As we move deeper into earnings season, the surreal becomes commonplace. And the investment community continues to spin, spin and spin. At some point, the total disaster that has befallen the American economy or faces will suddenly burst forth into the conscious of the American citizen. When (not if) that happens, things will change dramatically..

The performance of this bellwether of the computer industry and DJIA stalwart is a perfect example of today's investment climate.

Fourth Quarter 2001 revenues were off a large 11%, which wasn't expected. This is the third quarter in a row IBM has missed forecasts by massive amounts: $1.1 billion in 2001's second quarter, $700 million in the third quarter and $1.1 billion in the fourth quarter. Fourth quarter revenues were about on a par with those of the fourth quarter of 1997 when IBM sold for $53.00 a share not $105 per share.

In the environment following the Enron debacle and with Gerstner retiring, perhaps, the whispers about IBM's accounting practices will gain legs.

![]()

Bill Fleckenstein comments::

Lights Out In The Abbey In essence, what really goes on in the market today was illuminated nicely this past Saturday in Barron's Roundtable piece. None other than Abby Cohen was heard promoting the greater fool theory on the occasion of her recommendation of IBM. After another panelist pointed out its absurd valuation vis-à-vis fundamentals, she came back with, "Your points are well taken, but I would rather own IBM than some of the household products names and some of the consumer staple names that are trading at PE's that are just as high if not higher." Just in case you didn't recognize that as the greater fool theory of paying some stupid price for one stock because something else sells at an equally silly price, she amplified her view by saying, "For now, they are willing to pay for these kinds of stocks." So, you see, in the rarefied world of investment strategists, one ridiculous price justifies another ridiculous price, and one can completely overlook the fundamentals. She goes on to make the same ridiculous claim for Dell, which while its accounting isn't anywhere near as questionable as IBM's, still sells at an absurd valuation.

So would someone please tell me why the stock sells at a P/E ratio of 25 unless the investment community is wearing rose-colored glasses. Certainly, times and moods change but this is beyond the pale.

Intel is an example of a NASDAQ leader whose performance is highly weighted in both the NASDAQ and DJIA averages.

Although the market peaked in March 2000, Intel finally broke down in the 3rd quarter of the year. Although the stock has fallen from the $70 per share level to today's $30 level, the actual operating results are even worse.

![]()

With revenues off 20% from the year earlier period and earnings off 61%, how can one justify a P/E ratio of 64 for Intel in an economy which at best is going to grow slowly for the balance of the year. As the chart clearly shows, every quarter has seen decreases in both sales and earnings over the year earlier period. When will the market determine that Intel has a rocky road ahead of it. What is even worse is that the difference between the GAAP accounting numbers and those reported to their shareholders makes a mockery of "truth in accounting." Prudent investors should carefully scrutinize the balance sheet and cash flow statements of Intel before investing.

TI reported their fourth quarter results this week.

I believe that this is called putting your best foot forward! The chart shows the actual stock price action for the past year!

Look again at that headline. Now let's look at the quarterly numbers.

![]()

To state that 4Q Revenue is off 3% sequentially when it is actually 41% below the year earlier period is "spin control at its best."

Enron perhaps has made the investment community finally take notice of the accounting manipulations that have been going on. Whether the results will finally be reported correctly as opposed to aggressively still remains to be seen. William Grieder has written an excellent article in the February 4, 2002 issue of The Nation . . . "Crime in the Suites" which I commend to all my readers. Suffice it to say, that Enron, K-mart, Cisco, Microsoft, JP Morgan Chase, Citibank and others are under indictment by Grieder.

INTERNET WIRE - For the first three quarters of 2001, the one hundred companies that make up the NASDAQ 100 reported $82.3 billion in combined losses to the Securities and Exchange Commission. For the same period, these companies reported $19.1 billion in combined profits to shareholders via headline, "pro forma" earnings reports - a difference of $101.4 billion or over $1 billion per company. The five largest NASDAQ 100 companies (by market capitalization) had combined profits both on a GAAP and a pro forma basis; however, Microsoft, Intel, Cisco Systems, Oracle, and Dell reported combined real profits of $4.4 billion to the SEC, but they reported $13.4 billion headline profits to shareholders via pro forma earnings - $9.0 billion more . . . Outgoing SEC Chief Economist Lynn Turner says pro forma earnings are effectively "EBS" earnings - "Everything but the Bad Stuff."

For more information go to: http://www.smartstockinvestor.com

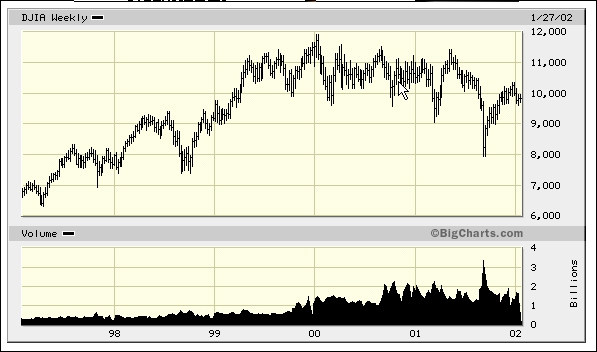

The market has climbed from the depths of its 9-11 shock but a look at the chart below shows that the trend is still probably down. Whether it tests the 8,000 level in the near future is a matter of conjecture but with the fundamentals being out-of-whack with reality, can the DJIA continue to hold a P/E of 27 which is the highest in history.

During 2001, corporate bankruptcies were beneath most investors radar screens. Yet, the number of bankruptcies and dollars lost were at an all-time high in the U.S.

Bankruptcy record set in'01

255 public US firms filed, Web site says

By Bloomberg News, 1/4/2002

"More publicly traded US companies sought bankruptcy court protection in 2001 than ever before, a Web site that tracks such filings reported. The amount of assets involved was more than double the previous record.

Last year, 255 publicly traded companies filed for bankruptcy, breaking the previous mark of 176 set in 2000, according to Boston-based BankruptcyData.com. At the height of a 1991 wave of bankruptcies, 123 public companies filed, the firm said.

Observers say the trend will continue into this year.

''We're only in the middle of this, and 2002 will have more bankruptcies than last year,'' said Barry Ridings, an investment banker and head of corporate restructuring at Lazard Freres & Co.

Bankruptcy filings generally follow the junk bond market, which peaked in the number of new issuances in 1998, said Ridings.

''There's typically a two- or three-year lag from time of issue to default,'' he said. ''They don't call them junk for nothing.''

Assets of public companies entering bankruptcy in 2001 totaled $258.5 billion, more than doubling the previous record of $94.8 billion set the year before. Before 2000, the record for assets going into bankruptcy was $93.6 billion set in 1991.

Enron Corp., which sought Chapter 11 protection on Dec. 2 with $63.3 billion in assets, was the largest-ever Chapter 11 filing. The energy trader's bankruptcy topped Texaco Inc.'s $35.9 billion Chapter 11 case filed in 1987.

After Enron, the next five largest bankruptcies in 2001 were PG&E Corp.'s Pacific Gas and Electric unit with $21.4 billion in assets; Finova Group Inc. with $14.1 billion; Reliance Group Holdings Inc. with $12.6 billion; Federal-Mogul Corp. with $10.2 billion; and Comdisco Inc. with $8.8 billion.

Overall, 45 companies with more than $1 billion in assets sought to reorganize under Chapter 11 in 2001, more than doubling the previous record of 21 a year earlier."

During the past 60 days, we have seen the Argentina default, the largest government default in history, the Enron bankruptcy (the largest corporate bankruptcy in US history), (and in January) the K-mart bankruptcy (the largest retail bankruptcy in history), and this week, the Global Crossing bankruptcy.

From the AP wire:

Hutchinson Whampoa Ltd. (H.HUW) and Singapore Technologies Telemedia Pte. Ltd. agreed to acquire a majority stake in Global Crossing for $750 million, a sum that won't go far toward paying off its $9 billion in bank debt and bonds. The deal is subject to approval by Global Crossing's creditors. The bankruptcy filing listed $22.4 billion in assets and $12.4 billion in debts, making it the fourth largest bankruptcy filing ever.

The financial devastation from these events will undoubtedly spread. As the saying goes, a billion here, a billion there and soon you are playing with real money!

Since 9-11, the yen has lost about 15% of its value against the dollar.

Since 9-11, the yen has lost about 15% of its value against the dollar. The options for the Japanese government are relatively limited today. They can not cut interest rates below 0%, their federal debt is at the highest level of GDP of any industrialized nation, and the economy is on the threshold of deflation. The problem facing Japan as well as the US Fed is on the demand side of the equation. Unfortunately, the consumer in the US is about maxed out and the savings rate is beginning to creep up . . . all bad news for a faltering economy.

The reduction of government guarantees to $75,800 in Japan on bank deposits by March is beginning to move large amounts of Japanese deposits to other countries and/or assets. Gold purchases are increasing daily according to many sources in Japan. When coupled with the decline in the yen's value, the Japanese finance ministers must be sweating as depositors pull out their assets from the banking institutions. Since the Japanese banks still have a huge overhang of bad loans to write off (estimated at $1.3 trillion), reduction of the asset base is exactly the wrong palliative.

The market moved up during the past two days of January on a couple of assumptions. One, that the TYCO management was buying their own shares (were they trying to prevent a panic), and two, that the 4th Q GDP was not as bad as expected. From the King report, we pull the following:

Nominal GDP fell .1%, the deflator (2.3 expected) was -.3%, the biggest drop since ’52. Procedure created the unexpected (fictitious) GDP gain of 0.2%. The problem is this proves price cuts are necessary to survive the decline in nominal GDP. This means no profits, which means no jobs/recovery. That’s the business reality of the numbers, and there is no benign spin for it…Government spending surged 9.2% in Q4; military spending increased 9.3%. Business investment fell 5.2%, non-residential fixed investment fell 12.8%. The trade deficit was $432.6B. Personal spending at +5.4% was the fastest rate in 2 years. This cannot continue. We may have had the bounce already. Our friend Paul notes that every recession has at least one up quarter in it.

Many of us are frankly very suspicious of any governmental data. The initial reports for the past few years have all been better than the subsequent revisions.

Remember those federal budget surpluses? Forget them, the War on Terror, Homeland Security and the President's 8% increase in the next budget have consigned them to the trash heap!

The Strategic Investors readers know that we sold all of our holdings in the model portfolios on Monday. We continue to believe that despite the best efforts of the Plunge Protection Team, the MNBC cheerleaders, and bogus government statistics, it will soon become apparent that the reality is quite different from that espoused by the spin doctors and that it will be acknowledged by the investing public.

Unfortunately, when that happens, a lot of them won't have heeded the warning signs and will find themselves with greatly reduced prospects. .

But then - 'Tis Only My Opinion!

Fred Richards

February 2002

Corruptisima republica plurimae leges. [The more corrupt a republic, the more laws.] -- Tacitus, Annals III 27

This issue of 'Tis Only My Opinion was copyrighted by Adrich Corporation in February 2002.

All rights reserved. Quotation with attribution is encouraged.

Tis Only My Opinion is intended to provoke thinking, then dialogue among our readers.

![]()

![]() 'Tis Only My Opinion Archive Menu

'Tis Only My Opinion Archive Menu

Last updated - July 6, 2008