The question before the reader is whether we are in a bear market rally or has the economy begun the recovery which many economists and financial guru's predicted would begin in the 2nd Q 2001, the 3rd Q 2001, or the 4th Q 2001. During October, many economists and Wall Street analysts were suggesting that the economy would now recover in the 2nd half of 2002. However, last week, a few on CNBC were reading tea leaves that suggested that the economic recovery in the US might begin as early as March 2002. Since the 9-11 tragedy, the market has climbed significantly from the bottoms made the week following that event.

That reminds me that we must be cognizant of the level of training our current Wall Street analysts enjoy.

We begin our review of the past year and our expectations for the future with the following homework assignment for our readers.

Many guru's simply point out that the economy has fallen so far down and that inventories have decreased that with the stimulus package (oops, Daschle and the Senate democrats forgot to pass the stimulus package) and low interest rates (failed to work for Japan) coupled with increases in government spending programs (and you can bet that pork barrel spending will happen), the market has to recover.

Sometimes it is helpful to look at historical statistics in order to put today in perspective. On Sunday, I listened to a relatively young preacher talk about how terrible the events of 9-11 were and how the lives of everyone had been changed forever. To that young preacher without a view of history, perhaps, it was. But to those of us who had lived through WWI, WWII, and lived with the nuclear bomb feelings of the 1950's, the events of 9-11, while certainly difficult, did not have the greatest impact on our lives and fears. It is a terrible thing when a nation and its people lose their historical perspective.

So please forgive me if during this Opinion article, I add a little historical perspective to the discourse.

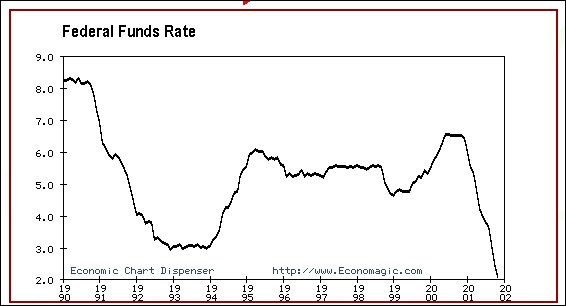

In the early 1990's, the Federal Reserve also cut the rates from 8.25% down to the 3% level and then ramped them up again beginning in 1994. Sometimes, I wonder what would have happened if John Maynard Keynes had not lived. Would we have a much more robust economy?

One of the major problems facing any business is the uncertainty caused by changes in interest rates which can quickly cause long-term investments to lose their economic returns. Hence, rather than planning on the long-term, many businesses and investors including financial analysts have adopted a short-term approach to investing. As a result, we have today a stock market that swings wildly over a few cents difference in a stock's earnings performance.

Since December 2000, the only difference in the Fed's reaction to the economic downturn is that it has cut more times and quicker than during the previous downturn. And despite all the cuts, the economy is now officially in a recession! In December, the Fed lowered the rate to 1.75% and the economy continues its downward spiral.

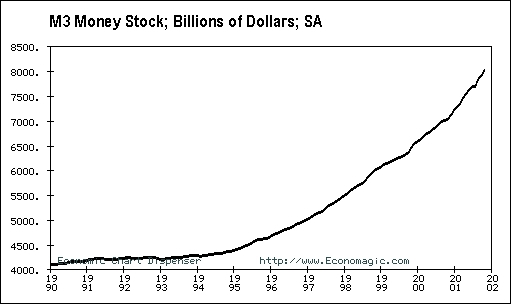

The Federal Reserve also can impact the money supply in an attempt to stimulate or cool down an economy. The following chart shows the growth in the M3, the broadest measure of the money supply. Please note the increasing slope since 1995.

During the past year, growth in M3 has risen at rates never before seen in history. The economy is awash in money yet capital spending continues in the doldrums. In the most recent report, M3 exceeded the $8 trillion level. In the last two years, M3 has increased from about $6.5 trillion to $8.0 trillion, or an increase of about 25%!

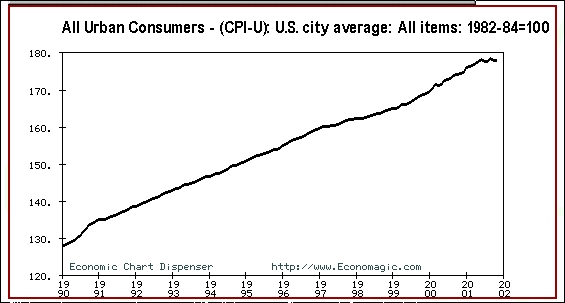

The amazing thing to me is that so far the cost of living has not been materially impacted. But whether that is because of the way the numbers are being massaged (Hedonic Quality Adjustments for the statistically minded reader) or not is still open to question. My wife reports that the cost of almost everything in the grocery stores are increasing. However, the drop in oil and natural gas prices during 2001 has provided a positive improvement to the cost of living numbers.

But since we are now in a recession, a recovery is imminent, isn't it?

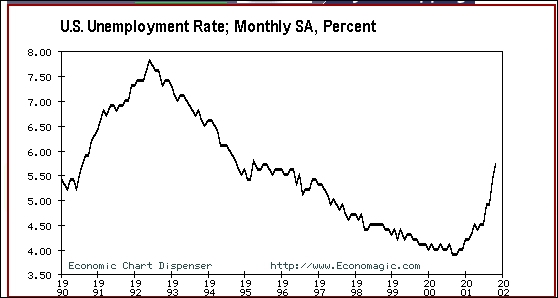

Wall Street guru's and liberal economist cite as proof of a turnaround the reduction in initial jobless claims and a decrease in the number of people collecting unemployment (completely ignoring the fact that most unemployment benefits terminate after 13 or 26 weeks). Of course, the unemployment rate is a lagging indicator. In November 2001, the unemployment rate had increased to 5.7%. Over 1.2 million jobs had been lost this year and many of those were high-paying technical, professional and middle-management positions.

There are several analysts who don't believe any of the numbers coming out of the government and who think that the US unemployment rate is probably around 8% now. Seems as if the BLS is adding 360,000 jobs per month to the self-employment category as an estimate (another of those hedonic quality adjustments).

When you look at the companies that have made major job cuts, you find that a significant number of those companies are foreign-owned. Anyone want to bet that any recovery will find jobs being offered to their citizens before an upturn occurs in the US.

Wall Street and the federal governments proposed stimulus package is designed to increase capital spending. Low interest rates coupled with government spending on pork barrel projects should stimulate increased capital spending according to the politicians (oops, lawyers without any understanding of true business knowledge) in Congress (overlooking the fact that most industries are operating way below 80% capacity and several are below 65%). On average, capacity utilization is at the lowest level in decades at under 74%. But, perhaps, there are other factors at work preventing a recovery.

In fact, one well-known economist from a university situated on the banks of the Charles River stated,

"Since we now have an official recession, it is only a matter of time before the economy will recover."

It is interesting that the economist forgot to indicate how much time it would take!

THE IBD/TOPP poll contained in the December 31, 2001 issue of the Investor's Business Daily shows that the months of gloom are lifting as faith in the President and war successes lift hopes.

But that is exactly what it is . . . faith and not facts. The citizenry is still optimistic that the success in fighting terrorism (despite the erosion of civil rights fought for by our ancestors) will spill over into the economy.

The Conference Board's December 28th report showed a jump to 93.7 from 84.0 in consumer confidence thus reversing a four month slide. But the following chart tells the real story . . . at 93.7, it may be up but it still has a long way to go! But the spinners will tell you how positive the numbers are.

The housing industry fueled by no down-payment loans and low mortgage rates has been the bell-weather of the economy during 2001. The housing market has been fueled by the refinancing frenzy as well as new construction. But with long-term rates beginning to move higher despite the U.S. Treasury's attempt to drive down long-term rates, it is questionable if the housing industry will continue to make the same impact on the economy in 2002.

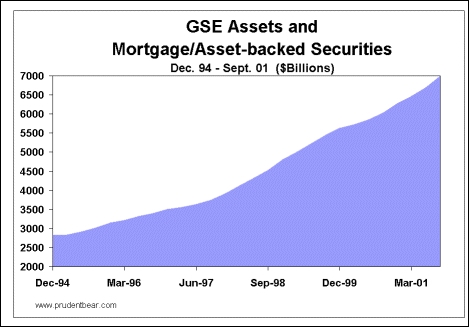

However, no one is really discussing the continuing rise in delinquencies on mortgage payments of the GSE's, e.g., Fannie Mae, Freddie Mac and the Federal Land Bank, which are making all-time records each month. These GSE's are the Federal government's version of another Enron disaster in the making but the exposure is magnitudes greater. Enron was a major disaster for the US financial sector but consider the impact of a default in GSE assets which are now approaching $7 trillion.

The delinquency rate on Fannie Mae mortgages is approaching 4% and on the no down payment programs 12%. Last week, we learned of one unemployed couple that moved into a new home financed by the FHA with no money down and $45,000 in credit card debt. Banks are tightening up their credit requirements for almost every business but is the government? I expect that the delinquency rate on the GSE's will continue to increase during 2002 and become a major problem for the taxpayer.

Credit card debt delinquencies are also rising. Some credit card companies that issue cards to the lower-rated consumers are reporting delinquency rates in excess of 10%.From the International Forecaster's latest issue,

Spiegel, the Catalog Company, and retailer that operates the Eddie Bauer stores had losses of 20% in November, up from 16% in September on its credit card portfolio. Most credit card companies have losses of 5-10%.

The refinancing cycle caused by the lowered interest rates has enabled many to reduce their equity in their homes and pay off some of the credit card debt.

John van Eck continues to worry about the interplay of consumer spending and consumer debt. From his latest treatise, he reports:

"household debt may be excessive and vulnerable to a weakening economy because household budgets are stretched so thin. Household debt was $7.6 trillion (100% of disposable income) on September 30, 2001, having risen at an average 7% annual rate since 1991. It even rose at a rate of 8.8% in the second and third quarters of 2001 after the recession began.

No one knows how long debt will grow faster than income, but a slowdown in consumer credit growth may be reached sooner than expected. Debt-servicing costs as a percent of disposable income have grown close to previous peak levels. Refinancing has repaired balance sheets, but they are still weak. The percent of personal savings to disposable income fell from approximately 9% in the early 1990s to last year’s record low of 1%.

If households were to scale back their borrowing and spending to a more normal level due to low confidence and rising unemployment, a prolonged recession might not be avoided."

The manufacturing sector has been in recession for 18 months. New Orders for manufactured durable goods in November, down five of the last six months, decreased $8.8 billion or 4.8 percent to $175.6 billion, the Department of Commerce, Bureau of the Census reported today. This follows a 12.5 percent October increase which benefited from the 9-11 event and the malaise caused by it Excluding transportation, new orders increased 1.1 percent. Year to date, new orders are 12.6 percent below the same period a year ago. November orders for durables ex-defense increased 2.7% continuing the October turnaround but all orders including defense were down 4.8%. However, orders in December were again down another 4.8%.

There are two major factors in my opinion as to why the dollar has increased.

First, the US was viewed as the country with the strongest economy and its currency was considered to be the major reserve currency in the world.

Second, with fiscal uncertainty facing many other currencies, prudent investors poured money into the US to offset the deterioration of their own currencies. As a result, overseas investors repatriated their excess earnings back to the US resulting in huge capital inflows which by 2001 amounted to over $2 billion per day. Without these capital inflows, the US Treasury would have a significantly different problem. At this time, foreign owned debt of the US exceeds 40% of the total.

The dollar is the world's reserve currency.

However, as the US economy enters a recession and the Euro enters the picture as another reserve currency in 2002, the situation could change. Since the Bretton Woods agreement was signed after WWII and the President Nixon closed the US gold window, the US dollar has been the only reserve currency in the world. The following graph highlights the movement of the US dollar index since August. I believe that the Euro will begin to play a major reserve role in the future and thus, the dollar support will find capital inflows declining. In fact, the $3 trillion of foreign owned debt of which Japan owns over 40% could start to be withdrawn. Any withdrawal will add to the pressures on the dollar.

Although the dollar has risen from the 113 level to the 118 level, it is now nearing the all-time record level of April 2001. With Russia, China, and Malaysia indicating that they will move a portion of their currency reserves to the Euro which is partially backed by gold, the dollar could find itself falling.

The war on terrorism has also caused the budget surplus to vanish. The federal debt ceiling is bumping against the $5.95 trillion limit and President Bush has asked Congress for an $750 Billion increase. This increase will cause certain foreign investors to reconsider the advisability of using the US as a safe haven for their funds.

Despite many requests from Congress and people outside of the federal government, the reclassification of the US gold reserves remains unexplained. Some cynics suggest that the physical US gold reserves don't even exist except as a hedge from future production of Barrick.

If the Exchange Stabilization Fund and the US Treasury have swapped out approximately 80% of the US gold reserves, the world's confidence in the dollar could disappear. Since the Federal Reserve note is not backed by anything other than confidence, does anyone dare to worry what might happen if not only foreigners but also American citizens decide to demand hard assets in exchange for "fiat money."

James Turk has studied the gold situation at length and in his essay, "The Mystery of the Disappearing SDR Certificates", published at the GATA Internet site, www.GATA.org. An SDR, which is acronym for Special Drawing Rights a.k.a. 'paper gold,' is a monetary instrument issued by the International Monetary Fund, representing special drawing rights for one 35th of an ounce of gold. At the end of 1995, the US held about 10,168 SDR's. The following table shows the changes since then:

Exchange Stabilization Fund

|

|

SDR Holdings | SDR Certificates |

| Dec 1998 | 10603 | 9200 |

| March 1999 | 9682 | 8200 |

| June 1999 | 9719 | 8200 |

| Sept 1999 | 10284 | 7200 |

| Dec 1999 | 10336 | 6200 |

| March 2000 | 10335 | 6200 |

| June 2000 | 10444 | 4200 |

| Sept 2000 | 10316 | 3200 |

| Dec 2000 | 10539 | 2200 |

Source: US Treasury Bulletin

The question is where did the SDR certificates which represent the US gold reserve disappear. If GATA is correct, then the gold market has been manipulated by the Plunge Protection Team in an effort to maintain a strong dollar. Eventually, the house of cards may fall. Reg Howe and GATA have filed a lawsuit in Federal Court in Boston and the Judge is trying to decide whether to allow discovery to proceed. The pressures on that Judge from the administration must be enormous although President Clinton, Secretary Rubin and Chairman Greenspan were probably the initiators of the scam.

For if the gold reserve is gone, the mighty dollar might become worthless paper in the eyes of the world and the strength of capital inflows which have been supporting a large portion of the federal debt financing during the last decade could dry up. Confidence is a very fragile thing and so is the perception of it...just ask the citizens of Turkey or Argentina this year! For the US, there is no IMF (thank you) to bail us out. Of course, the IMF's record is pretty bad anyway . . . just ask any country whose has received its help!

First, it was Turkey with major financial problems last year where overnight interest rates exceeded 50%. There have been problems in South Africa, Zimbabwe, Malaysia and others during the past year.

But the default of Argentina last week on $155 Billion in government bonds, the largest default in history, and its ramifications will increase the cost of all government borrowing in the future. Argentina is now four years deep in recession, with unemployment at 18 percent, tax revenues vanishing and with its credit rating ruined, Argentina will now resort to the printing press...watch for the return to hyper-inflation in Argentina. And the chaos in that country continues today as the fourth President or acting President in a week takes office. Perhaps, no one wants to be responsible for the mess caused largely by the IMF and outsiders who thought they could orchestrate the financial system.

The following quotes from the December 29th issue of World Net Daily are particularly interesting.

A year ago, a fool could see Argentina was headed for chapter 11. But Treasury Secretary Paul O'Neill, who came into office preaching the old-time religion – no more bailouts! – suffered a failure of nerve. He prodded the IMF to keep funneling money in, so Argentina could keep paying principal and interest on a soaring debt she could no longer service with her own tax revenues.

"Printing money to satisfy the popular desire for spending unmatched by taxation is a recipe for chaos," warns the Financial Times. "The new currency would then swiftly disappear into the hyper-inflationary flames." Rely upon it. For the Peronists are less concerned with chaos than victory in the March elections.

For this disaster, Argentinians are, themselves, to blame. They have repeatedly elected demagogues and wastrels who misruled and looted their nation. But the International Monetary Fund once again carries off the Oscar for Best Supporting Actor in an Emerging Market Debacle.

Argentina's is the greatest default in history – not the last. More are coming. For all that keeps this game going is a U.S. trade deficit of $450 billion and IMF and World Bank loans that shovel tens of billions of dollars abroad annually to stave off defaults.

Other nations are seriously in trouble including Brazil, South Africa, many Latin American countries and several African states. The hardest hit creditor nation of Argentina seems to be Spain which lent billions to its major trading partner.

The trade deficit for 2001 will probably fall from $430 billion to the $350 billion level. Some analysts will point out that it is improving and that the US is finally getting its act together. I submit that is false. It is essential to recognize that the U.S. trade deficit of $300 - $400 billion a year, is really a tax on the whole world, for the benefit of the U.S.

For until they demand hard assets, other countries are shipping us their goods and services and only getting back worthless paper which can be repudiated by the government at any time.

Many bankers are waiting for the next shoe to fall. Will Japan be next? Before the decade is out, Japan will default on a national debt that is already 125 percent of GDP according to a prediction from Pat Buchanan. With six of the largest Japanese banks already underwater by any definition of creditworthiness, can Japan itself not be far behind?.

J. P. Morgan Chase has a $23 trillion interest rate derivative position. J. P. Morgan Chase has lost $2.6 billion on Enron dealings(up from $200 million initially reported) and they expect to get most of it back. Do you believe that? If gold breaks out interest rate volatility will increase and Morgan could go under. If they do they will take the financial system with them. We must also consider the massive losses that will be taken by Morgan and other international banks as Argentina, South Africa and other emerging countries go bankrupt.

And the proof is not just in the demand/production statistics but in the fact that silver lease rates are exceeding 20% for one month leases. Silver has increased from the $4.00 level to the $4.50 level in less than 30 days.

Only the action of the Plunge Protection Team has prevented gold from increasing over $300 per oz. during recent months. The effort to rig interest rate markets by doing away with the 30-year has backfired. J. P. Morgan Chase has a $23 trillion interest rate derivative position. If gold breaks out interest rate volatility will increase and Morgan could go under as well as several other bullion banks including Goldman Sachs.

But the like the drunk gymnast on the balance beam in a hurricane . . . the odds are not in favor of a perfect score!

These are just some of the many unknowns:

| 1. | The impact of another major terror attack upon the US or Europe. |

| 2. | The impact of a war between Pakistan and India and the possibility of the conflict escalating into nuclear war and the entry of China on Pakistan's side. |

| 3. | The default of Brazilian and/or South African government bonds. |

| 4. | The impact of the discovery process in Reg Howe's lawsuit and the exposure of wide spread market manipulation by the federal government in both the stock and commodity markets. |

| 5. | The impact of a disastrous 4Q earnings season and a deterioration in the outlook for recovery. |

| 6. | A decision by the Japanese citizen to convert some of their yen holdings into Gold, thus, creating upward pressure on gold supplies. A de facto devaluation of the yen is currently happening as the yen has fallen from 115 to the dollar to 130 in the last two weeks. As the yen craters, the prospect for a US recovery diminishes. Other Asian countries will allow or force their currencies to decline in a spiral of competitive devaluations. They desperately need to stimulate economic growth. This cannot be spun into something beneficial for the US, no matter how ridiculous Street-shill braying gets. |

| 7. | The return of partisanship to Congress with Senator Daschle insisting that the President compromise (surrender) to the Democrat's point of view on each and every issue. Gridlock is returning to the Beltway. |

Other unknowns that will affect the future are Federal Reserve policy, U.S. foreign policy, U.S. domestic policy, European monetary policy, OPEC policy, FTC policy, foreign governments and their stability, where a war might break-out and how Congress is likely to treat a particular piece of legislation.

Bill Murphey of GATA cautions that "bankruptcies continue to rise, the savings level of the American consumer remains at historic lows, while price/earnings ratios are higher now than they were at the 2000 stock market peak."

So students, the test is in the future. The crystal ball is cloudy. For now, I believe that the major force for an upturn is the citizens faith in President Bush and that just might be enough to overcome all the other economic facts . . . I hope so!

Otherwise, we are in for a long and difficult ride wherein the September lows could very well be tested and broken and the recovery delayed for a year or more.

In this environment, prudent investors will trade cautiously and be willing to retreat to the sidelines at the drop of a hat! Don't under any scenario, invest and hold. That adage has cost people their 401(k)'s, their IRA's and their sense of well-being during the past 24 months. And don't follow the advice suggested by the following cartoon.

If you do invest, thoroughly research the company, invest only in stocks with high earnings growth and strong relative strength positions relative to the market in general and make sure to set and maintain those Action Points (known as Take Profit or Stop Loss) positions regularly. Remember that the stock market is based upon emotion and not facts but it pays to bet on well-managed growing companies and to be diligent in reviewing your stock portfolio.

We hope that faith and optimism in the current administration will overcome the fact that Christmas sales were the worst in a decade and all the other negatives facing the market.

The last 2001 issue of the Privateer summed up the situation quite nicely from my viewpoint:

Back when the U.S. huge stock markets peaked (January/March 2000), the S&P 500 also scored a record in the form of a price earnings (P/E) ratio of 35.8. Then, in October 2001, that same P/E ratio on the S&P 500 stood at 41. REAL earnings are the worst in 50 years. Put these two basic facts side by side and a solid set of conclusions follow. U.S. stock markets are more overvalued now than they were at their peak in early 2000. Earnings are non-existent. What Americans and the world are seeing in present U.S. stock markets is nothing more or less than an act of faith.

The U.S. stock market situation is a panic just waiting to happen

So get a close watch on developments in 2002 and stay safe, healthy and keep your optimism flowing for all markets present opportunities . . . the trick is to find the winners!

But then - 'Tis Only My Opinion!

Fred Richards

January 2002

Corruptisima republica plurimae leges. [The more corrupt a republic, the more laws.] -- Tacitus, Annals III 27

This issue of 'Tis Only My Opinion was copyrighted by Adrich Corporation in January 2002.

All rights reserved. Quotation with attribution is encouraged.

Tis Only My Opinion is intended to provoke thinking, then dialogue among our readers.

![]()

![]() 'Tis Only My Opinion Archive Menu

'Tis Only My Opinion Archive Menu

Last updated - July 6, 2008