar is faltering. Many nations including Russia, China, Malaysia, Argentina, Brazil, India and oil-rich Middle Eastern countries have already indicated that they are moving their currency reserves from U.S. dollars to gold and the Euro. Should not U.S. citizens consider the same line of defense? Because no one can really see the future . . . whether it will be inflation, stagflation, or deflation is not important. The prudent course of action is to be prepared to preserve and increase one's wealth irrespective of which one is the scenario of the future. |

|

But then - 'Tis Only My Opinion! |

|

| Fred Richards June 2003 Corruptisima republica plurimae leges. [The more corrupt a republic, the more laws.] -- Tacitus, Annals III 27

This issue of 'Tis Only My Opinion was

copyrighted by Adrich Corporation in 2003.

Last updated - July 6, 2008

|

|