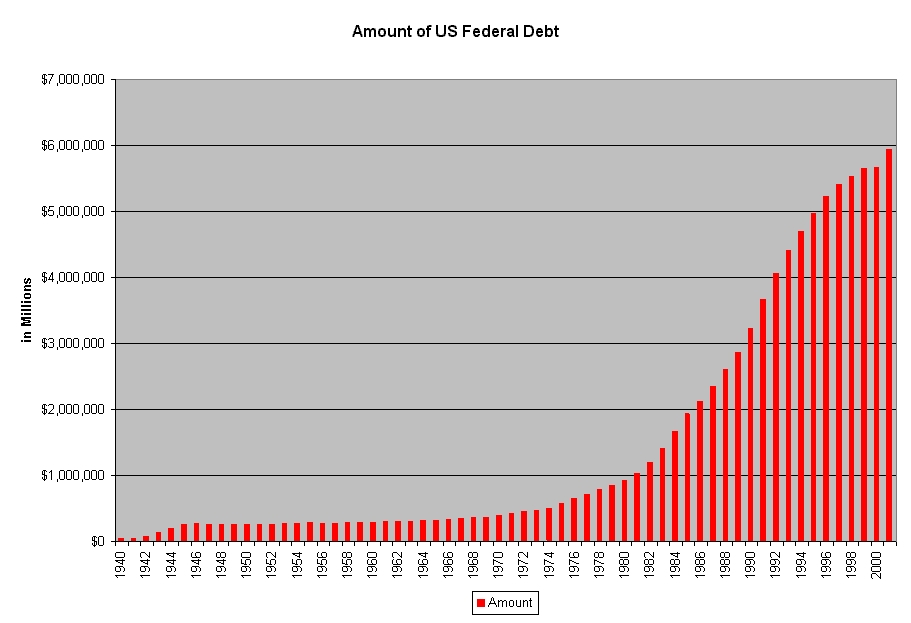

Politicians of all parties in the U.S. were responsible for the burgeoning federal debt as shown in the following graph.

Fiat money as promoted by the Federal Reserve has enabled the U.S. government debt to soar to levels which would have been thought impossible just 50 years ago. Nixon's closing of the gold window removed the final restraint on the growth of M3 and the federal debt. Policy makers could thereafter continue to inflate debt almost without any worry about the ultimate necessity to repay. Of course, at some point in the future, the jig would come crashing down but with the dollar being the sole international reserve currency, almost all governments were being swept along on the tidal way of fiat money.

The balance of payments problem is becoming serious. Despite a small dip last year because of the declining economy and a major drop in the price of oil, the balance of payments for 2001 made a small decline. However, during the first quarter of 2002, the price of oil increased as did the volume of imports as companies began rebuilding their inventories. At the moment, the 2002 balance of payments on a trade basis is headed to its highest deficit in history and some projections place the total at in excess of $475 billion.

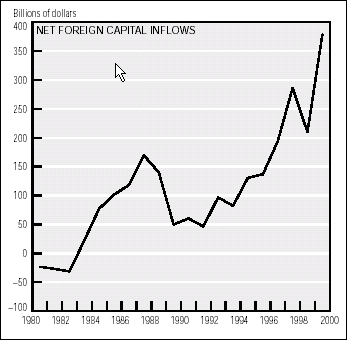

During the past three decades the U.S. has moved from being the world's largest creditor nation to the world's biggest debtor. Although the dollar has been strong for the past decade, signs are appearing that a crack is beginning to appear.

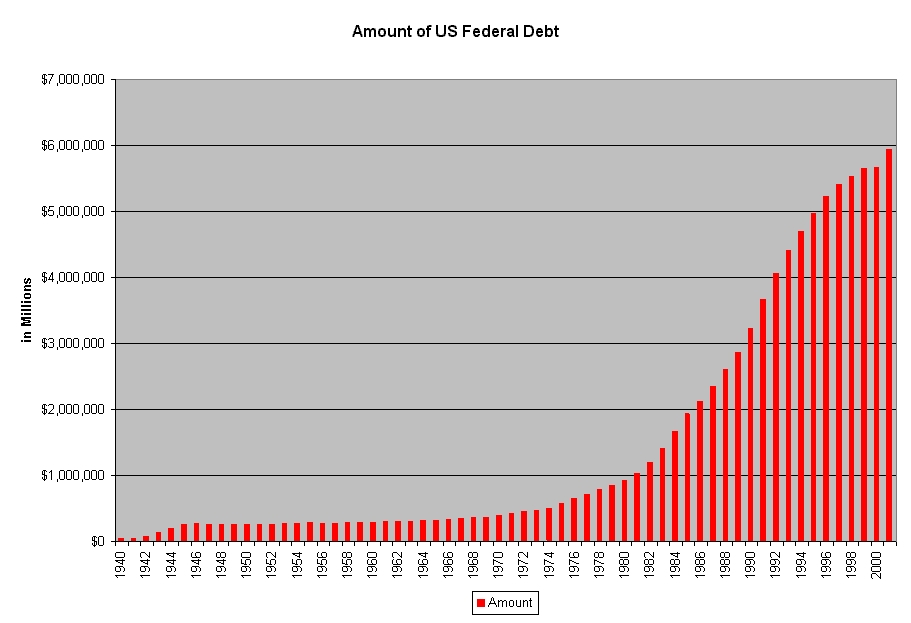

The growth in the money supply since 1995 has been extremely high in comparison to previous periods. A large portion of that growth found its way into the stock market action that culminated in the tech bubble in March 2000.

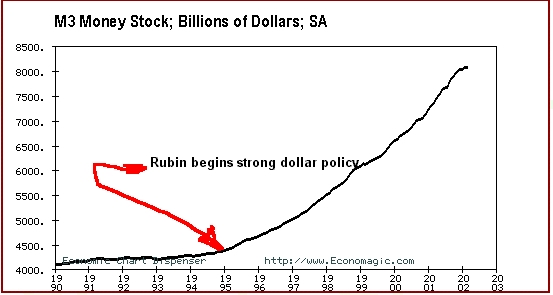

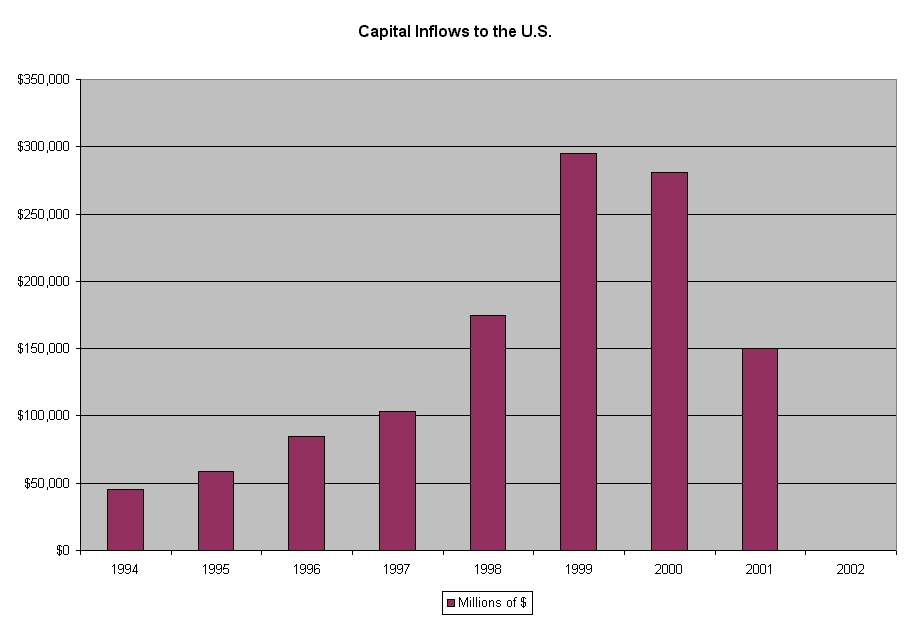

Although capital inflows to the U.S. have been increasing for years, the rate of increase changed dramatically beginning in 1995. The increase in capital inflows during the last third of the 20th century have enabled the Federal Reserve to print less money and thus, keep down inflation. I am often reminded of Ron Linam's comment that "Foreigner's are stupid. They send us their hard-asset goods and only get paper for it." I wonder at what point they will find that they have made a bad bargain.

The Clinton Administration under Robert Rubin initiated a strong dollar policy in 1995. One of the key elements of that effort was the use of the Exchange Stabilization Fund to maintain pressure on the price of gold and to encourage foreign investment capital to continue to flow into the U.S. The rising stock market which was fueled with the increases in M3 supported by the Federal Reserve as well as an open policy towards the acquisition of many U.S. corporations by foreign-owned entities saw the net capital inflows to the U.S. surge as shown in the following graph.

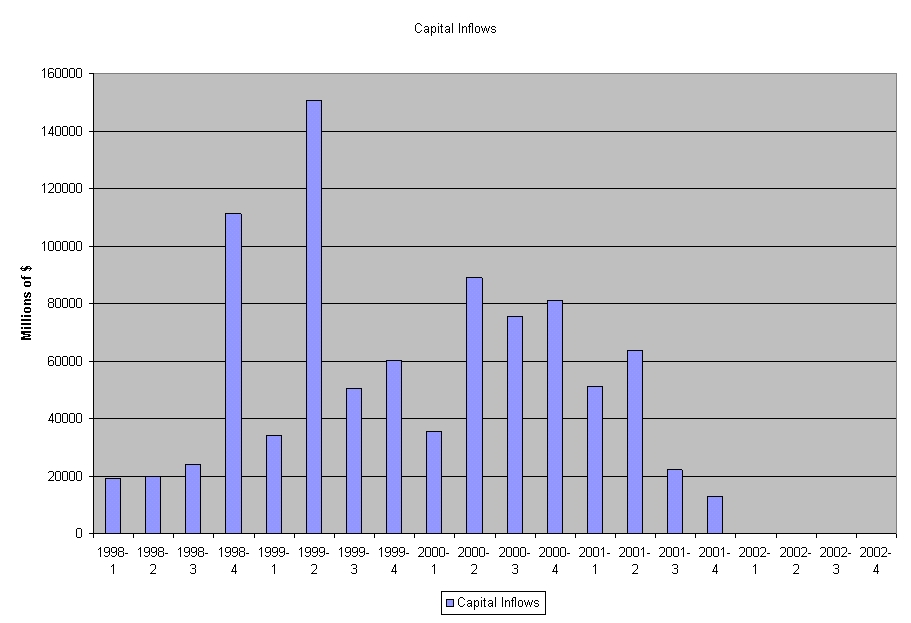

However, beginning in 2000, with the bursting of the stock market bubble, capital inflows to the U.S. have fallen on a quarterly basis as shown in the following chart.

As the above chart clearly shows, capital inflows on a quarterly basis have been trending down at a significant rate since the 1st quarter of 2000. This deterioration in capital inflows speaks clearly to the risks facing the Federal Reserve as it attempts to implement further monetary and fiscal policy in the U.S.

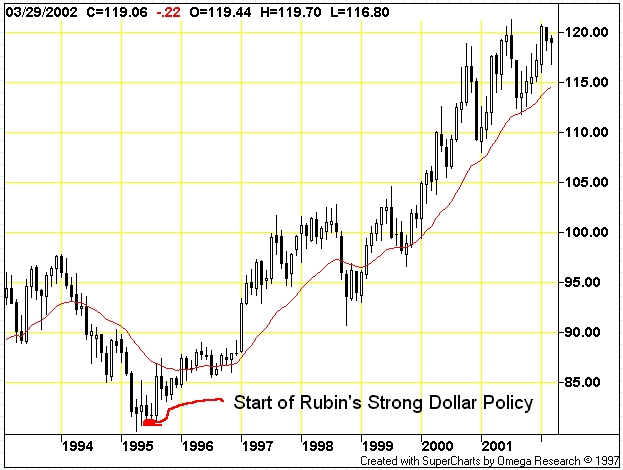

Rubin's strong dollar policy did cause the dollar to rise in relation to other currency. But for every action, there is a reaction. The reaction was the drop in U.S. exports both in manufactured goods and in agricultural products and a significant increase in the number of U.S. companies that found themselves controlled by foreign interests. Hardly any market sector was immune from the transfer of ownership: financial companies, telecom, electronics, apparel, semi-conductors, automobiles were all absorbed by this phenomenon.

The strong dollar policy did keep the printing pressures from running overtime. Just imagine what M3 would have been if all those dollars had not been recycled to the U.S. At the start of Rubin's strong dollar policy, the U.S. dollar index was at about 82 and during the intervening years, the index strengthened to a peak of 122 as shown in the following chart.

The question before the house is simply this - - Where is the dollar headed?

Quite clearly, the tensions in the Middle East, the disappearance of the Federal budget surplus and the large increase in the federal spending plans, the increase in the price of gold, the rise of the Euro as a possible reserve currency, and the shrinkage in the capital inflows flowing into the U.S. have placed pressure on the dollar in recent months. The following chart shows clearly the pressure placed upon the dollar since the beginning of this year.

From a technical perspective, the action of the US Dollar index on Friday was not good as it fell into new low territory. While it is highly doubtful that the dollar will retreat to the 85 level shortly, the move of gold to new high ground should be of concern to the Federal Reserve Open Market Committee who are now between a rock and a hard place.

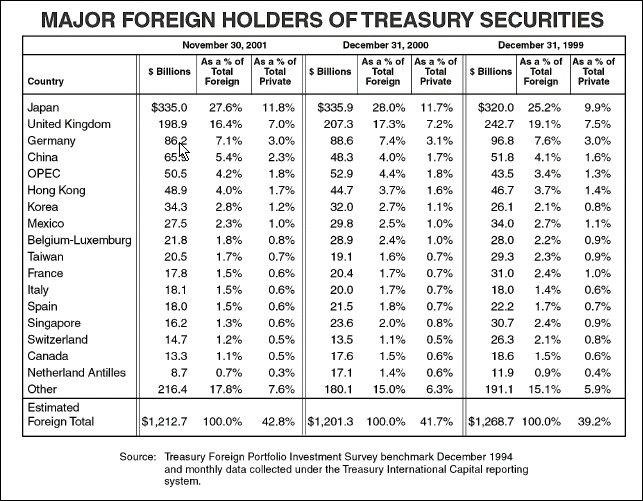

During the 1990's, the percentage of foreign-owned debt continued to rise until today over 40% of the publicly held debt is foreign-owned either by governments and/or private entities. The following chart shows the major foreign-debt holders of the $1.3 trillion of federal debt

.

The actions of the Japanese government will play a major role in determining whether a frontal attack on the U.S. dollar will occur. Japan is trying to ward off a depression and many politicians are openly talking about either cashing in the Japanese holdings of U.S. securities or, in some circles, even using that cash to purchase gold and to back the yen with gold.

The low rate of return on U.S. securities is a sore point with some Japanese politicians. If the Fed increases interest rates, it will seriously hinder the current slow recovery in the U.S. and could stop it in its tracks.

Increasing discount rates will have a disastrous effect on the earnings of the major Dow corporations who have engaged in interest rate swaps and further distress earnings levels for these corporations. Also, an increase in interest rates will further slow the sales of both new and existing homes as mortgage rates increase. The housing sector has been the star performer in the domestic sector during the past year.

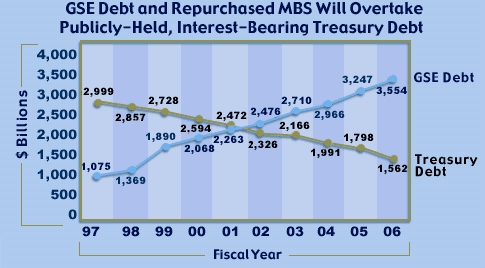

However, a far more serious threat to the financial markets is the growth of GSE debt, particularly, Fannie Mae and Freddie Mac, which have enabled the housing market to continue to show strength. Yet, the quality of the GSE portfolio is suspect with delinquencies at all-time levels and the GSE debt at all-time records. The graph showing the growth of GSE debt versus publicly-held federal debt is from President's Bush budget. Of course, the numbers after 2001 are already suspect as we are no longer expecting a surplus.

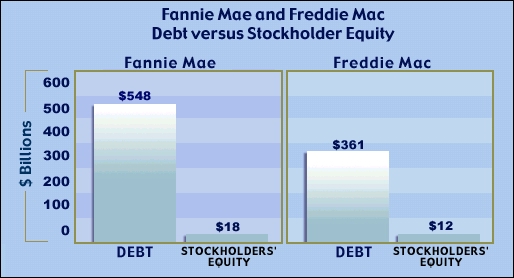

The real problem facing the GSE's is that the debt to equity ratio is over 30:1 and climbing. The GSE's have been playing the derivative game and if, interest rates increase, the losses on the portfolio will make the saving & loan debacle look like a small hiccup. One analysts suggests that the GSE losses could exceed $2.7 trillion (that's right, folks, $2.7 trillion) if the fed raises interest rates to the 4% level. There goes the federal debt again . . . up, up, and away!

How the foreign holders of debt and US currency will feel about holding on to our fiat money under that scenario could be very, very interesting.

Perhaps, they just might want something tangible other than pieces of paper or electron bytes in a computer.

If they do, the price of gold could go threw the roof and the value of the fiat dollar might end up like the German mark during the hyper-inflation period of 1920-1922.

Let's hope we can muddle through these mazes.

But then - 'Tis Only My Opinion!

Fred Richards

May 2002

Corruptisima republica plurimae leges. [The more corrupt a republic, the more laws.] -- Tacitus, Annals III 27

This

issue of 'Tis Only My Opinion was copyrighted by Adrich Corporation in

2002.

All rights reserved. Quotation with attribution is encouraged.

Tis Only My Opinion is intended to provoke thinking, then dialogue among our

readers.

![]()

![]() 'Tis Only My Opinion Archive

Menu

'Tis Only My Opinion Archive

Menu

Last updated - July 6, 2008