In this day of a dumbed down education system, the question often arises whether students can add? If you can add two numbers together from 0-99 and get the correct answer, there is hope that you can markedly improve your stock market performance!

1. Ask yourself who has your best interests at heart.

If you have any doubt, you should stick to CD's and U.S. Treasury bills as your investment vehicle of choice!

2. Do you have enough self-discipline to follow a few simple rules.

3. Are you willing to spend about $200 per year to get a subscription to the Investors Business Daily newspaper, or to go to the local Public Library each Friday to obtain the necessary information.

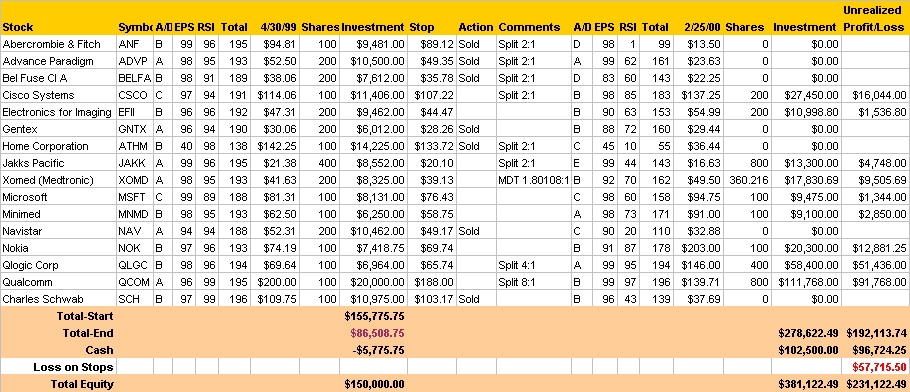

Shown below is the actual performance of a portfolio that was invested as of 4/30/99 starting with an initial capital investment of $150,000 and being invested in 16 stocks with an approximate position of $10,000 each in round lots plus one stock (ATHM) which was added to the portfolio because of its potential.

Although this portfolio did not exactly use the rules stated above, it did appreciate from $150,000 to $381,111.69 in less than 10 months, or a gain of 2.54 times the initial investment. Not too bad but the individual who managed this portfolio decided in July to not reinvest any proceeds from sales of stock and kept it in cash. This individual did not use all the above rules and picked the stocks from the Investors Business Daily list of the 200 best managed companies in the U.S. from its 20th Anniversary issue.

As the performance of this portfolio increased in the first two months following the initial investment, it became obvious that something was happening. Further research into the selection criteria for stocks lead to some very interesting ideas.

Thinking about the success of this portfolio versus all other portfolio's caused several ideas to surface.

As a result, we began to test the following theory. We started with the following thesis.

From a list of all stocks beginning on 4/30/99 that had a combined EPS + RSI total of 194, we took a position of approximately $10,000 in each stock. Thereafter, we followed the rules stated above except Rule 4. Initially, we found only 14 stocks that met this criteria out of all the stocks in the NYSE, ASE, and NASDAQ national markets. Quite a small universe to worry about.

The results of this investment strategy were remarkable. During the next few months, it produced winners like Qualcomm, Qlogic, JDSUniphase. Veritas, Network Appliance, Proxim, Zomax, Checkpoint, Clarify, Advanced Digital, Inforsys Technical Advisors, Cree Research, Seibal, and others. Try it for yourself, you just might make a few dollars!

As of September 30, 1999, this portfolio had increased to over $203,000 or a gain of $53,000. Not too shabby!

But the real gains were made in the next five months. As of February 25, 2000, this portfolio had increased to $624,065, or a gain of $474,065.

If not, why not?

This performance was created by looking at the Weekend Review in the Investors Business Daily Friday's edition and spending about 20 minutes on Friday morning finding any new companies to add to the list or to remove any company that had slipped to a C or worse in the Accumulate/Distribution rating and revising each stocks stop-loss for the forthcoming week.

If you can't beat the random walk theory, or the best advice you can get from your local stockbroker, you don't have the discipline to be in the market and should stick to CD's. This strategy should beat the performance of almost any mutual fund over the same period.

But try it at your own risk . . .

But then - - 'Tis Only My Opinion!

Fred Richards

March 2000

This issue of 'Tis Only My Opinion was copyrighted by Adrich Corporation in March 2000.

All rights reserved. Quotation with attribution is encouraged.

Tis Only My Opinion is intended to provoke thinking, then dialogue among our readers.

![]()

Last updated - July 3, 2008ArA