who saved his town by plugging a hole in a dike with his finger?

"...Any child in Holland will shudder at the thought of A LEAK IN THE DIKE! The boy understood the danger at a glance. ... Quick as a flash, he saw his duty. ... The boy clambered up the heights until he reached the hole. His chubby little finger was thrust in, almost before he knew it. The flowing was stopped! Ah! he thought, with a chuckle of boyish delight, the angry waters must stay back now! Haarlem shall not be drowned while I am here! ...

In today's world, the main character would be named Alan Greenspan! The only problem is that he only has eight fingers and two thumbs and the dike may have many more holes! But the air of optimism continues to pervade the US stock markets despite the chill of the ocean currents pounding against the dike.

During the past month, we have been treated to a number of cheerleading calls that would tend to indicate that the economy was recovering from a one quarter recession and maybe, not even that. Of course, when one takes the time to look into the numbers and strip away the seasonal adjustments and the changes in measurement, a different picture continues to emerge.

In January, the employment rate was down from 5.8% to 5.6% but conveniently, 964,000 people were mysteriously removed from the rolls of those seeking work. Of course, that is just the fudge factor as nobody really counts them, do they?

Sales of existing homes were trumpeted to be rising in January and the market boomed. Since when, does a 16.8% drop in actual unit sales year to year get reported as an increase unless the seasonal adjustments were skewed. CNBC barely mentioned that sales of new homes in January fell 14.8%. Ah, selective reporting and spin control at work again.

Do you really believe that the CPI methodology needed to be changed 9 times in the past six years? Of course, by doing so, we no longer are measuring apples but something quite different. Unreported in the housing numbers was the fact that the median house price during January increased 10.2% on a year to year basis. Yet, Greenspan et. al. try to convince the public that there is no inflation in the economy.

From Bill King's report:

"Ignored in the home sales report was existing home prices rose 10.2% y/y. Wall St. & media stooges stridently trumpet meager economic numbers, but ignore the much stronger inflation indications. The recent benign CPI was due to soft oil prices. When oil and/or food prices are rising, Wall St. shills and the media highlight ‘core’ CPI, but when core misbehaves, they ignore it and brandish CPI."

Barron's reports that Standard & Poor's have indicated that they will be changing the methods which they have historically used to calculate earnings per share for stocks. Gone are the GAP numbers, in are "pro forma" or "continuing operation" earnings. The price/earnings (p/e) ratio on the S&P 500 stood at 60. Now, S&P has HALVED the most recent S&P 500 p/e ratio. How? Simple, they changed the calculations. S&P has switched to calculating the p/e ratio on "operating earnings" rather than on GAAP (Generally Accepted Accounting Principles) which has been in use for nearly a century. When transparency and truth is needed, now we have to refigure even reported earnings to calculate year to year comparisons. From Barron's mailbag:

"The Market Week report on stock market indexes' P/Es and yields has changed the S&P 500 net earnings of $28.31 to operating earnings of $39.28. The change lowers the P/E ratio of 40.03 to a more reasonable (but still high) 28.57. The reason given for the change was that Standard and Poor's modified its reporting to use operating earnings. Standard & Poor's has been reporting operating earnings since 1988 and net earnings since 1926 and will continue to report both in the future."

From the Christian Science Monitor:

"After a decade in which the stock market became an unofficial bank vault for millions of Americans, many investors are now finding their confidence shaken by the fuzzy math of a few corporations. Everyone from the heads of major companies to cab drivers are discovering that some of the companies they are socking their savings into are using accounting devices that belong more in a Hollywood movie about con men. In response, investors are now putting more of their money into less risky investments such as homes and bonds."

Well, is it any wonder that the investors are beginning to lose faith in Wall Street?

Is it any wonder that the few of us who try to understand what is really happening have very little faith any longer in the government's propaganda numbers?

Now even Donald Rumsfeld has been forced to disband the Office of Strategic Information. It was to provide terrorist states with disinformation about the activities of our military activities in the name of truth. Does the media even have a clue? What sane person would telegraph their missions, goals and objectives to the enemy? Hence, I guess the media are insane by definition in this case. With our military budget for fighting terrorism approaching 40% of the total military spending in the world, perhaps, clarity is needed. I wonder what Fertig would have said about the Philippines guerrilla activity to the Japanese controlled press, perhaps, something like this . . ."Next Monday, we are going to strike at the communications complex in Davao at 5:45 a.m."

Hopefully, Rumsfeld will find another way to provide disinformation to the enemy. I guess the press is only concerned about truth when it hurts our efforts on fighting the war on terrorism but the truth about the economic numbers is accepted blindly and on faith.

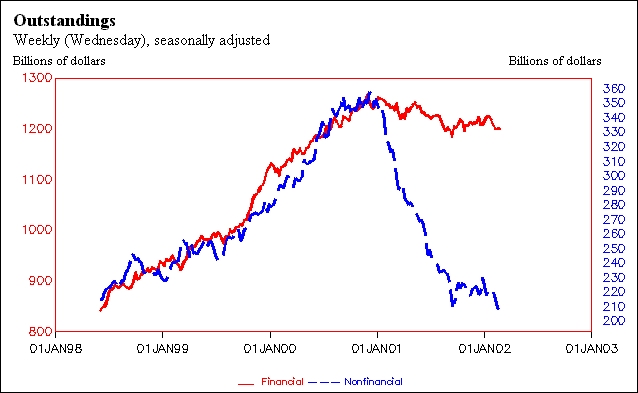

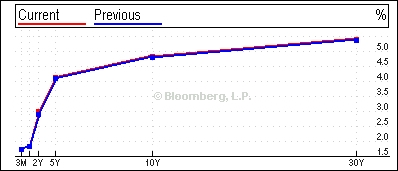

The deterioration of credit markets is amazing and rarely reported. The commercial paper market for non-financial institutions other than the top-rated firms has disappeared. The following graph as of February 27, 2002 shows the changes in vivid detail.

As companies are unable to roll over paper in this market, they have had to draw down stand-by lines of credit. The rating agencies are using the failure to issue commercial paper as a indicator to review the credit rating for these companies. As a result, many companies have seen their credit reduced to junk, or near junk, status during the past 45 days.

JP Morgan Chase is one of the largest providers of commercial paper and standby lines of credit. It is interesting to note that the reinsurance pool in London has changed the interest cost of JPM from 4th lowest to the highest cost of the 10 largest banks during the past 30 days. One bank analyst after working on the financials of JPM for a week recently on January 30th called it a $3.60 stock not a $36 stock. He was very concerned about the $27 trillion derivative exposure coupled with all the bad debt losses that were facing the bank. The chart for JPM is shown below.

While JPM is the largest derivative player, the other money center banks are also exposed. One wag noted that "JPM is too big to fail, yet too big to bail."

Our best advice to each of our readers is to take all numbers provided by the government and its proxies with a ton of salt.

WASHINGTON, Feb. 27 — Federal Reserve Chairman Alan Greenspan on Wednesday told Congress he sees signs that the U.S. economy is rising out of recession, but warned that the rebound will likely be moderate.

So there you have it, the oracle has spoken. But can we believe him? In June 1930, Herbert Hoover also said that the "recession is over." The following graph might be of interest to some of you.

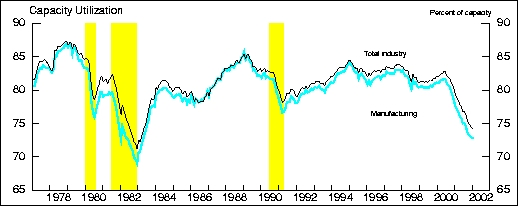

President Bush's economic advisor, Lawrence Lindsey, commented recently that the recovery would be dependent upon capital expenditures. Capacity utilization for total industry edged down 0.2 percentage point in January, to 74.2 percent, a level well below its 1967-2001 average of 81.9 percent. With current capacity utilization below 75%, it may be quite a while before capital expenditures add impetus to this economic recovery.

Moreover, the American manufacturing industry is in deep trouble thanks to our high labor costs and the rising dollar. Except in a few high tech cases American manufacturing is no longer competitive with goods manufactured in the rest of the world, where the corporations and the individuals increase their savings in order to put them to use for future development of manufacturing industry in that country.

Despite Greenspan's assurances, the rest of the world's economies are not rising out of recession. Rather, the opposite is true, they are either entering a depression scenario, e.g., Argentina, Brazil, Japan, Indonesia, or sliding further into a recession, e.g., Europe, the Middle East and the old USSR countries. Following the debacle in Argentina, the fifth government in the last 90 days is now having difficulty and plans to print more fiat currency. Seems as if the Argentine citizen has decided not to pay their taxes whether on income, property, value-added, or anything else. Tax revenues have plummeted in Argentina so fast that it should be a wake-up call to the rest of the world. In the final analysis, governments can be toppled by their constituents easily and it doesn't necessarily require weaponry. It just takes people who say "No way, Jose."

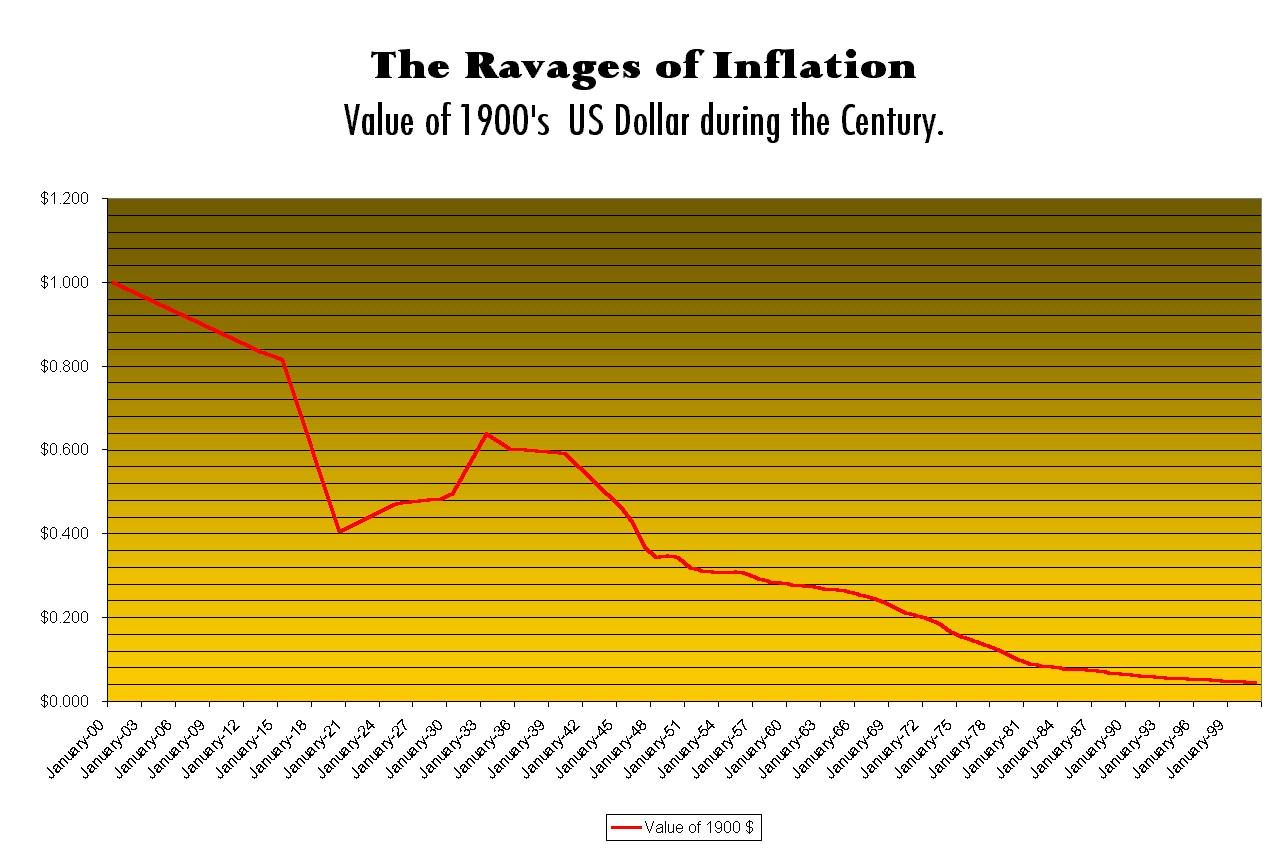

Currency devaluations continue. During the past year, Turkey, Argentina, Egypt, Brazil, Venezuela, Japan and many others have seen the value of their fiat currencies deteriorate. Finally, the Japanese housewives began to remove their savings from their failing banks and purchase gold bars. That is not a good sign for any fiat currency as when confidence begins to falter, the tsunami can pass over the dike quickly. M.A. Nystrom has succinctly developed the history of the debasement of the American dollar from the time when only the U.S. Treasury was empowered to issue coin can be seen here.

Japan's economy which is the world's second largest is stuck in a liquidity trap. It also finds that China is now undercutting its manufacturing capabilities on many products resulting in a smaller slice of the world's exports. This decline coupled with the $1.3 trillion of bad debts held by the Japanese banks has paralyzed the Japanese authorities. Unless they repatriate a substantial portion of their overseas investments, the only alternative is to print more money which will cause inflation.

As the Euro became effective, many countries are beginning to move their foreign currency reserves into either gold or the Euro. Either move will eventually cause the dollar to weaken.

The real problem for the US is that the dollar inflow from foreign countries might stop. For the past several years, the US has an annual net capital inflows from foreign countries of between $2 and $4 billion per day. From the International Forecaster's latest issue:

"Japan converted over $23.1 billion of foreign bonds, mostly U.S. Treasuries, during January 2002. They sold $23.1 billion worth, but last January they bought $107.6 billion. That's a swing of $130.7 billion and is very significant. January's sales were the biggest for any month in the past five years. Over the next six weeks we could see additional sales of $50 billion."

The risk to the dollar caused by capital outflows is huge. The following table shows the net capital inflows by quarter for the past seven quarters as reported by the U. S. Department of Commerce, Bureau of Economic Analysis.

| Year | Quarter | Net Capital Inflow in millions of $ |

| 2000 | 1st | $11,294 |

| 2nd | $12,461 | |

| 3rd | $13,080 | |

| 4th | $16,673 | |

| 2001 | 1st | $11,734 |

| 2nd | $12,038 | |

| 3rd | $12,355 |

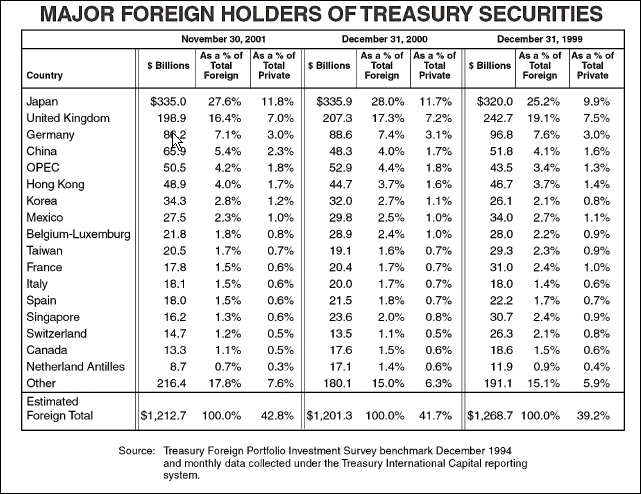

As of November 30, 2001, the U.S. Treasury provided the following statistics as to the foreign holdings of its securities. Note that the Japanese are significant holders of our debt. If to get out of their liquidity crisis, they decide to repatriate some of those holdings, the dollar will become under serious pressure.

While a falling dollar might eventually help domestic manufacturers in some areas, the financial sector could well become a disaster because of the massive derivative problem. A falling dollar would increase interest rates in the US and would also benefit the price of gold. The recent price movements in the US dollar index as shown in the chart below give me cause for concern.

The collapse of these two derivative markets could implode the major money center banks in the US. Despite the Treasury's attempt to eliminate the 30 year bond to drive down interest rates further, one look at the yield curve should give the derivative players pause.

As we have often stated, JP Morgan Chase is exposed to over $27 trillion in notational values in its latest Comptroller of the Currency report. Citibank, Bank of America and Goldman Sachs also have large exposures. For comparison, $27 trillion is just slightly more than the GDP of the US and certainly, in excess of JP Morgan Chase's overstated net worth. And that net worth must be shrinking considering all the losses from Enron, Golden Crossing, K-mart, Tyco, and others.

If the foreign holders of treasury securities begin to redeem or sell those securities, the Federal Reserve will be required to print more fiat money. Since 2000, the Federal Reserve has been injecting money into the system and reducing the discount rate. These huge infusions of money and lower interest rates have not been able to stop the economic slowdown although there may be some evidence to suggest that the bottom is not falling out yet.

The growth in M3 began accelerating during 1995 about the time Robert Rubin using the Exchange Stabilization Fund and in conjunction with the bullion bankers and foreign central banks began to use central bank holdings of gold to keep the gold price down. Since the March 2000 market top, the changes in M3 are historic as shown in the following chart.

While the Fed injected massive funds into the market in September following the 9-11 event, M3 has been increasing over 8% over the prior period of the previous year since 2000. The amazing thing to me is that this massive inflow of additional liquidity has not caused major price inflation yet. Remember clearly, that this is fiat money and not backed by anything other than the word of the Federal Reserve. When I asked Bob McTeer of the Dallas Federal Reserve where they had gotten the $100 - $125 billion that was injected into the system on the day after 9-11, he refused to comment. Of course, they just created it out of thin air.

Somehow, I don't think that the founding fathers would have approved. Sometimes, I think it is necessary to remind people of just what our Constitution says:

No State shall…coin Money, emit Bills of Credit, make any Thing but gold and silver Coin a Tender in Payment of Debts.

Obviously, something has changed since the Constitution was ratified. The real question is simply this: At what point in time, will the value of the American dollar become worthless. Since 1900, the value of the American dollar which was backed by gold and/or silver has depreciated to less than a plugged nickel and the dollar is no longer backed by anything other than the Federal Reserve's assurance that "This note is legal tender for all debts, public and private."

This is what fiat money and inflation has done to the value of your money. Quite a fall from grace, some would say. We have been living on our reputation as a source of value but perhaps with the rise of the Euro and the end of the Gold cartel, the bloom might be coming off the rose.

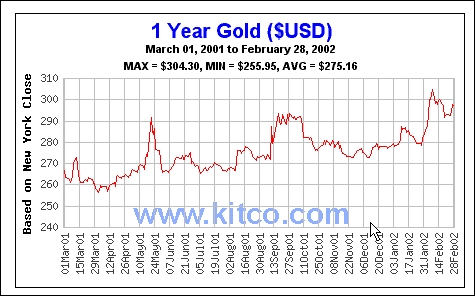

The gold market seems to have started to overcome the price manipulation activities which started in earnest in 1995. Demand is increasing, sales of central banks gold are almost finished, new mine supply is shrinking and many mines are running out of hi-grade ore. As investors lose confidence in fiat currencies, demand for the yellow metal will increase. Major resistance levels to look for are $305 per oz., $325 per oz. and $340 per oz. If these are breached, the price of gold and gold stocks could sky rocket. Shown below is 34 year Gold chart since 1968.

The action of the gold market for the past year has been most rewarding to those who have participated as shown by the following chart.

As the subscribers to our Strategic Investing website now, the gold stocks which we placed on our watch list on May 18th have outperformed the market quite handsomely.

The stocks that have under performed on the above list all had large hedging operations during the period. As of the beginning of 2002, Newmont and AngloGold have indicated that they are in the process of reducing their hedge positions.

The Fed, the CNBC crowd and all the economists who advise the Wall Street crowd say yes. However, for me, there are many waves out there that could swamp the recovery boat and the Japanese economic problem is just one. I wonder if we will point to the headline in today's Dallas Morning News as another great misstatement . . .

Now don't get me wrong . . . but it is going to take more than words to make it happen. Until we see real improvement and capital spending on things other than military and infrastructure projects occur, I would be very, very cautious.

Jim Nantz has revised the original story of the Dutch Boy updating it to the reality of today.

But then - 'Tis Only My Opinion!

Fred Richards

March 2002

Corruptisima republica plurimae leges. [The more corrupt a republic, the more laws.] -- Tacitus, Annals III 27

This issue of 'Tis Only My Opinion was copyrighted by Adrich Corporation in March 2002.

All rights reserved. Quotation with attribution is encouraged.

Tis Only My Opinion is intended to provoke thinking, then dialogue among our readers.

![]()

![]() 'Tis Only My Opinion Archive Menu

'Tis Only My Opinion Archive Menu

Last updated - July 6, 2008