'Tis Only My Opinion!™January 2015 - Volume 35, Number 1Outlook 2015"Beyond the Tipping Point?"The stock market in the U.S. has reached new record highs on a nominal basis as 2014 comes to a close thanks largely to low-interest rates and corporate financial engineering moves that obscure the real world. We often characterized the economy in 2014 as one of "Hope versus Reality." The Ministry of Truth changed the methodology for calculating many of its economic reports during the year so that the headline numbers for Gross Domestic Product (GDP), the Consumer Price Index (CPI) and Unemployment as reported by the Main Stream Media presented a picture of "apples vs. oranges." In a December 30th interview on Bloomberg. the former Federal Reserve Chairman Alan Greenspan acknowledged that the country was "not doing that well as we have a very sluggish economy." Greenspan cautioned that weakness in capital goods, real estate and housing mean that the economy is still under-performing. The U.S. is just "muddling-through" whereas most of the rest of the world is undergoing shrinkage in their economy including China and the emerging market countries. Much of the third-world and the Middle Eastern countries are finding that recent drops in commodity prices, including oil, copper and iron ore, have caused a major deterioration in their export revenues.

The Federal Reserve Bank's low-interest and quantitative easing policies enabled banks which were saddled since 2007 with a mountain of bad-debt and shaky derivatives to attempt to rebuild their capital positions. Unfortunately, low-interest rates decimated the earnings of savers and others who relied upon interest earnings to meet their obligations. Pension funds and insurance companies built their portfolios on a ladder of bonds. After almost eight years of relatively low returns on U.S. and corporate bond portfolios, many of these institutions are now facing major capital needs to fund the obligations to their policy-holders and pensioners. The following charts of the NASDAQ and the S&P 500 indices since 1995 show the nominal values of those indices. By looking at these charts, you might conclude that the economy and the stock-market were doing well.

However, the above charts do not reflect the loss of purchasing power caused by inflation during the past 20 years. The following chart shows the variation in the U.S. dollar index which peaked in 2001. The increase in 2014 can be attributed to the U.S. dollar's "safe-haven" status as well as comparative economic weakness throughout the rest of the world. Economic sanctions against Russia and Iran are beginning to change the playing field as countries respond.

Recently, Germany, Belgium, Saudi Arabia, China and other nations have added to their gold bullion reserves through open-market purchases or by removing bullion which had been held abroad in the U.S. and at the London bullion banks. China is now the largest gold producer in the world. Many analysts believe that China's gold holdings are significantly understated. Although the U.S. has significant reported gold bullion reserves, the last audit was conducted was in 1952 under President Dwight D. Eisenhower. A major question arises about whether any of the gold is actually owned by the U.S. Treasury. Charts of the NASDAQ and S&P 500, once deflated by the value of Gold, present a completely different picture of the health of the stock market as shown below.

Since the Bretton-Woods agreement in 1947 effectively made the U.S. dollar the world's reserve currency, the U.S. has been able to take advantage of that position to leverage its currency and world influence for over 60 years. However, with the rise in gold from $250/oz. and the growing influence of China and the emerging market countries, that position is under pressure. Here are a few points that investors should consider:

The Obama administration promised to be the "most transparent administration" ever, but has instead stone-walled investigations into dubious endeavors like the IRS's handling of 501(c3) applications, Benghazi, and undertaken policies through executive orders and memo's which clearly are in violation of the Constitution of the U.S. The fact that members of Congress acknowledge those violations by the executive branch and yet fail to take immediate action to impeach and/or indict those responsible for those violations has eroded trust in our system of government. Quite frankly, when you live in a society where only some of the laws are obeyed and others ignored, trust in the fairness of the system is eroded and agitators are quick to attempt to create further upheavals. Outside of Bernie Madoff and his conspirators, very few of the perpetrators of the fraud which caused the financial meltdown that began with Bear-Stearns in June 2007 are in jail. The robo-signing mortgage mess has created serious chain-of-title problems for the real-estate industry and yet, the big banks continue to act as if they can foreclose with impunity. Good, not excellent, customer service is no longer a requirement for the major banking companies. The 3 D's ...In the long-run, there are only three things -- the three D's -- that will determine whether this nation will survive as a democratic republic. They are simply --- Demographics, Debt and Default. DemographicsIn the recent decade, it has become obvious that our welfare system has created an under-class of citizens that are raising children without a nuclear family and that welfare in many cases has become a way of life. The U.S. birthrate has fallen below the replacement level required. see here.

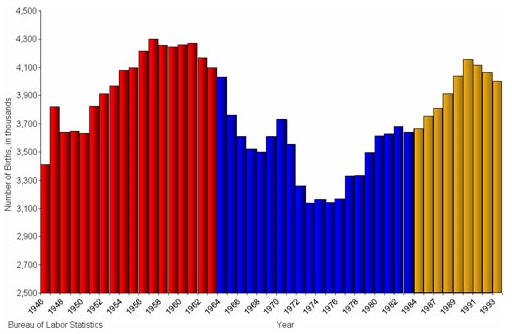

The groups that are reproducing at rates higher than the average all tend to be either among the recent immigrant (both legal and illegal) groups and those on welfare. As a result, the fabric and composition of the society are being transformed from one where exceptionalism was strived for into one which has become dependent upon the government for many of its needs. Our citizens just expect things to work and when they are broken they do not have the skills to fix the problems. It should not be a surprise that crime statistics show that a much-higher percentage of crime is committed by those living in poverty and without the benefits of a nuclear family as role-models. The ability to think critically is no longer a focus of the education system; rather the goal has become to make the students "feel good" about themselves. Many college graduates are not equipped with the skill levels and/or knowledge possessed by an eighth grade graduate in the early 1900's. Meanwhile, they graduate with high levels of debt which preclude them from marriage and/or homeownership. Moreover, the student debt which they have incurred can not be excised through bankruptcy. As the baby-boomers head into their retirement years, many are finding that savings and pension programs including social security are not sufficient, thereby placing an increasing burden upon social services. The following graph shows the ramp-up of births in the late 1940's to 1964. Beginning in 2015, those reaching the age of 65 will materially increase over the next decade.

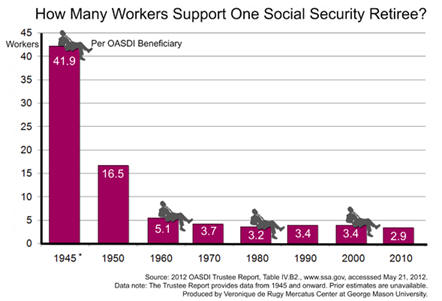

The solvency of the social security system is suspect as fewer workers have to support an increasing number of retiree's as the work-force changes along with increasing life-expectancy.

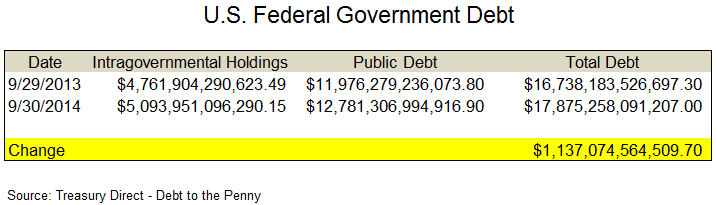

The ethnic and cultural makeup of the U.S. is being changed forever by the birthrates and immigration into the U.S Long regarded by its citizens as a "melting-pot", members of the Caucasian race will become a minority before 2043 according to recent estimates from the U.S. Census Bureau, see here. DebtA prime example of the lack of critical thinking in the US population can be found in almost any analysis of public finance. For example, in FY 2014, the federal government's deficit was only $483 billion according to the U.S. Treasury Department. The fact that during the same fiscal year the amount of the stated cash debt actually rose $1.1 trillion dollars fails to register.

Elementary accounting says that a deficit of $483 billion should increase the stated cash debt by the same amount. So what caused the $654 billion difference, or does not anyone care? Another example is the obfuscation which the U.S. government uses to hide the value of assets which it presumably holds. For instance, gold is carried on the books at a value of $42.22/oz. when the current market value is about $1,200/oz. As a result, gold is under-valued by $300 billion or almost 70% of FY 2014's deficit.

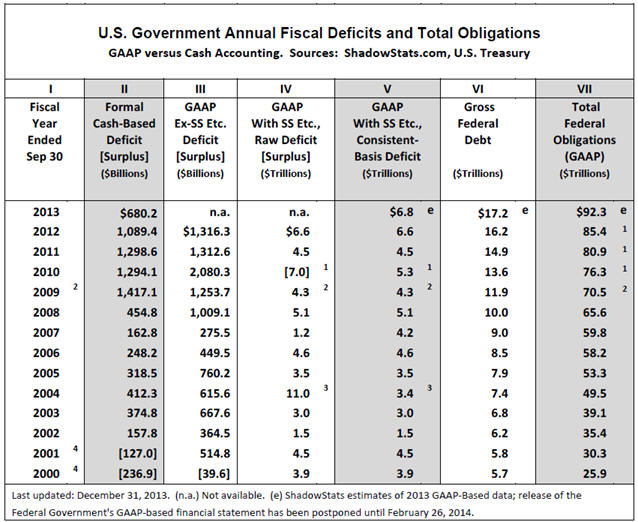

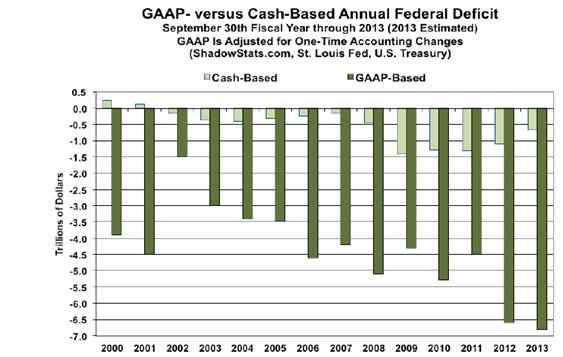

Of course, politicians do not want you to really understand about the magnitude of the government's potential liabilities. The above government debt numbers use cash accounting and not generally accepted accounting principles (GAAP) methods. John Williams of Shadow Government Statistics attempts to determine the true state of the U.S. financial obligations using GAAP accounting, see here. The following table shows through FY 2013 various differences between cash-based and GAAP accounting. Note that the GAAP total of current federal obligations stands at $92.3 trillion as of FY 2013. However, even that number of $92.3 trillion is suspect because 3 of the four largest governmental agencies could not be given a "clean bill of health" by the governmental auditors.

The following graph shows the difference between cash-based accounting and GAAP accounting for the U.S. government in recent years.

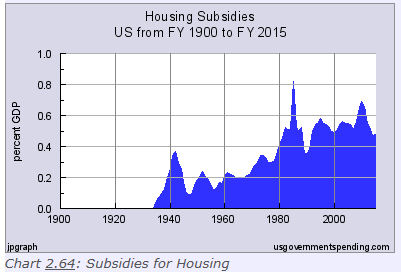

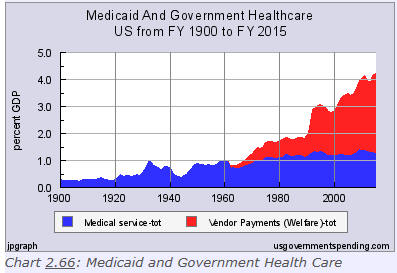

There is an old saying in finance: "How do you go bankrupt? The answer is... suddenly!" And in too many cases, those in positions of authority simply fail to see it coming! Since the start of the Great Society programs under President Lynden B. Johnson, members of both the Republican and Democratic parties have consistently under-funded commitments which they have made to their constituents to secure votes and attempt to retain political power. While many of the Great Society programs were designed to provide a safety-net, as programs matured and were increased, the law of unintended consequences overcame the compassion of the safety-net. As a result, particularly in low income and/or minority communities, the nuclear family virtually disappeared, see here. With childcare, housing and food stamp programs, and Social Security disability payments, many individuals found it no longer necessary to be a productive member of the community. The cost of the Great Society programs has contributed to increased federal and state spending levels. see here. The next two graphs are of government housing subsidies and Medicaid and government healthcare spending. The graphs show show the several-fold increase of these two programs since the 1960's.

Despite the sweeping Republican election gains in the 2014 mid-terms, Speaker John Boehner pushed through a spending bill in December 2014 that failed to make a dent in the amount of spending or materially change any of the programs about which the electorate was concerned. Of course it remains to be seen if the current backlash against Speaker Boehner from the conservative grass-roots will really pick up sufficient strength to oust the Speaker from his position in the new Congress. Thus, it is highly doubtful whether the political will exists to make a significant cut in governmental spending levels in order to begin to reduce not only the on-going cash deficit, but to reduce the overall levels of debt and unfunded liabilities. As a result, politicians and central bankers are left with limited options to resolve the problems caused by profligate spending. They are:

DefaultCould the U.S. simply default? Well, it has before. At the inception of the democratic republic of the U.S., there was not a national bank and many of the founding fathers were strongly opposed to the formation of a central banking system. However, in 1782, the Bank of North America was opened. In 1791, Alexander Hamilton, the Secretary of the Treasury, assisted in using the Bank of North America to obtain a charter for the First Bank of the United States (1791 - 1811) for an initial period of 20 years. However, it was not solely responsible for the country's supply of bank notes. The First Bank of the United States was only responsible for about 20% of the countries banknotes. The rest was issued by state-chartered banks. Congress did not renew the charter of the First Bank of the United States in 1811 as the state-chartered banks had serious questions about the competition which it presented and the opportunity for corruption that might have existed. It can be argued that the demise of the First Bank of the United States was not a bankruptcy, just a dissolution of the entity. After five years, the Second Bank of the United States was formed in 1816 again with a charter good for 20 years. However, in 1836, Congress again refused to renew the charter citing corruption issues and favoritism and it was dissolved in 1836 ushering in the Panic of 1837. This was the second dissolution of a national banking entity. State-chartered banks dominated the banking business until 1863 when the National Banking Act was passed to assist with the financing of the Civil War and national bank charters were issued by the newly-authorized Comptroller of the Currency. When a 10% tax was subsequently passed on state-issued banking notes, the number of federally-chartered banks supervised by the Comptroller of the Currency soared. Two problems were apparent in this banking environment which culminated in the Panic of 1907.

These liquidity crises led to bank runs, causing severe disruptions and depressions, the worst of which was the Panic of 1907. After a series of meetings, Congress passed the Federal Reserve Act of 1913 ushering in the current banking system. There are some legal scholars who suggest that the signing of the Federal Reserve Act by President Wilson was another act of bankruptcy. President Roosevelt's Executive Order 6102 required U.S. citizens to deliver on or before May 1, 1933, all but a small amount of gold coin, gold bullion, and gold certificates owned by them to the Federal Reserve, in exchange for $20.67 per troy ounce. Within only eight months, the Gold Reserve Act of January 30, 1934 required that all gold and gold certificates held by the Federal Reserve be surrendered and vested in the sole title of the United States Department of the Treasury. Within a year and a half, the official price of gold was established at $35.00/oz., effectively stealing about 70% of the U.S. citizens' wealth. This was simply another act of bankruptcy. The next act of bankruptcy occurred when President Richard M. Nixon announced on August 15, 1971, that the U.S. would no longer officially trade dollars for gold. The era of fiat currency was in full bloom. RegulationCass Sunstein, a Harvard Law Professor, has been considered by many liberals as one of the country's most influential legal scholars. He is an advocate of defining democracy for the "regulatory state" by reforming the workings of government and society to promote "the central goals of the constitutional system .. freedom and welfare." Of course, when one really analyzes Sunstein's writings ... welfare comes first and freedom takes a back-seat unlike the beliefs of our founding fathers and many conservative legal scholars. With a major remake of the political landscape brought about by the recent mid-term elections, it remains to be seen if real change can be accomplished in a government where policies are often implemented by faceless and non-elected bureaucrats. The Obama administration foisted more than 75,000 pages of new regulations on the United States in 2014, costing over $200 billion, on the low end, if new proposed rules are taken into account, see here. But far more insidious is the fact that no one can keep up with all the outpouring of regulations from the "nanny state". The end-result is that a citizen's chances of being found in violation of a new, or revised, regulation grows exponentially. Or as it was said in ancient Rome before its downfall by Tacitus in his Anals III 27:

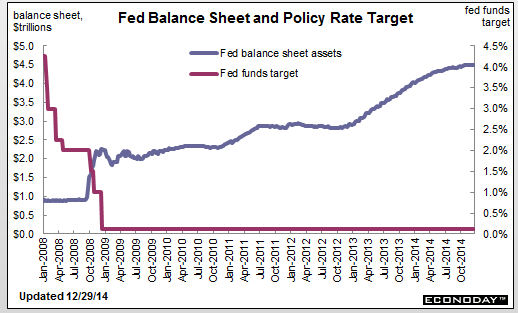

Corruptisima republica plurimae leges. The Federal Reserve and Market ManipulationThe Federal Reserve mandates (according to the enabling legislation) are to provide the following objectives for monetary policy: maximum employment, stable prices, and moderate long-term interest rates. The Federal Reserve expanded its balance sheet since 2007 from $680 billion to over $4 trillion as it sought to manipulate banking reserves after the Bear, Stearns and Lehman Brothers implosions. It also reduced its Fed funds target rate to almost zero.

The Keynesian economists only required a few key-strokes on a computer to inject dollars "out-of-the-ether" into the banking system to hopefully offset the sudden illiquidity of a derivative-based overnight banking system using fractional reserves. Since 2007, the advent of the Federal Reserves quantitative easing programs has had a clear impact on the level of the stock market as the following chart shows.

Rather than wringing the excesses out of the economy, the Federal Reserve moves enabled banks to "rebuild" their capital accounts at the expense of the middle-class and savers. Working in conjunction with the Working Group on Capital Markets, otherwise known as the Plunge Protection Team (PPT), which was formed during the Reagan administration in response to the October and November 1987 market sell-offs, these two groups have managed to turn-back any meaningful sell-offs in the markets. The stock market has now become the 3rd longest bull-market in history. The management of the gold price and its lack of movement to the upside by more than 2% in a trading day is "prima facie" evidence that governments are involved heavily in the trading scheme. The withdrawal of firms from the "price-fix auction" in London is a further indication that the potential liability to the members of the Gold Fixing Company is huge. Investment ConcernsIn the current environment, investors need to be aware that a "black swan event" could occur suddenly to change the entire picture. On the world stage, here are some flash points to consider:

The long timebomb facing all developed nations is the social benefit programs which, based upon the current spending levels and country demographics, simply can not be supported. How politicians will find solutions to their vote-buying schemes remains an imponderable. A betting person will probably opt for the "kick the can down the road" solution. Investing IdeasPrudent investors should have a diversified portfolio of commodities such as physical gold & silver, equities, real estate and other types of assets. Bonds are only useful if they are short-term plays when the interest cycle is on the upswing. Holding a bond to maturity will most-likely see a significant reduction in the amount of purchasing power available when redeemed. Invest in those equities which have increasing sales, increasing earnings, positive cash flow and liquidity. The general market trend provides between 75-80% of the movement in a stock. Hence, it is prudent to try to invest in those industry groups and/or market sectors which are leading the pack or accelerating through the pack. Many suggest that a long dividend payment history is also important. However, a quick analysis of Seadrill might cause the prudent investor to question whether dividends really are important. Of course, it did not have a long dividend payment history.

Trend-following trading styles like that of High Growth Stocks, or the Scooter system of StockCharts.com, as well as point & figure analysis can provide investors with potential winners. Still, there is no way of knowing the future. Trend-following of stable, growth-oriented stocks will provide "bug & flea" investors with possible gains in almost any investing environment if you are willing to go long and/or short.; In the long run, maintenance of suitable risk/reward levels and strict-adherence to them will serve investors well. Finding the "elephants" in the market takes an entirely different mind-set. An elephant is a company whose stock has the potential to grow over 10x in a period of five years. Basically, an elephant is a company that will change the way the world operates or provide a universal need. It does not need to be profitable initially, but it must be eventually. For example, every computer needed an operating system and Microsoft provided it. Visa and MasterCard built a payment infrastructure that is almost impossible today to duplicate. DeBeer's ruthlessly controls the world's diamond supply. Finding elephants takes a questioning mind and exposure to all aspects of society. It is a time-consuming process requiring patience, vision and thought. Understanding how the world works is also a major consideration for finding elephants. Great ideas can be quickly blown away by politicians and vested interests. ConclusionIs there hope for an investor to make a profit without jeopardizing their capital? The answer is not clear. Unfortunately, unless significant strides are made in the immediate future to rein in spending at all levels including excessive government pensions and nonessential programs, the nation will be unable to return from the current tipping point. The U.S. "age of exceptionalism" will quickly be replaced by the "age of dependency." It is simply impossible to service, from an $18 trillion economy, the requirements of a $18 trillion national debt and $90 trillion (or more) in unfunded liabilities. When interest rates increase, and there is little doubt that at some time they will, the pressure on the economy and government will result in inflation rising at a rate that will probably create a major upheaval in society. We have elected politicians without the political will to undertake the reforms necessary to back away from the tipping point. The lack of term limits has created the environment which prevents citizens from having an impact upon the "body politic." Smaller government is just not in the cards as too many individuals now benefit from the current mosaic. The real question is not about whether you will make good investment decisions. It is whether the democratic republic will survive? I am not taking any bets on that outcome. But then... 'Tis Only My Opinion!™

Fred Richards |

Corruptisima republica plurimae leges

[The more corrupt a republic, the more laws]

-- Tacitus, Annals III 27

©2014 Strategic Investing - All rights reserved.

Quotation with attribution is encouraged.

'Tis Only My Opinion™ is intended to provoke thinking,

then dialogue among our readers.

Last updated - December 31, 2014