We have heard the economists, bureaucrats, and politicians all pontificate that the recession is either over or never was! But shortly, the proof will be before us. Is the market priced correctly or are the rose-colored glasses obscuring the real world?

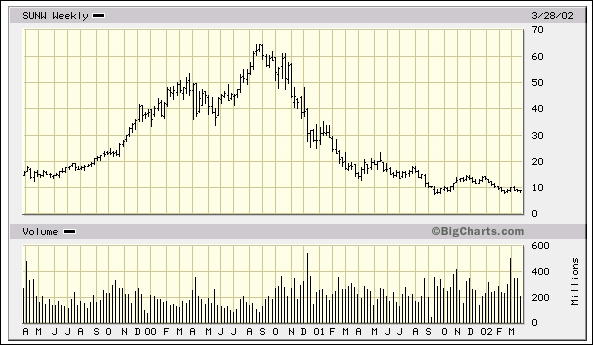

I think the following excerpts from a recent Business Week interview with Scott McNealy of Sun might be of interest:

"But two years ago, we were selling at 10 times revenues when we were at $64. At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don't need any transparency. You don't need any footnotes. What were you thinking?"

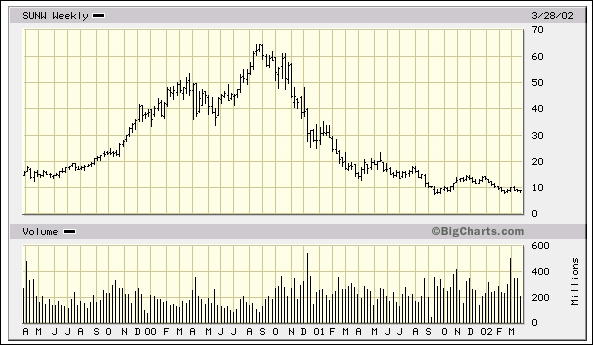

SUNW closed at $8.85 per share on 3/28/2002. And of course, the quarterly operating results indicate that SUNW may still be overvalued as it is priced at 220 times EPS based on GAPP 12 month trailing numbers as shown below. Also, note the differences between the IBD® numbers and those reported to the SEC.

| Period | Sales in millions | EPS as reported by IBD | EPS as reported to SEC | Difference in EPS |

| March 2000 | $4005 | $0.14 | $.15 | +$.01 |

| June 2000 | $5016 | $.21 | $.24 | +$.03 |

| Sept 2000 | $5045 | $.14 | $.13 | <$.01> |

| Dec 2000 | $5115 | $.14 | $.12 | <$.02> |

| March 2001 | $4095 | $.08 | $.04 | <$.04> |

| June 2001 | $3895 | $.04 | <$.02> | <$.06> |

| Sept 2001 | $2861 | <$.05> | <$.06> | <$.01> |

| Dec 2001 | $3108 | <$.03> | <$.13> | <$.10> |

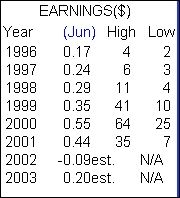

Today's valuation of SUNW considering the falloff in sales and the earnings results in any normal environment might be considered excessive. Or another way to look at the valuation of SUNW is to realize that the company is valued more than 7 times higher than the average P/E ratio for the S&P 500 index which is at or near an all-time high. Take a look at the historic P/E valuations given for SUNW from the table shown below. Even in the frothy go-go years of NASDAQ prior to March 2000, SUNW and a lot of other companies were never sold at P/E's approaching 220 times earnings.

SUNW is not the only stock in the high-tech NASDAQ which despite its fall from grace is still way over priced based upon any reasonable historic P/E and/or dividend valuation criteria.

A recent study using a screening tool at http://www.hoovers.com showed that 87 publicly traded companies were selling in excess of 50 times revenues and an additional 109 companies were selling in excess of 20 times revenues. Apparently, there is still some fluff in company valuations despite the NASDAQ decline of 60% in its valuation since March 2001.

The following graph looks at the average P/E ratio for the S&P 500 from 1954 through 2000.

The point I am trying to make you aware of is that today's stock valuations are outrageous when viewed in a historical context. The question is simply this:

Can earnings increase significantly in the near future to bail out the stock valuation or at what point will the realization begin that the market is extremely overpriced?

Despite the Enron scandal, companies will report earnings that may bear no relation at all to the SEC reported GAPP numbers. First Call admits that they are going to eliminate the charges for writing off good will in presenting the First Call earnings numbers. Moody's and Standard and Poor’s are also revising their stand on GAPP versus pro-forma earnings. Talk about apples and oranges confusing the investing public. The opportunity to obfuscate and spin the numbers on the income statement is mind-boggling to me. The old-time analysts in the New York Society of Security Analysts in the 1960’s are probably having conniptions over the reliability of accounting standards. With all the notes in the 10-K and 10-Q reports, it is becoming almost impossible to determine whether a corporation is viable.

A hundred years ago determining whether a company was profitable was relatively easy. If they paid out dividends and cash continued to increase, the company was probably making money. Today, the NASDAQ 100 report $11 Billion in profits (pro-forma) to their shareholders in 2001 and $89 billion in losses to the SEC. To me, something smells here. And that is before the adjustment for stock options is made. Microsoft's and many other high-tech companies reported profits in several recent years would have been losses if the stock options were reported under standards currently being discussed.

At the end of the first quarter 2002, the DJIA stocks were selling for an average P/E based upon GAPP earnings of 28.2 and an average Price to Book Value of 5 with an average dividend of 1.76%.A breakdown of the individual component stocks is shown in the following chart.

By any historic standard, the valuation for all three major indices, (DJIA, S&P 500, or NASDAQ) are suspect. So just what confidence can we place on earnings improving in the near-term to justify these valuations. Significantly, FirstCall reports that as of March 29, 2002, negative preannouncements were 1.6 times the number of positive preannouncements. Based upon that revelation, logic would indicate that the stock market is overpriced. But you must be careful, the stock market is also ruled by emotion and rarely facts.

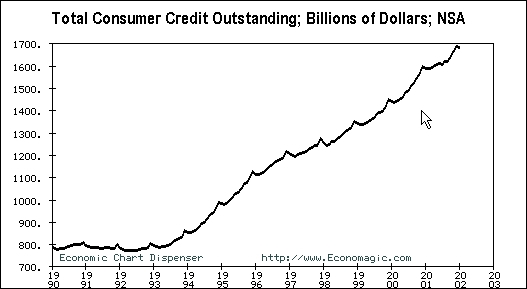

Consumer spending aided by credit card debt and low interest rates on refinancing homes have enabled consumer installment and mortgage debt to increase to all-time high levels. Since 1994, consumer debt has doubled and despite the recession, it continues to increase. The easy bankruptcy laws have made many consumers unafraid to take on additional debt despite the economy.

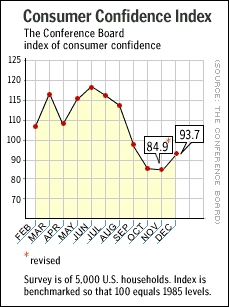

The Conference Board’s Consumer Confidence Index, after a small dip in February, surged in March. The Index climbed to 110.2 (1985=100), up from 95.0 in February. Both key barometers increased. The Present Situation Index rose from 96.4 to 111.5. The Expectations Index increased from 94.0 to 109.3.

Unleaded gasoline prices are up 20 to 30 cents per gallon in the past 45 days . . . Oops, I forgot . . . energy prices are not counted in the CPI core numbers. Of course, in May, the CPI will be revised for the 9th time in 6 years. Is it any wonder that there is no inflation reported?

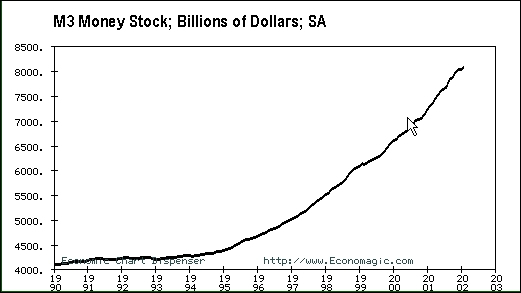

The massive infusion of funds into the economy won’t have any effect upon inflation . . . well, maybe just a little, but it is manageable according to Harvey Rosenblum of the Dallas Federal Reserve. Since 9-11, the rate of growth in M3 has been at all-time highs. But not to worry about inflation, the Federal Reserve does not see any on the horizon.

Health insurance premiums increase 18% to 25% over last year and prescription drugs are up an average of 15% over last year. But the effect on CPI is negligible because of productivity and quality improvements.

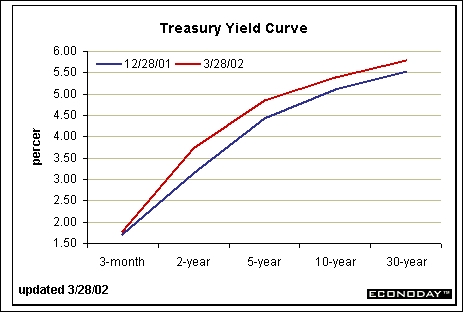

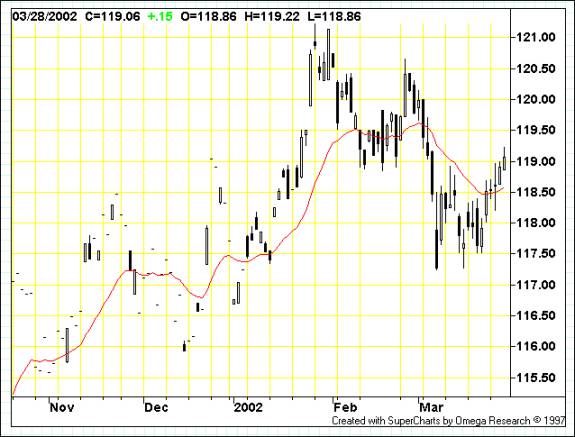

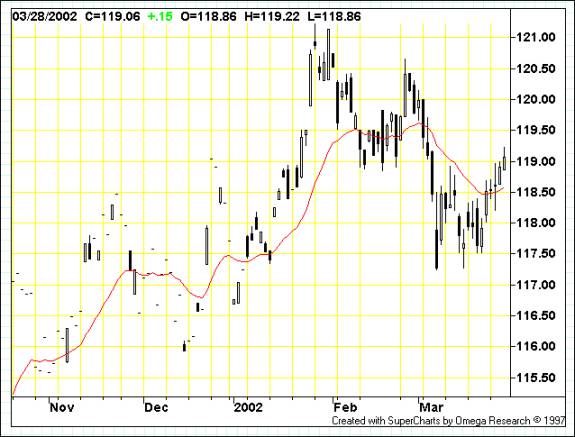

Home refinancing applications are slowing down. Mortgage interest rates are increasing. The yield curve is trending up as shown in the following graph since the beginning of the year.

The Federal Reserve has moved to a neutral position on interest rates .. that probably portends higher interest rates at the May meeting of the OMC. Fed funds futures project a 3.34% rate by yearend. That's 159 basis points above the current rate of 1.75%.

Did you look at your property tax bill this past year? Maybe the tax rate did not increase (highly doubtful) but you can bet that they increased the valuation of the property to be taxed. All the games politicians and bureaucrats pay. And what about all those tax rate changes . . . I forgot that most decreases only become effective at sometime in the future.

Lettuce is now $4.00 a head in stores and hardly worth the price. The CRB index is now moving up which historically has signaled increase inflation as shown in the following chart.

On Friday morning, the news carried accounts of the Israeli tanks entering Arafat’s compound. The Zinni mission to curtail the PLO-Israeli terror attacks is all but over.The Arab League yesterday issued a communiqué following their summit in which they might recognize the right of Israel to exist but only if all Palestine refugees were allowed to return to their so-called homeland and the Israeli’s give up all territory obtained in the various conflicts that the Arabs started. If you think any sane Israeli will agree to those conditions, you have to be smoking some strong stuff!

Sharon’s government has finally been pushed to the brink of war. They say that Arafat is a terrorist but don’t want to hurt him. Arafat is calling for peace but is willing to be a martyr for his cause . . . all the while, calling on his factions to wage further terrorist strikes against the infidels. Somehow, the quicksand is becoming deeper.

One can almost bet that the price of oil on Monday, April 1st, April Fool’s Day, will be higher than it closed on Thursday. President Bush has been trying to restrain the Israeli’s from retaliating against the increased suicide bomber attacks because of the timetable to strike Saddam Hussein and Iraq later on this summer. However, events are spinning out of control.

The Saudi government seems in jeopardy from the fundamentalist Wahhabi sect and could well be facing a major revolt from its citizens. Saudi Arabia’s dominant Wahhabi elite mission is to expunge the Islamic world of any remaining element of cultural and religious diversity. “It is a way for the Wahhabi sect to show that there is no form of Islam—on the ground, in the past, or in people’s memories—other than their own”.

U.S. forces in Saudi are now in the process of moving to bases outside the kingdom because of the bickering between the religious leaders and certain factions among the royal family. The death of King Faud could well see the beginning of a major internal conflict in the Kingdom even though he passed at the start of 1996, authority to Crown Prince Abdullah, saying he needed rest.

For many years, it has been the Saudi’s that have been building hospitals, mosques and schools throughout the world in an attempt to spread the Wahhabi doctrine. It is no surprise to many observers that the majority of the terrorists taking part in the 9-11 plane crashes were Saudi’s.

For centuries before Genghis Kahn overran Central Asia, the winning side either killed all the males or sold them into slavery. This reduced the ability of the vanquished to rise up and create problems for the conquering tribe and/or nation. However, Kahn was ruthless in his methods. Today, the winning side wants to be seen as compassionate and leaves the battlefield before the job is finished. As a result, we have the Balkan’s, the Middle East where Arafat, Hussein and Gaddafi remain in power and up to all types of mischief. President Kennedy was unwilling to allow air cover over the beaches at the Bay of Pigs so we still have Castro in Cuba. I won’t even discuss the problems in Southeast Asia nor in South America where rules of engagement prevented the military from winning the war.

The only way to fight and win a war whether it is an economic, military, or terrorist contest between sovereign nations and/or terrorist groups is “no holds barred, no sanctuary allowed and no quarter given.” Until our leaders understand that basic fact, the war on terror will not nor cannot be won.

During the past year, we have seen serious currency problems throughout the world. Turkey, Malaysia, Argentina, and Japan have all seen serious problems. As a result, many areas of the world are beginning to see a demand for non-fiat holdings. Gold, silver, land, diamonds, postage stamps, and works of art have all seen major price increases as the fear of inflation, currency devaluations, and terrorist wars become evident.

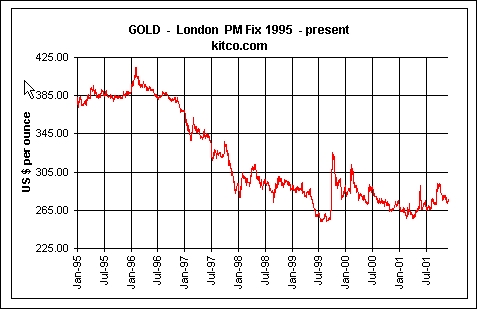

The Japanese financial year ends March 31st and many fear that the policy of marking investments in the banks to market could spell significant financial trouble for the Japanese banking system. Coupled with the reduction in the amount of deposit insurance guaranteed by the government, the demand for physical gold in Japan has been increasing. With physical gold production on the decline, an apparent shortage in gold stocks held by the Central Banks, the unwinding of hedge books by many gold producers, the stage is being set for a continued rise in the price of gold. The following chart shows the gold price trend since January 1995. Robert Rubin began the policy to strengthen the dollar in mid 1995 as capital inflows were required to offset the negative trade balance of payments. One of the cornerstones of that policy was the manipulation of the gold market and the signing of the Washington Agreement on the sale of Central Bank gold in the fall of 1999.

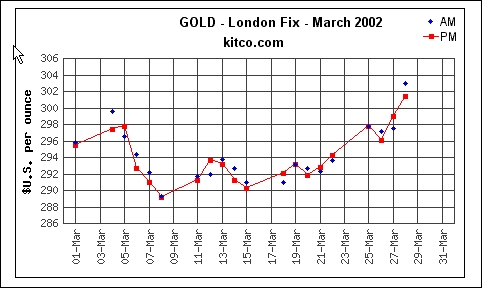

Perhaps, more telling is the price of gold during the past 30 days despite the efforts of the Central Banks and the Bullion banks to keep the price below $300 per ounce.

.

.

The $305 level is a key resistance level. If breached, the price of gold could easily move to the $345 level. James Turk's study on the disappearing SDR's from the Exchange Stabilization Fund and the reclassification of the US Treasury gold stocks indicate that the Central Banks and the Bullion banks might be caught in a massive short squeeze because of their short physical gold position as well as their exposure to the derivative price problem.

The following chart shows the increasing strength of the

dollar since 1995 when Robert Rubin began the efforts to push the price of gold

down. A strong dollar policy keeps

money flowing into the US allowing the US to continue to carry its huge balance

of payments easily. Compare the USD

chart with the price of gold above and you will see almost an inverse

relationship.

However, the price action of the US dollar index during the past month may indicate that the strong dollar policy is in trouble.

Bob Chapman in the latest

International Forecaster says,

“Unless the dollar begins its decline soon a major shift of money from the US to overseas markets is inevitable. If that happens gold will take flight. US asset prices are clearly way over valued. The dollar still trades at a 16-year high and the current account deficit is 4.5% of GDP. The dollar, now that many countries have sold off their gold reserves, accounts for 68% of global currency reserves up from 51% ten years ago. US stock valuations are at a 25-year high versus Europe and are trading at a 56% premium to emerging markets.”

“The result is that the US represents 56% of global market capitalization in spite of having lost $5 trillion in value in the tech-dot com collapse. The US markets are fortunate in as much as the rest of the worlds' market are a shambles. Irrespective the US markets will fall but foreign markets will fall further leaving the only alternatives to be gold and US government bonds and notes for long side investors. There will be special situations and you of course can go short.”

“As soon as US consumer mega consumption wanes the US economy and markets will deteriorate. The consumer markets and economy are up 281% over the past 10 years due to massive availability of money and credit. This is a recovery built on sand. The US should have stayed in recession in 1992. Returns overseas have ranged from 8-12% during that time frame. Emerging markets are again beginning to appreciate up 11.3% for the last year versus 4.1% for the DOW. For that to happen money has to be leaving the US. The equity mindset of the 1990's is fast losing its luster and risk is falling appropriately on the US. It is now only a matter of time before the US markets again correct and the last three bubbles, credit, real estate and derivatives bursts.”

Absolutely not! Do I think the economy is going up? Outside of housing which has been helped by the interest rate cuts, healthcare which is benefiting from an aging population, gaming stocks for a fast buck, and government spending on defense and terrorism items, the rest of the economy is only growing as inventory replenishment occurs.

My conclusion is simply this:

But then - 'Tis Only My Opinion!

Fred Richards

April 2002

Corruptisima republica plurimae leges. [The more corrupt a republic, the more laws.] -- Tacitus, Annals III 27

This

issue of 'Tis Only My Opinion was copyrighted by Adrich Corporation in April

2002.

All rights reserved. Quotation with attribution is encouraged.

Tis Only My Opinion is intended to provoke thinking, then dialogue among our

readers.

![]()

![]() 'Tis Only My Opinion

Archive Menu

'Tis Only My Opinion

Archive Menu

Last updated - July 3, 2008